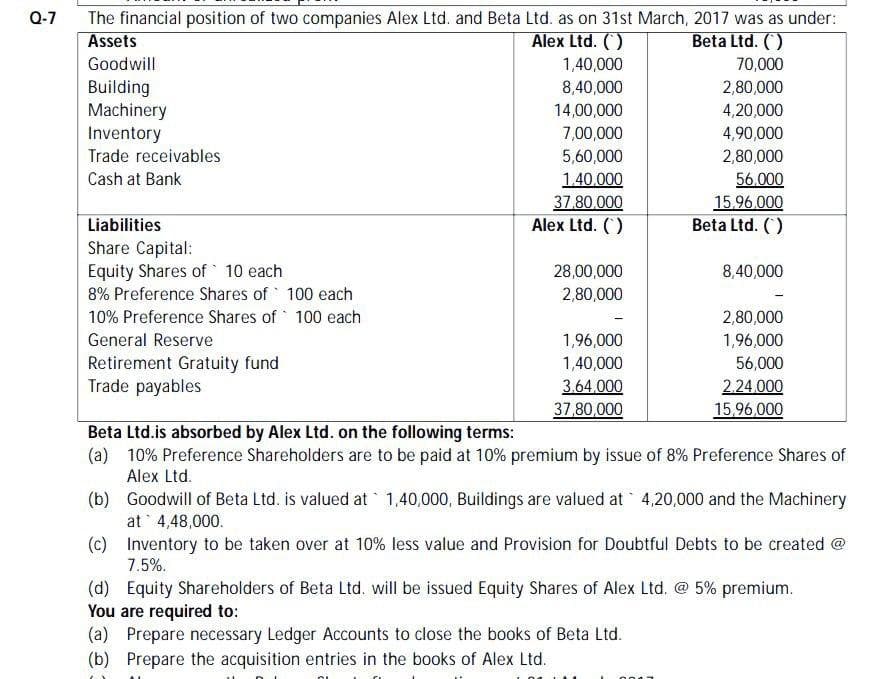

Q-7 The financial position of two companies Alex Ltd. and Beta Ltd. as on 31st March, 2017 was as under: Assets Alex Ltd. () Beta Ltd. () Goodwill 1,40,000 70,000 Building Machinery Inventory Trade receivables 8,40,000 2,80,000 14,00,000 4,20,000 7,00,000 4,90,000 5,60,000 2,80,000 1.40.000 37,80,000 Alex Ltd. () Cash at Bank 56.000 15,96.000 Beta Ltd. () Liabilities Share Capital: Equity Shares of 10 each 8% Preference Shares of 100 each 28,00,000 8,40,000 2,80,000 10% Preference Shares of 100 each 2,80,000 General Reserve 1,96,000 1,96,000 Retirement Gratuity fund Trade payables 1,40,000 56,000 3.64.000 37,80,000 2.24.000 15,96,000 Beta Ltd.is absorbed by Alex Ltd. on the following terms: (a) 10% Preference Shareholders are to be paid at 10% premium by issue of 8% Preference Shares of Alex Ltd. (b) Goodwill of Beta Ltd. is valued at 1,40,000, Buildings are valued at 4,20,000 and the Machinery at 4,48,000. (c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created @ 7.5%. (d) Equity Shareholders of Beta Ltd. will be issued Equity Shares of Alex Ltd. @ 5% premium. You are required to: (a) Prepare necessary Ledger Accounts to close the books of Beta Ltd. (b) Prepare the acquisition entries in the books of Alex Ltd.

Q-7 The financial position of two companies Alex Ltd. and Beta Ltd. as on 31st March, 2017 was as under: Assets Alex Ltd. () Beta Ltd. () Goodwill 1,40,000 70,000 Building Machinery Inventory Trade receivables 8,40,000 2,80,000 14,00,000 4,20,000 7,00,000 4,90,000 5,60,000 2,80,000 1.40.000 37,80,000 Alex Ltd. () Cash at Bank 56.000 15,96.000 Beta Ltd. () Liabilities Share Capital: Equity Shares of 10 each 8% Preference Shares of 100 each 28,00,000 8,40,000 2,80,000 10% Preference Shares of 100 each 2,80,000 General Reserve 1,96,000 1,96,000 Retirement Gratuity fund Trade payables 1,40,000 56,000 3.64.000 37,80,000 2.24.000 15,96,000 Beta Ltd.is absorbed by Alex Ltd. on the following terms: (a) 10% Preference Shareholders are to be paid at 10% premium by issue of 8% Preference Shares of Alex Ltd. (b) Goodwill of Beta Ltd. is valued at 1,40,000, Buildings are valued at 4,20,000 and the Machinery at 4,48,000. (c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created @ 7.5%. (d) Equity Shareholders of Beta Ltd. will be issued Equity Shares of Alex Ltd. @ 5% premium. You are required to: (a) Prepare necessary Ledger Accounts to close the books of Beta Ltd. (b) Prepare the acquisition entries in the books of Alex Ltd.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 1.25EX: Financial statements We-Sell Realty, organized as a corporation on August 1, 2018, is owned and...

Related questions

Topic Video

Question

100%

Transcribed Image Text:Q-7

The financial position of two companies Alex Ltd. and Beta Ltd. as on 31st March, 2017 was as under:

Assets

Alex Ltd. ()

Beta Ltd. ()

Goodwill

1,40,000

70,000

Building

Machinery

Inventory

8,40,000

2,80,000

14,00,000

4,20,000

7,00,000

4,90,000

Trade receivables

5,60,000

2,80,000

Cash at Bank

1.40.000

37.80.000

Alex Ltd. ()

56.000

15,96,000

Beta Ltd. ()

Liabilities

Share Capital:

Equity Shares of 10 each

28,00,000

8,40,000

8% Preference Shares of 100 each

2,80,000

10% Preference Shares of 100 each

2,80,000

General Reserve

1,96,000

1,96,000

Retirement Gratuity fund

Trade payables

1,40,000

3.64.000

37,80,000

56,000

2.24.000

15,96,000

Beta Ltd.is absorbed by Alex Ltd. on the following terms:

(a) 10% Preference Shareholders are to be paid at 10% premium by issue of 8% Preference Shares of

Alex Ltd.

(b) Goodwill of Beta Ltd. is valued at 1,40,000, Buildings are valued at 4,20,000 and the Machinery

at 4,48,000.

(c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created @

7.5%.

(d) Equity Shareholders of Beta Ltd. will be issued Equity Shares of Alex Ltd. @ 5% premium.

You are required to:

(a) Prepare necessary Ledger Accounts to close the books of Beta Ltd.

(b) Prepare the acquisition entries in the books of Alex Ltd.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning