1. Consider the following version of the earned income tax credit (EITC). All persons who earn less than $20,000 are given a wage subsidy of $0.50 for each dol. vorked. The maximum benefit is therefore $10,000. All persons who earn between $20,000 and $30,000 are paid the maximum benefit of $10,000. This is the income disregard region. The phaseout occurs in the income range from $30,000 to $50,000. In this range the m penefit $10,000 is cut by $0.50 for each dollar earned. For example, a person who earn $30,001 will get paid $10,000 -$0.50 = $9,999.50. At an income of $50,000 the program been totally phased out. Now focus on a person initially working and earning $15,000 before the plan is introdud %3D

1. Consider the following version of the earned income tax credit (EITC). All persons who earn less than $20,000 are given a wage subsidy of $0.50 for each dol. vorked. The maximum benefit is therefore $10,000. All persons who earn between $20,000 and $30,000 are paid the maximum benefit of $10,000. This is the income disregard region. The phaseout occurs in the income range from $30,000 to $50,000. In this range the m penefit $10,000 is cut by $0.50 for each dollar earned. For example, a person who earn $30,001 will get paid $10,000 -$0.50 = $9,999.50. At an income of $50,000 the program been totally phased out. Now focus on a person initially working and earning $15,000 before the plan is introdud %3D

Chapter9: Payroll, Estimated Payments, And Retirement Plans

Section: Chapter Questions

Problem 16MCQ

Related questions

Question

Transcribed Image Text:QUESTION 2

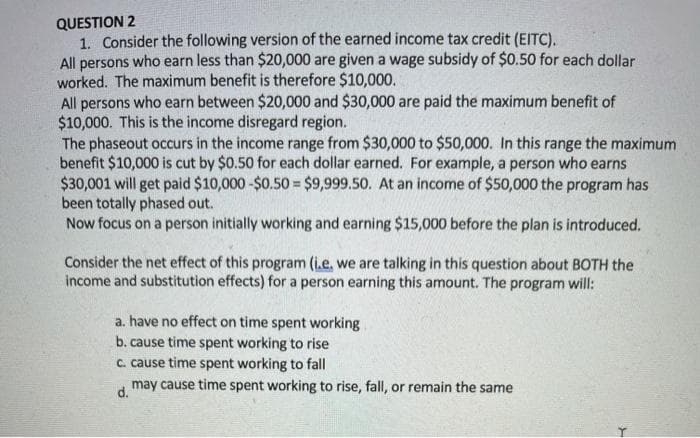

1. Consider the following version of the earned income tax credit (EITC).

All persons who earn less than $20,000 are given a wage subsidy of $0.50 for each dollar

worked. The maximum benefit is therefore $10,000.

All persons who earn between $20,000 and $30,000 are paid the maximum benefit of

$10,000. This is the income disregard region.

The phaseout occurs in the income range from $30,000 to $50,000. In this range the maximum

benefit $10,000 is cut by $0.50 for each dollar earned. For example, a person who earns

$30,001 will get paid $10,000 -$0.50 = $9,999.50. At an income of $50,000 the program has

been totally phased out.

Now focus on a person initially working and earning $15,000 before the plan is introduced.

Consider the net effect of this program (i.e, we are talking in this question about BOTH the

income and substitution effects) for a person earning this amount. The program will:

a. have no effect on time spent working

b. cause time spent working to rise

c. cause time spent working to fall

may cause time spent working to rise, fall, or remain the same

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College