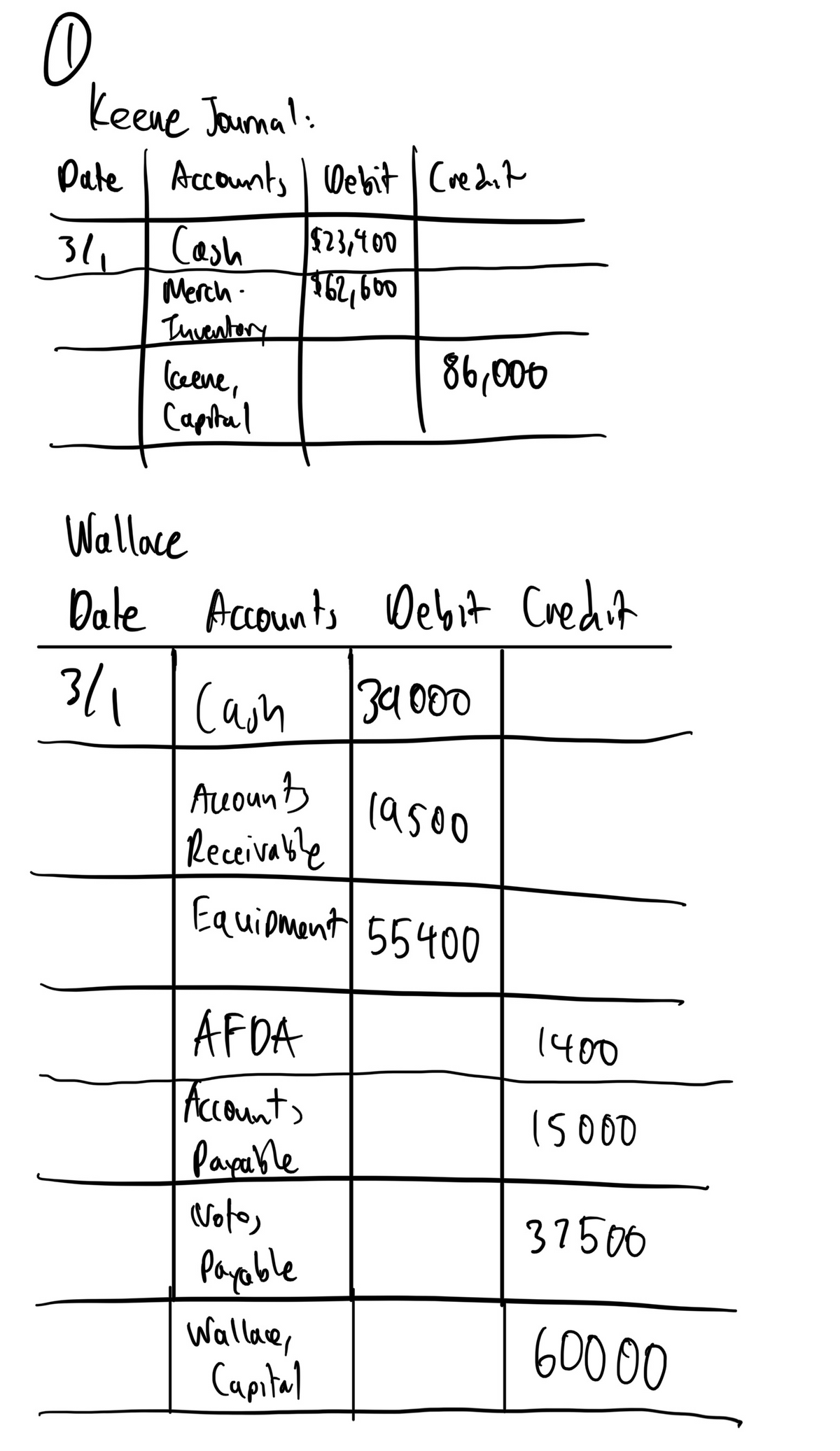

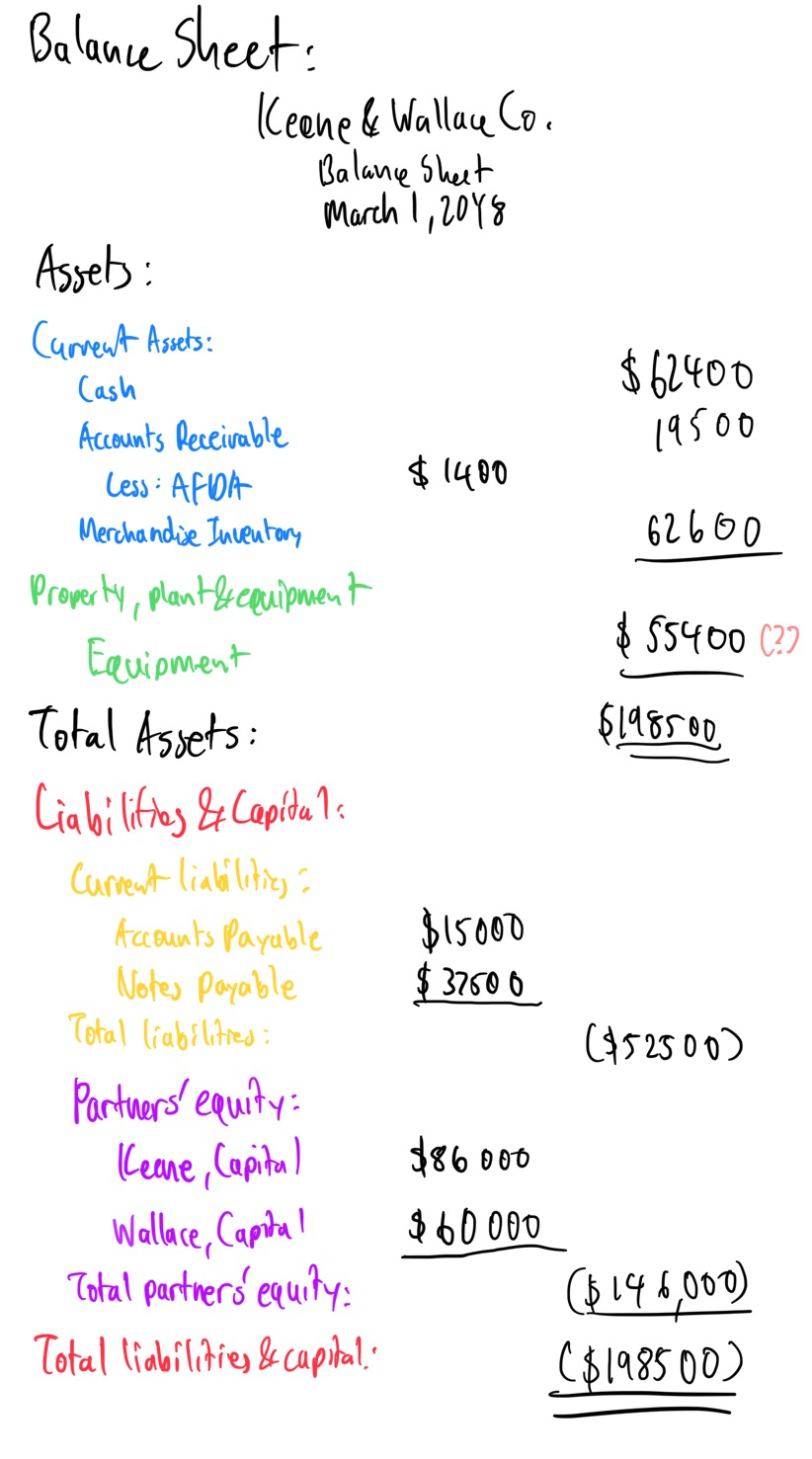

March 1, 20Y8, Eric Keene and Renee Wallace form a partnership. Keene agrees to invest $23,400 in cash and merchandise inventory valued at $62,600. Wallace invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $60,000. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow: Wallace's Ledger Balance Agreed-Upon Valuation Accounts Receivable $19900 $19500 Allowance for Doubtful Accounts 1200 1400 Equipment 83500 55400 Accumulated Depreciation - Equipment 29800 Accounts Payable

On March 1, 20Y8, Eric Keene and Renee Wallace form a

| Wallace's Ledger Balance | Agreed-Upon Valuation | |

| $19900 | $19500 | |

| Allowance for Doubtful Accounts | 1200 | 1400 |

| Equipment | 83500 | 55400 |

| Accumulated |

29800 | |

| Accounts Payable | 15000 | 15000 |

| Notes Payable (current) | 37500 | 37500 |

The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 10%, salary allowances of $19,000 (Keene) and $24,000 (Wallace), and the remainder equally.

The

After adjustments at February 28, 20Y9, the end of the first full year of operations, the revenues were $300,000 and expenses were $230,000, for a net income of $70,000. The drawing accounts have debit balances of $19,000 (Keene) and $24,000 (Wallace). Journalize the entries to close the revenues and expenses and the drawing accounts at February 28, 20Y9.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps