1. You were offered to buy shares of stock of a newly listed company. You decided to take 300 shares at Php 1200 per share. You plan on selling these shares when the market value doubles. If the prevailing rate of increase is 12% per year, how long do you expect to wait until you decide to sell your shares of stock?

1. You were offered to buy shares of stock of a newly listed company. You decided to take 300 shares at Php 1200 per share. You plan on selling these shares when the market value doubles. If the prevailing rate of increase is 12% per year, how long do you expect to wait until you decide to sell your shares of stock?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 6E

Related questions

Question

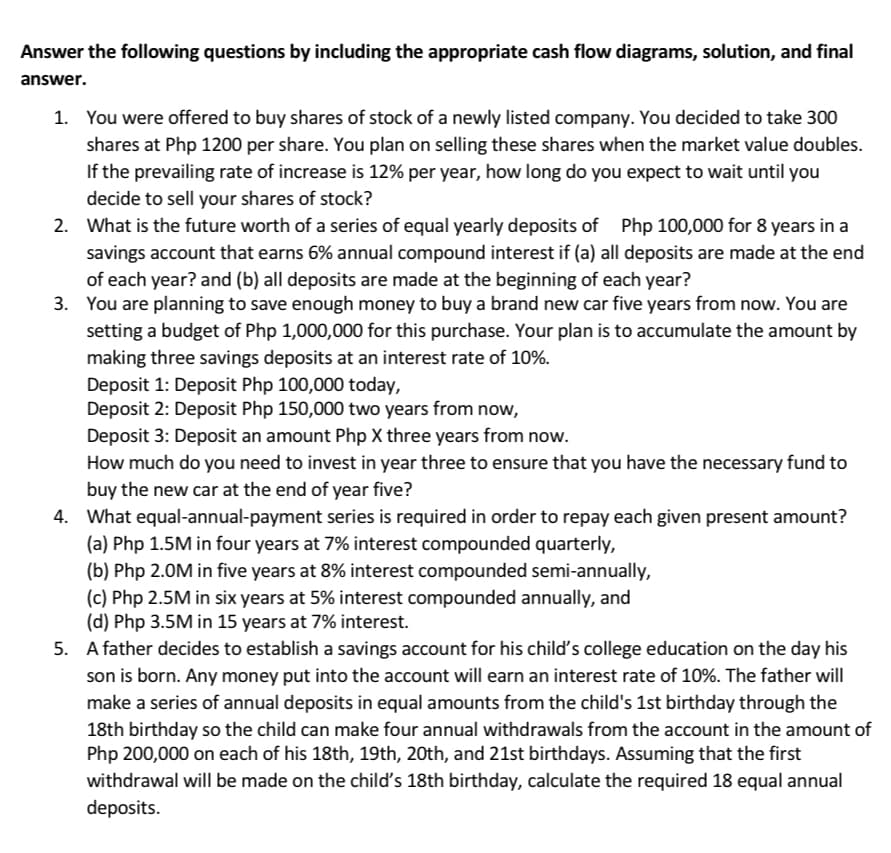

Transcribed Image Text:Answer the following questions by including the appropriate cash flow diagrams, solution, and final

answer.

1. You were offered to buy shares of stock of a newly listed company. You decided to take 300

shares at Php 1200 per share. You plan on selling these shares when the market value doubles.

If the prevailing rate of increase is 12% per year, how long do you expect to wait until you

decide to sell your shares of stock?

2. What is the future worth of a series of equal yearly deposits of Php 100,000 for 8 years in a

savings account that earns 6% annual compound interest if (a) all deposits are made at the end

of each year? and (b) all deposits are made at the beginning of each year?

3. You are planning to save enough money to buy a brand new car five years from now. You are

setting a budget of Php 1,000,000 for this purchase. Your plan is to accumulate the amount by

making three savings deposits at an interest rate of 10%.

Deposit 1: Deposit Php 100,000 today,

Deposit 2: Deposit Php 150,000 two years from now,

Deposit 3: Deposit an amount Php X three years from now.

How much do you need to invest in year three to ensure that you have the necessary fund to

buy the new car at the end of year five?

4. What equal-annual-payment series is required in order to repay each given present amount?

(a) Php 1.5M in four years at 7% interest compounded quarterly,

(b) Php 2.0M in five years at 8% interest compounded semi-annually,

(c) Php 2.5M in six years at 5% interest compounded annually, and

(d) Php 3.5M in 15 years at 7% interest.

5. A father decides to establish a savings account for his child's college education on the day his

son is born. Any money put into the account will earn an interest rate of 10%. The father will

make a series of annual deposits in equal amounts from the child's 1st birthday through the

18th birthday so the child can make four annual withdrawals from the account in the amount of

Php 200,000 on each of his 18th, 19th, 20th, and 21st birthdays. Assuming that the first

withdrawal will be made on the child's 18th birthday, calculate the required 18 equal annual

deposits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning