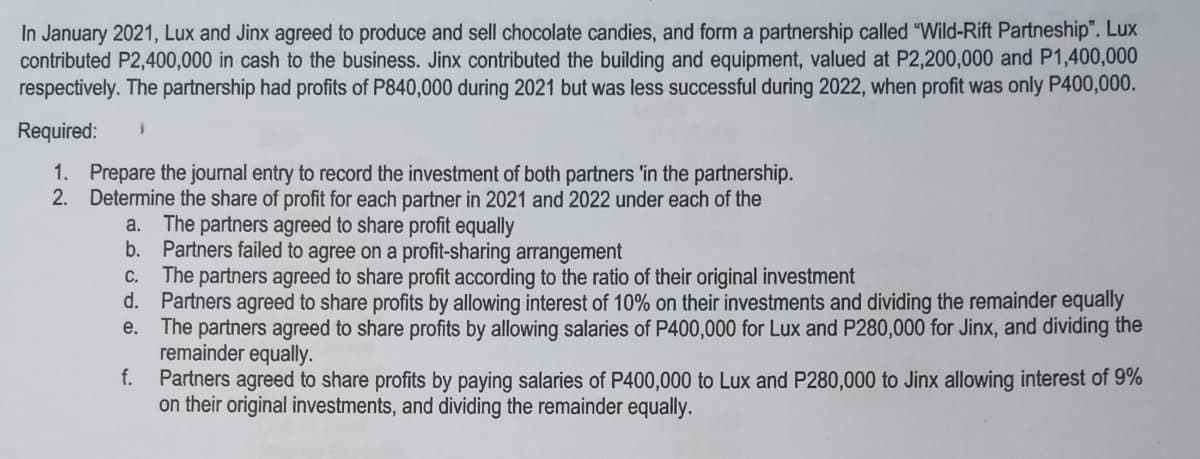

In January 2021, Lux and Jinx agreed to produce and sell chocolate candies, and form a partnership called "Wild-Rift Partneship". Lux contributed P2,400,000 in cash to the business. Jinx contributed the building and equipment, valued at P2,200,000 and P1,400,000 respectively. The partnership had profits of P840,000 during 2021 but was less successful during 2022, when profit was only P400,000. Required: 1. Prepare the journal entry to record the investment of both partners 'in the partnership. 2. Determine the share of profit for each partner in 2021 and 2022 under each of the The partners agreed to share profit equally b. Partners failed to agree on a profit-sharing arrangement c. The partners agreed to share profit according to the ratio of their original investment a.

In January 2021, Lux and Jinx agreed to produce and sell chocolate candies, and form a partnership called "Wild-Rift Partneship". Lux contributed P2,400,000 in cash to the business. Jinx contributed the building and equipment, valued at P2,200,000 and P1,400,000 respectively. The partnership had profits of P840,000 during 2021 but was less successful during 2022, when profit was only P400,000. Required: 1. Prepare the journal entry to record the investment of both partners 'in the partnership. 2. Determine the share of profit for each partner in 2021 and 2022 under each of the The partners agreed to share profit equally b. Partners failed to agree on a profit-sharing arrangement c. The partners agreed to share profit according to the ratio of their original investment a.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter12: Corporations: Organization, Capital Structure, And Operating Rules

Section: Chapter Questions

Problem 27P

Related questions

Question

Please answering the following in the image.

Additional question: When distributing profits between owners in two consecutive accounting period, do we need to do the statement of changes in equity first (like adding the original investment + profit to get the new beginning capital of the 2nd year) then just proceed to getting the 2nd year profit? *I'm confused.

Transcribed Image Text:In January 2021, Lux and Jinx agreed to produce and sell chocolate candies, and form a partnership called "Wild-Rift Partneship". Lux

contributed P2,400,000 in cash to the business. Jinx contributed the building and equipment, valued at P2,200,000 and P1,400,000

respectively. The partnership had profits of P840,000 during 2021 but was less successful during 2022, when profit was only P400,000.

Required:

1. Prepare the journal entry to record the investment of both partners 'in the partnership.

2. Determine the share of profit for each partner in 2021 and 2022 under each of the

a. The partners agreed to share profit equally

b.

Partners failed to agree on a profit-sharing arrangement

The partners agreed to share profit according to the ratio of their original investment

d. Partners agreed to share profits by allowing interest of 10% on their investments and dividing the remainder equally

e. The partners agreed to share profits by allowing salaries of P400,000 for Lux and P280,000 for Jinx, and dividing the

remainder equally.

f. Partners agreed to share profits by paying salaries of P400,000 to Lux and P280,000 to Jinx allowing interest of 9%

on their original investments, and dividing the remainder equally.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you