1. Following is the profit and loss account of a limited company |Opening Stock Purchases 10,000 Sales 50,000 Closing Stock 50,000 90,000 20,000 Gross profit c/d 110,000 Administration Expenses Selling and Distribution Expenses 6,000 4,000 110,000 Gross profit b/d 50,000 Net Profit 40,000 50,000 50,000 Calculate: Gross profit ratio, Net profit ratio

1. Following is the profit and loss account of a limited company |Opening Stock Purchases 10,000 Sales 50,000 Closing Stock 50,000 90,000 20,000 Gross profit c/d 110,000 Administration Expenses Selling and Distribution Expenses 6,000 4,000 110,000 Gross profit b/d 50,000 Net Profit 40,000 50,000 50,000 Calculate: Gross profit ratio, Net profit ratio

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 53CE: Profitability Ratios The following data came from the financial statements of Israel Company:...

Related questions

Question

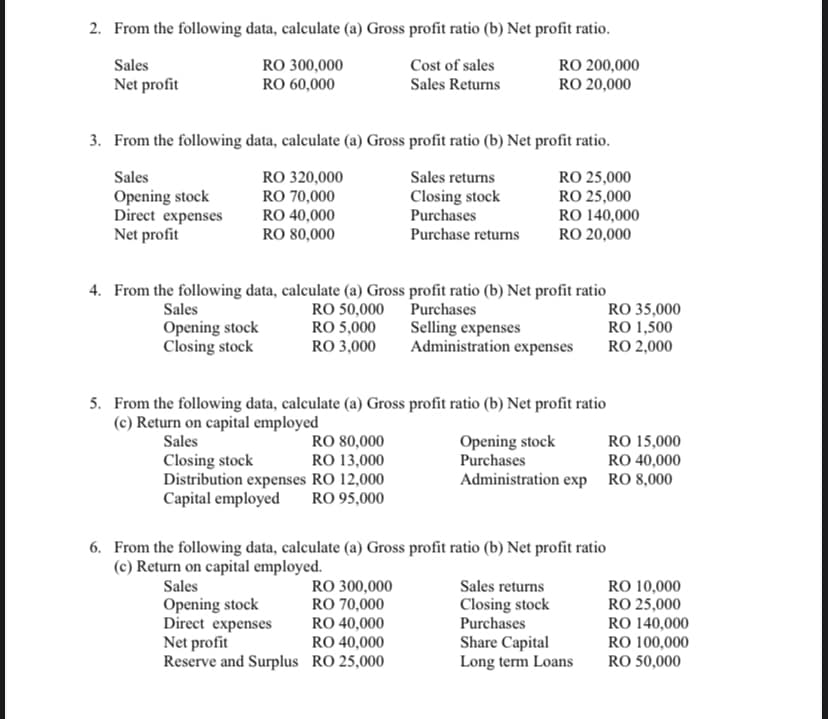

Transcribed Image Text:2. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio.

RO 200,000

RO 20,000

Sales

RO 300,000

RO 60,000

Cost of sales

Net profit

Sales Returns

3. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio.

Sales returns

Closing stock

Purchases

RO 25,000

RO 25,000

RO 140,000

RO 20,000

Sales

RO 320,000

RO 70,000

Opening stock

Direct expenses

Net profit

RO 40,000

RO 80,000

Purchase returns

4. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio

RO 50,000 Purchases

RO 5,000

RO 3,000

RO 35,000

RO 1,500

RO 2,000

Sales

Opening stock

Closing stock

Selling expenses

Administration expenses

5. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio

(c) Return on capital employed

Opening stock

Purchases

Sales

RO 80,000

RO 13,000

RO 15,000

RO 40,000

Closing stock

Distribution expenses RO 12,000

Capital employed

Administration exp

RO 8,000

RO 95,000

6. From the following data, calculate (a) Gross profit ratio (b) Net profit ratio

(c) Return on capital employed.

Sales

RO 300,000

RO 70,000

RO 40,000

RO 40,000

Sales returns

RO 10,000

RO 25,000

RO 140,000

RO 100,000

RO 50,000

Closing stock

Purchases

Opening stock

Direct expenses

Net profit

Reserve and Surplus RO 25,000

Share Capital

Long term Loans

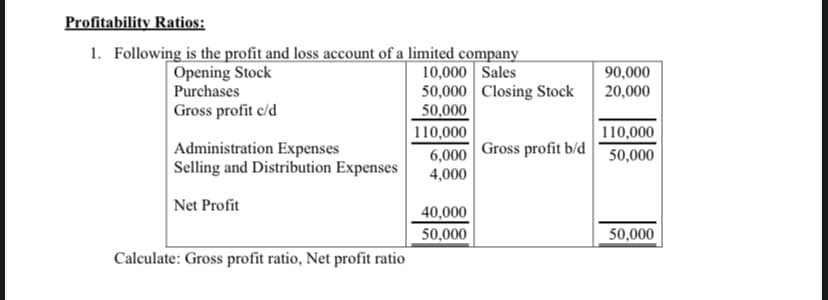

Transcribed Image Text:Profitability Ratios:

1. Following is the profit and loss account of a limited company

Opening Stock

10,000 Sales

50,000 Closing Stock

50,000

90,000

20,000

Purchases

Gross profit c/d

110,000

110,000

Administration Expenses

Selling and Distribution Expenses

Gross profit b/d

6,000

4,000

50,000

Net Profit

40,000

50,000

50,000

Calculate: Gross profit ratio, Net profit ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning