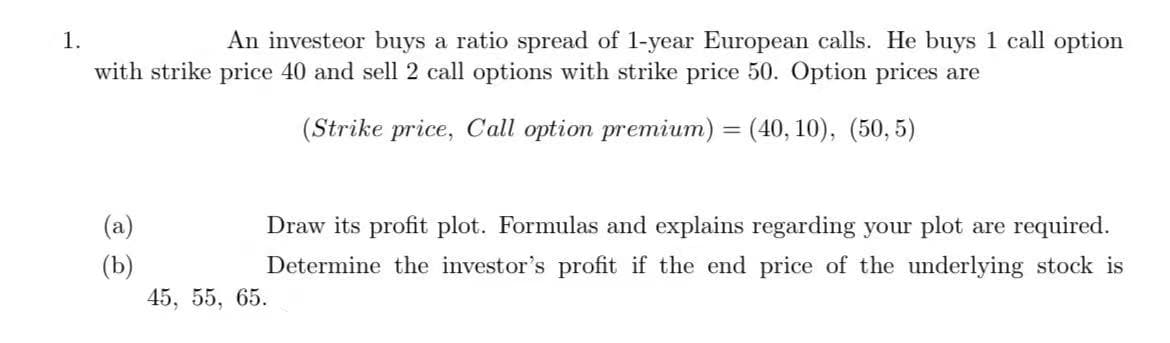

1. An investeor buys a ratio spread of 1-year European calls. He buys 1 call option with strike price 40 and sell 2 call options with strike price 50. Option prices are (Strike price, Call option premium) = (40, 10), (50, 5) (a) Draw its profit plot. Formulas and explains regarding your plot are required. (b) 45, 55, 65. Determine the investor's profit if the end price of the underlying stock is

1. An investeor buys a ratio spread of 1-year European calls. He buys 1 call option with strike price 40 and sell 2 call options with strike price 50. Option prices are (Strike price, Call option premium) = (40, 10), (50, 5) (a) Draw its profit plot. Formulas and explains regarding your plot are required. (b) 45, 55, 65. Determine the investor's profit if the end price of the underlying stock is

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 5ST

Related questions

Question

Transcribed Image Text:1.

An investeor buys a ratio spread of 1-year European calls. He buys 1 call option

with strike price 40 and sell 2 call options with strike price 50. Option prices are

(Strike price, Call option premium) = (40, 10), (50, 5)

(a)

Draw its profit plot. Formulas and explains regarding your plot are required.

(b)

45, 55, 65.

Determine the investor's profit if the end price of the underlying stock is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you