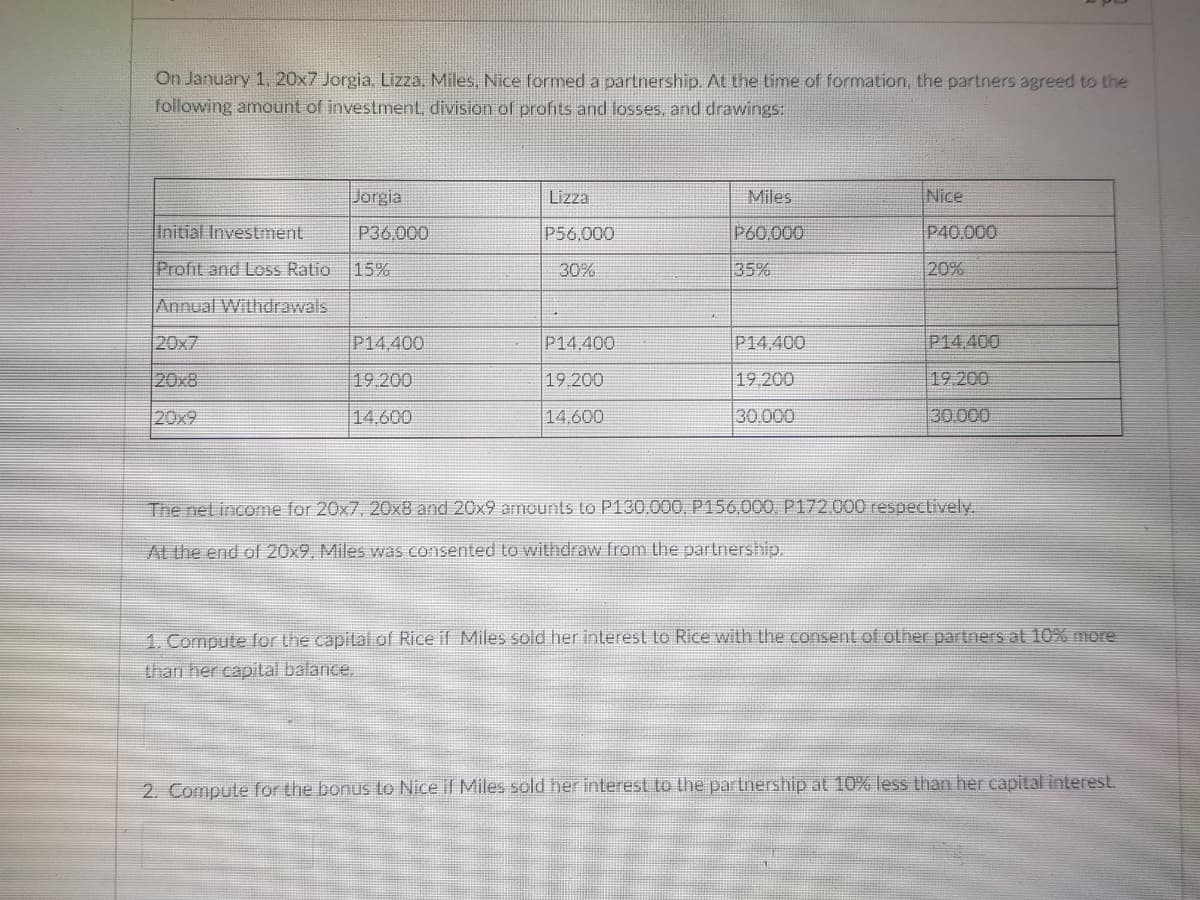

On January 1, 20x7 Jorgia, Lizza, Miles, Nice formed a partnership. At the time of formation, the partners agreed to the following amount of investment, division of profits and losses, and drawings: Jorgia Lizza Miles Nice Initial Investment P36,000 P56,000 P60,000 P40.000 Profit and Loss Ratio 15% 30% 35% 20% Annual Withdrawals 20x7 P14,400 P14,400 P14.400 P14.400 20x8 19.200 19.200 19.200 19.200 20x9 14,600 14.600 30.000 30.000

On January 1, 20x7 Jorgia, Lizza, Miles, Nice formed a partnership. At the time of formation, the partners agreed to the following amount of investment, division of profits and losses, and drawings: Jorgia Lizza Miles Nice Initial Investment P36,000 P56,000 P60,000 P40.000 Profit and Loss Ratio 15% 30% 35% 20% Annual Withdrawals 20x7 P14,400 P14,400 P14.400 P14.400 20x8 19.200 19.200 19.200 19.200 20x9 14,600 14.600 30.000 30.000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:On January 1. 20x7 Jorgia, Lizza. Miles, Nice formed a partnership. At the time of formation, the partners agreed to the

following amount of investment, division of profits and losses, and drawings:

Jorgia

Lizza

Miles

Nice

Initial Investment

P36,000

P56,000

P60,000

P40.000

Profit and Loss Ratio 15%

30%

35%

20%

Annual Withdrawals

20x7

P14,400

P14.400

P14,400

P14,400

20x8

19.200

19.200

19.200

19 200

20x9

14,600

14,600

30.000

30.000

The net income for 20x7, 20x8 and 20x9 armounts to P130,000, P156,000, P172.000 respectively.

AL the end of 20x9. Miles was consented to withdraw from the partrership.

1. Compute for the capilal of Rice if Miles sold her interest to Rice with the consent of other partners at 10% more

than her capilal balance.

2. Compute for the bonus to Nice if Miles sold her interest to the partnership at 10% less than her capital interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College