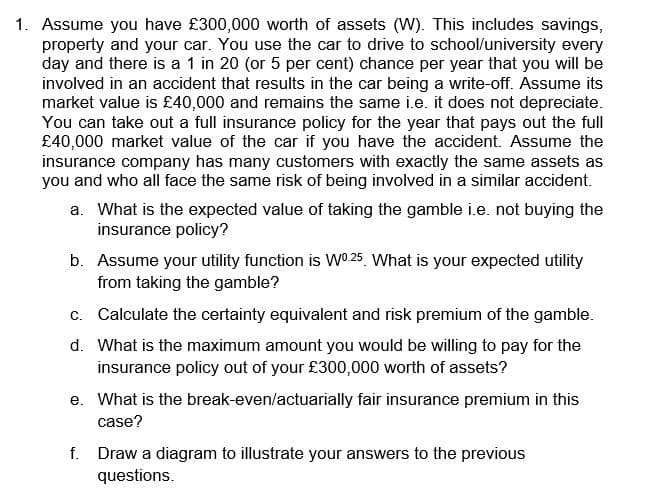

1. Assume you have £300,000 worth of assets (W). This includes savings, property and your car. You use the car to drive to school/university every day and there is a 1 in 20 (or 5 per cent) chance per year that you will be involved in an accident that results in the car being a write-off. Assume its market value is £40,000 and remains the same i.e. it does not depreciate. You can take out a full insurance policy for the year that pays out the full £40,000 market value of the car if you have the accident. Assume the insurance company has many customers with exactly the same assets as you and who all face the same risk of being involved in a similar accident. a. What is the expected value of taking the gamble i.e. not buying the insurance policy? b. Assume your utility function is W0.25, What is your expected utility from taking the gamble? c. Calculate the certainty equivalent and risk premium of the gamble.

1. Assume you have £300,000 worth of assets (W). This includes savings, property and your car. You use the car to drive to school/university every day and there is a 1 in 20 (or 5 per cent) chance per year that you will be involved in an accident that results in the car being a write-off. Assume its market value is £40,000 and remains the same i.e. it does not depreciate. You can take out a full insurance policy for the year that pays out the full £40,000 market value of the car if you have the accident. Assume the insurance company has many customers with exactly the same assets as you and who all face the same risk of being involved in a similar accident. a. What is the expected value of taking the gamble i.e. not buying the insurance policy? b. Assume your utility function is W0.25, What is your expected utility from taking the gamble? c. Calculate the certainty equivalent and risk premium of the gamble.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter13: best-practice Tactics: Game Theory

Section: Chapter Questions

Problem 14E

Related questions

Question

part A B C

Transcribed Image Text:1. Assume you have £300,000 worth of assets (W). This includes savings,

property and your car. You use the car to drive to school/university every

day and there is a 1 in 20 (or 5 per cent) chance per year that you will be

involved in an accident that results in the car being a write-off. Assume its

market value is £40,000 and remains the same i.e. it does not depreciate.

You can take out a full insurance policy for the year that pays out the full

£40,000 market value of the car if you have the accident. Assume the

insurance company has many customers with exactly the same assets as

you and who all face the same risk of being involved in a similar accident.

a. What is the expected value of taking the gamble i.e. not buying the

insurance policy?

b. Assume your utility function is W0.25 What is your expected utility

from taking the gamble?

c. Calculate the certainty equivalent and risk premium of the gamble.

d. What is the maximum amount you would be willing to pay for the

insurance policy out of your £300,000 worth of assets?

e. What is the break-even/actuarially fair insurance premium in this

case?

f. Draw a diagram to illustrate your answers to the previous

questions.

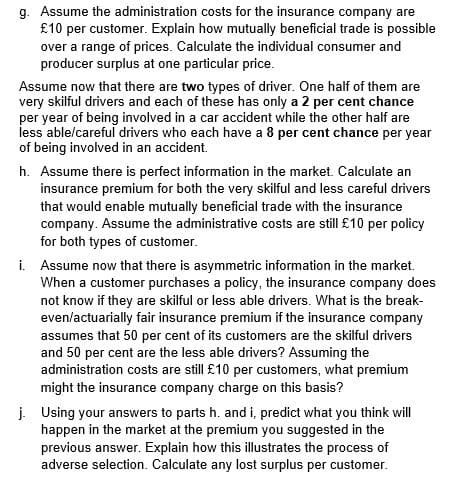

Transcribed Image Text:g. Assume the administration costs for the insurance company are

£10 per customer. Explain how mutually beneficial trade is possible

over a range of prices. Calculate the individual consumer and

producer surplus at one particular price.

Assume now that there are two types of driver. One half of them are

very skilful drivers and each of these has only a 2 per cent chance

per year of being involved in a car accident while the other half are

less able/careful drivers who each have a 8 per cent chance per year

of being involved in an accident.

h. Assume there is perfect information in the market. Calculate an

insurance premium for both the very skilful and less careful drivers

that would enable mutually beneficial trade with the insurance

company. Assume the administrative costs are still £10 per policy

for both types of customer.

i. Assume now that there is asymmetric information in the market.

When a customer purchases a policy, the insurance company does

not know if they are skilful or less able drivers. What is the break-

even/actuarially fair insurance premium if the insurance company

assumes that 50 per cent of its customers are the skilful drivers

and 50 per cent are the less able drivers? Assuming the

administration costs are still £10 per customers, what premium

might the insurance company charge on this basis?

j. Using your answers to parts h. and i, predict what you think will

happen in the market at the premium you suggested in the

previous answer. Explain how this illustrates the process of

adverse selection. Calculate any lost surplus per customer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning