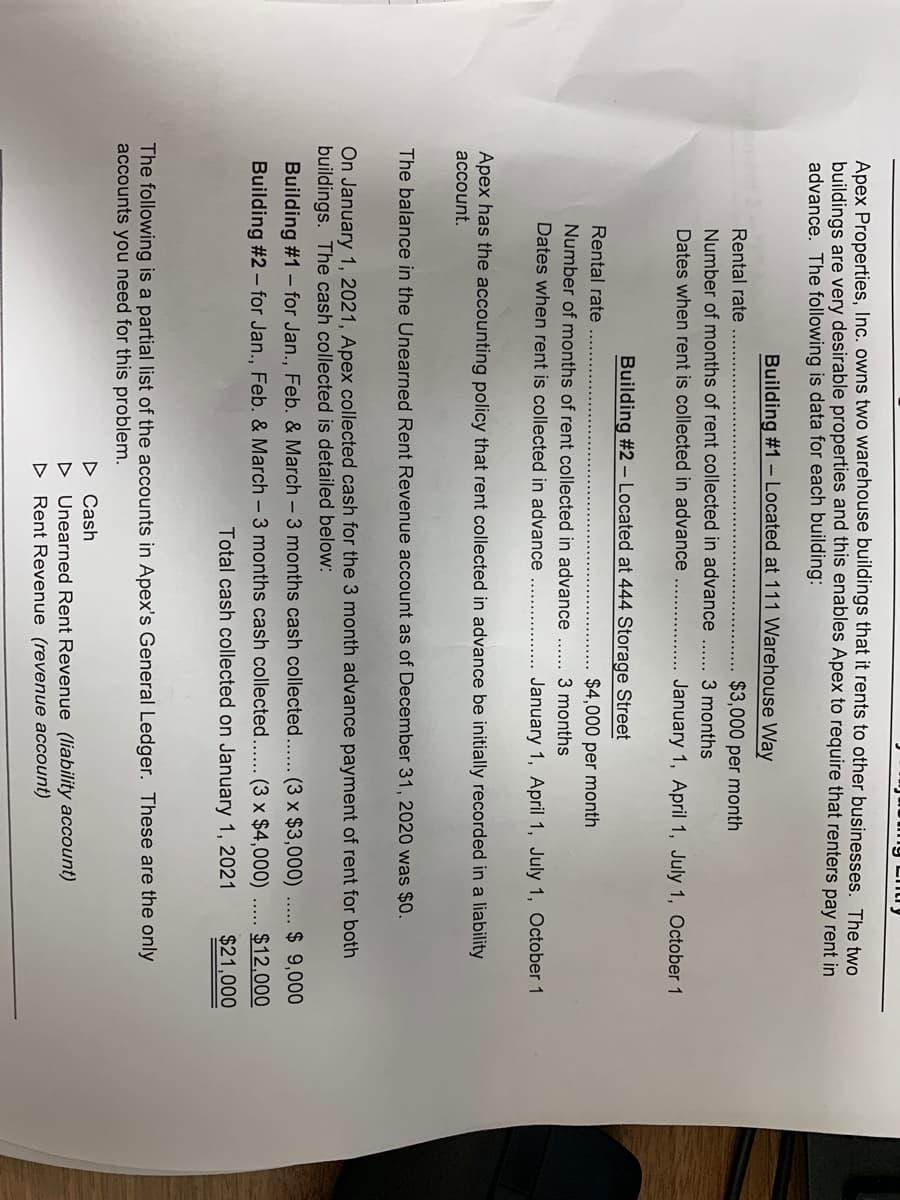

Apex Properties, Inc. owns two warehouse buildings that it rents to other businesses. The two buildings are very desirable properties and this enables Apex to require that renters pay rent in advance. The following is data for each building: Building #1 - Located at 111 Warehouse Way Rental rate $3,000 per month Number of months of rent collected in advance 3 months Dates when rent is collected in advance January 1, April 1, July 1, October 1 Building #2 – Located at 444 Storage Street Rental rate $4,000 per month Number of months of rent collected in advance .... 3 months Dates when rent is collected in advance January 1, April 1, July 1, October 1 Apex has the accounting policy that rent collected in advance be initially recorded in a liability account. The balance in the Unearned Rent Revenue account as of December 31, 2020 was $0. On January 1, 2021, Apex collected cash for the 3 month advance payment of rent for both buildings. The cash collected is detailed below: Building #1 - for Jan., Feb. & March-3 months cash collected.... (3 x $3,000) $ 9,000 ..... Building #2 - for Jan., Feb. & March -3 months cash collected.... (3 x $4,000) $12,000 ..... Total cash collected on January 1, 2021 $21,000 The following is a partial list of the accounts in Apex's General Ledger. These are the only accounts you need for this problem. D Cash D Unearned Rent Revenue (liability account) D Rent Revenue (revenue account)

Apex Properties, Inc. owns two warehouse buildings that it rents to other businesses. The two buildings are very desirable properties and this enables Apex to require that renters pay rent in advance. The following is data for each building: Building #1 - Located at 111 Warehouse Way Rental rate $3,000 per month Number of months of rent collected in advance 3 months Dates when rent is collected in advance January 1, April 1, July 1, October 1 Building #2 – Located at 444 Storage Street Rental rate $4,000 per month Number of months of rent collected in advance .... 3 months Dates when rent is collected in advance January 1, April 1, July 1, October 1 Apex has the accounting policy that rent collected in advance be initially recorded in a liability account. The balance in the Unearned Rent Revenue account as of December 31, 2020 was $0. On January 1, 2021, Apex collected cash for the 3 month advance payment of rent for both buildings. The cash collected is detailed below: Building #1 - for Jan., Feb. & March-3 months cash collected.... (3 x $3,000) $ 9,000 ..... Building #2 - for Jan., Feb. & March -3 months cash collected.... (3 x $4,000) $12,000 ..... Total cash collected on January 1, 2021 $21,000 The following is a partial list of the accounts in Apex's General Ledger. These are the only accounts you need for this problem. D Cash D Unearned Rent Revenue (liability account) D Rent Revenue (revenue account)

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter21: Accounting For Accruals, Deferrals, And Reversing Entries

Section: Chapter Questions

Problem 2AP

Related questions

Question

Transcribed Image Text:Apex Properties, Inc. owns two warehouse buildings that it rents to other businesses. The two

buildings are very desirable properties and this enables Apex to require that renters pay rent in

advance. The following is data for each building:

Building #1 - Located at 111 Warehouse Way

Rental rate

$3,000 per month

Number of months of rent collected in advance

3 months

Dates when rent is collected in advance

January 1, April 1, July 1, October 1

Building #2 - Located at 444 Storage Street

Rental rate

$4,000 per month

Number of months of rent collected in advance

3 months

Dates when rent is collected in advance

January 1, April 1, July 1, October 1

Apex has the accounting policy that rent collected in advance be initially recorded in a liability

account.

The balance in the Unearned Rent Revenue account as of December 31, 2020 was $0.

On January 1, 2021, Apex collected cash for the 3 month advance payment of rent for both

buildings. The cash collected is detailed below:

Building #1 – for Jan.., Feb. & March - 3 months cash collected... (3 x $3,000)

$ 9,000

.....

$12,000

Building #2 – for Jan., Feb. & March - 3 months cash collected.... (3 x $4,000)

Total cash collected on January 1, 2021

$21,000

The following is a partial list of the accounts in Apex's General Ledger. These are the only

accounts you need for this problem.

D Cash

D Unearned Rent Revenue (liability account)

D Rent Revenue (revenue account)

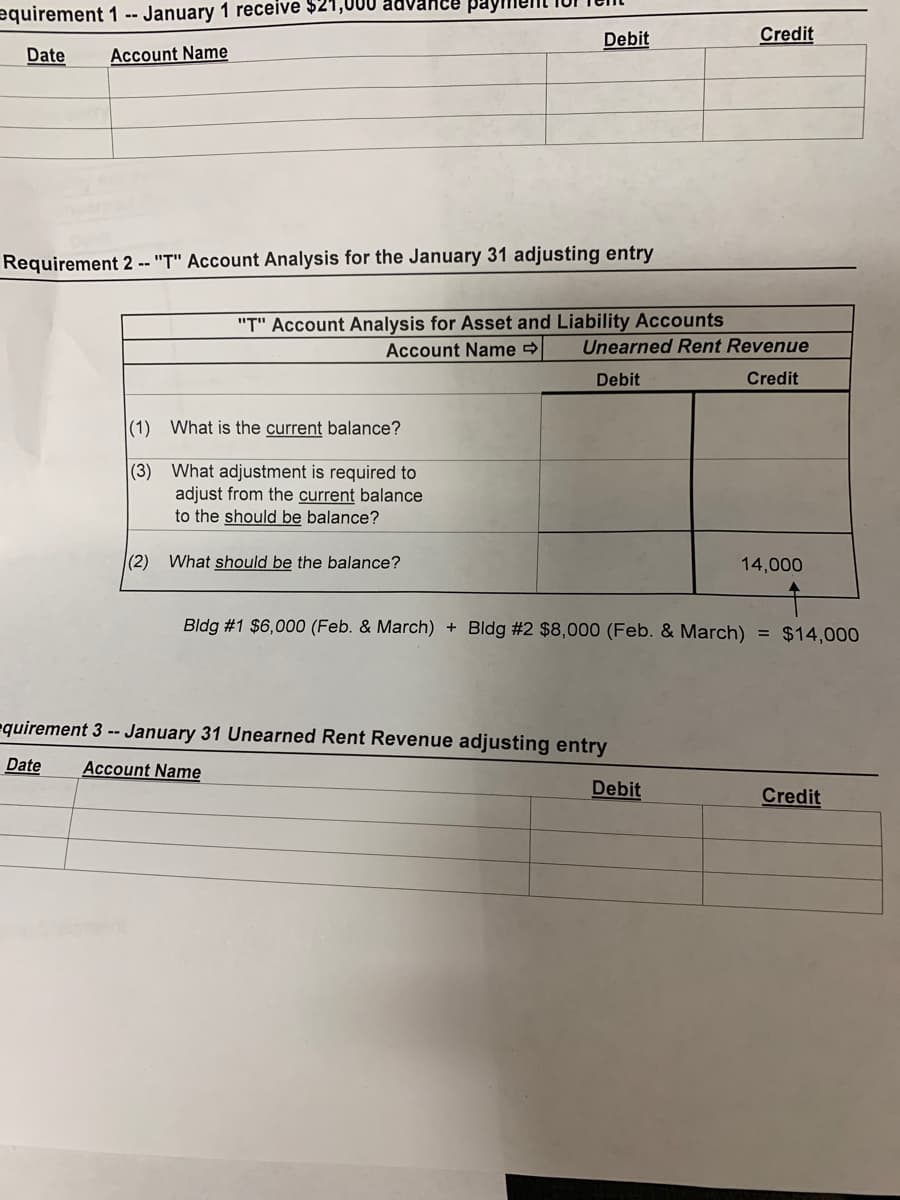

Transcribed Image Text:equirement 1 -- January 1 receive $21,000 adv

Debit

Credit

Date

Account Name

Requirement 2 -- "T" Account Analysis for the January 31 adjusting entry

"T" Account Analysis for Asset and Liability Accounts

Account Name →

Unearned Rent Revenue

Debit

Credit

(1) What is the current balance?

(3) What adjustment is required to

adjust from the current balance

to the should be balance?

|(2) What should be the balance?

14,000

Bldg #1 $6,000 (Feb. & March) + Bldg #2 $8,000 (Feb. & March) = $14,000

equirement 3 -- January 31 Unearned Rent Revenue adjusting entry

Date

Account Name

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning