1. Following the depreciation example on page 7-7 of the VLN determine Activity based year 2 accumulated depreciation?_______ 2. Following the depreciation example on page 7-7 of the VLN, determine Activity based Year 2 Book value?__________

1. Following the depreciation example on page 7-7 of the VLN determine Activity based year 2 accumulated depreciation?_______ 2. Following the depreciation example on page 7-7 of the VLN, determine Activity based Year 2 Book value?__________

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.5: Declining-balance Method Of Depreciation

Problem 1OYO

Related questions

Question

1. Following the depreciation example on page 7-7 of the VLN determine Activity based year 2 accumulated depreciation ?_______

2. Following the depreciation example on page 7-7 of the VLN, determine Activity based Year 2 Book value?__________

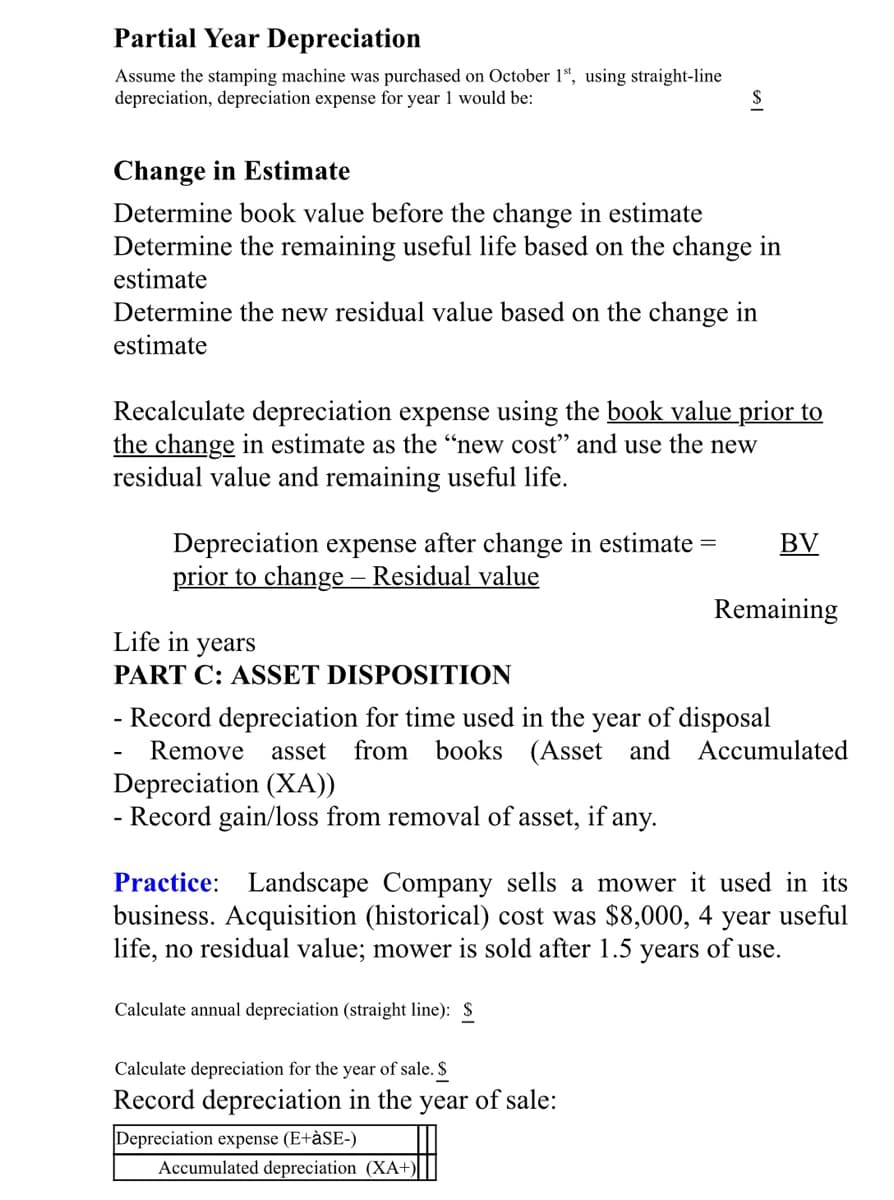

Transcribed Image Text:Partial Year Depreciation

Assume the stamping machine was purchased on October 1ª, using straight-line

depreciation, depreciation expense for year 1 would be:

Change in Estimate

Determine book value before the change in estimate

Determine the remaining useful life based on the change in

estimate

Determine the new residual value based on the change in

estimate

Recalculate depreciation expense using the book value prior to

the change in estimate as the “new cost" and use the new

residual value and remaining useful life.

Depreciation expense after change in estimate

prior to change – Residual value

BV

Remaining

Life in years

PART C: ASSET DISPOSITION

- Record depreciation for time used in the year of disposal

from books (Asset and Accumulated

Remove asset

Depreciation (XA))

- Record gain/loss from removal of asset, if any.

Practice: Landscape Company sells a mower it used in its

business. Acquisition (historical) cost was $8,000, 4 year useful

life, no residual value; mower is sold after 1.5 years of use.

Calculate annual depreciation (straight line): $

Calculate depreciation for the year of sale. $

Record depreciation in the

year

of sale:

Depreciation expense (E+àSE-)

Accumulated depreciation (XA+)

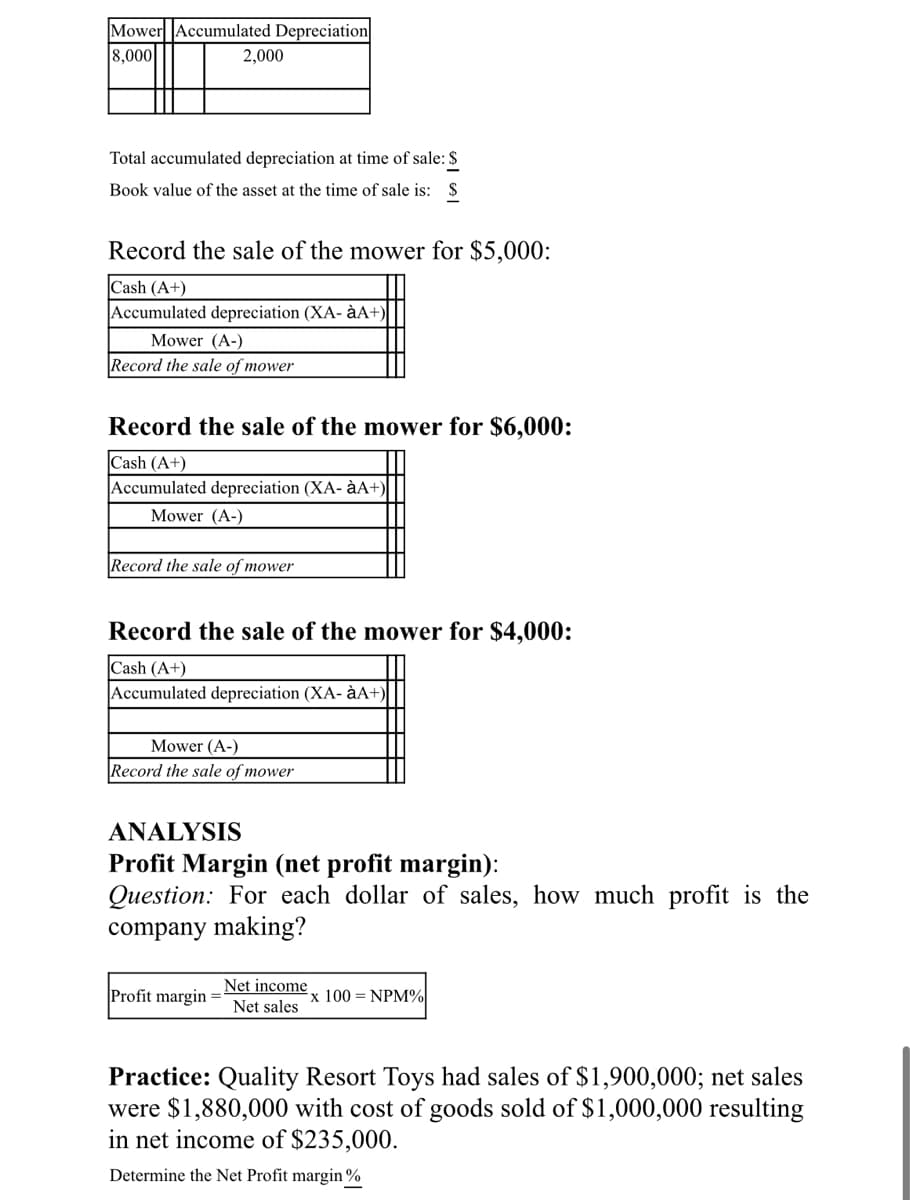

Transcribed Image Text:Mower JAccumulated Depreciation

8,000

2,000

Total accumulated depreciation at time of sale: $

Book value of the asset at the time of sale is: $

Record the sale of the mower for $5,000:

Cash (A+)

Accumulated depreciation (XA- àA+)

Mower (A-)

Record the sale of mower

Record the sale of the mower for $6,000:

ash (A+)

Accumulated depreciation (XA- àA+)

Mower (A-)

Record the sale of mower

Record the sale of the mower for $4,000:

Cash (A+)

Accumulated depreciation (XA- àA+)

Mower (A-)

Record the sale of mower

ANALYSIS

Profit Margin (net profit margin):

Question: For each dollar of sales, how much profit is the

company making?

Net income

Profit margin =

x 100 = NPM%

Net sales

Practice: Quality Resort Toys had sales of $1,900,000; net sales

were $1,880,000 with cost of goods sold of $1,000,000 resulting

in net income of $235,000.

Determine the Net Profit margin %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning