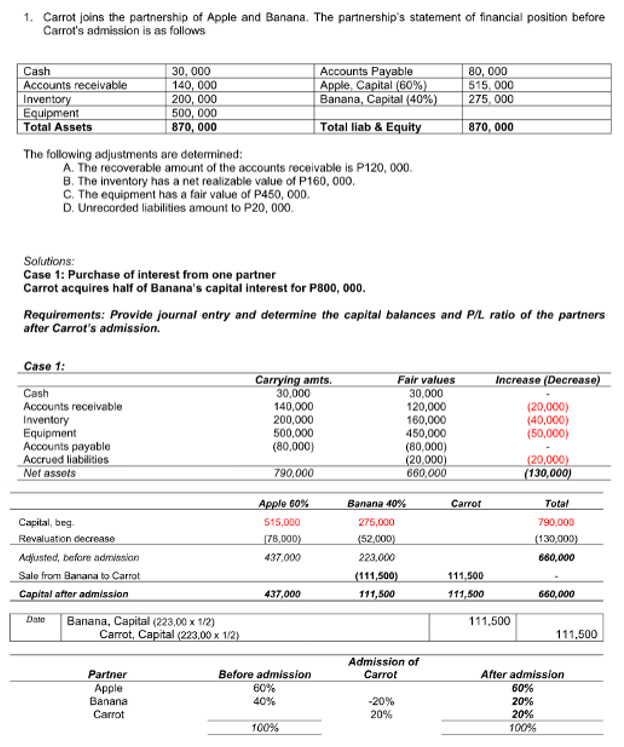

1. Carrot joins the partnership of Apple and Banana. The partnership's statement of financial position before Carrot's admission is as follows Cash Accounts receivable |Inventory Equipment Total Assets 30, 000 140, 000 | 200, 000 500, 000 870, 000 Accounts Payable | Apple, Capital (60%) Banana, Capital (40%) 80, 000 515, 000 275, 000 | Total liab & Equity 870, 000 The following adjustments are determined: A. The recoverable amount of the accounts receivable is P120, 000. B. The inventory has a net realizable value of P160, 000. C. The equipment has a fair value of P450, 000. D. Unrecorded liabilities amount to P20, 000. Solutions: Case 1: Purchase of interest from one partner Carrot acquires half of Banana's capital interest for P800, 000. Requirements: Provide journal entry and determine tho capital balances and P/L ratio of the partners after Carrot's admission.

1. Carrot joins the partnership of Apple and Banana. The partnership's statement of financial position before Carrot's admission is as follows Cash Accounts receivable |Inventory Equipment Total Assets 30, 000 140, 000 | 200, 000 500, 000 870, 000 Accounts Payable | Apple, Capital (60%) Banana, Capital (40%) 80, 000 515, 000 275, 000 | Total liab & Equity 870, 000 The following adjustments are determined: A. The recoverable amount of the accounts receivable is P120, 000. B. The inventory has a net realizable value of P160, 000. C. The equipment has a fair value of P450, 000. D. Unrecorded liabilities amount to P20, 000. Solutions: Case 1: Purchase of interest from one partner Carrot acquires half of Banana's capital interest for P800, 000. Requirements: Provide journal entry and determine tho capital balances and P/L ratio of the partners after Carrot's admission.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 14E

Related questions

Question

100%

Transcribed Image Text:1. Carrot joins the partnership of Apple and Banana. The partnership's statement of financial position before

Carrot's admission is as follows

Cash

Accounts receivable

Inventory

Equipment

Total Assets

30, 000

140, 000

200, 000

500, 000

| 870, 000

Accounts Payable

Apple, Capital (60%)

Banana, Capital (40%)

80, 000

515, 000

275, 000

Total liab & Equity

870, 000

The following adjustments are determined:

A. The recoverable amount of the accounts receivable is P120, 000.

B. The inventory has a net realizable value of P160, 000.

C. The equipment has a fair value of P450, 000.

D. Unrecorded liabilities amount to P20, 000.

Solutions:

Case 1: Purchase of interest from one partner

Carrot acquires half of Banana's capital interest for P800, 000.

Requirements: Provide journal entry and determine the capital balances and P/L ratio of the partners

after Carrot's admission.

Case 1:

Carrying amts.

30,000

Fair values

Increase (Decrease)

Cash

Accounts receivable

Inventory

Equipment

Accounts payable

Accrued liabilities

Net assets

30,000

140,000

200,000

500,000

(80,000)

120,000

160,000

450,000

(20,000)

(40,000)

(50,000)

(80,000)

(20.000)

660,000

(20,000)

(130,000)

790,000

Apple 60%

Banana 40%

Carrot

Total

Capital, beg.

515,000

275,000

790,000

Revaluation decrease

(78,000)

(52,000)

(130,000)

Acjiusted, before admission

437,000

223,000

660,000

Sale from Banana to Carrot

Capital after admission

(111,500)

111,500

437,000

111,500

111,500

660,000

Date

Banana, Capital (223,00 x 1/2)

Carrot, Capital (223,00 x 1/2)

111,500

111,500

Admission of

Partner

Before admission

Carrot

After admission

60%

60%

Apple

Banana

40%

-20%

20%

Carrot

20%

20%

100%

100%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College