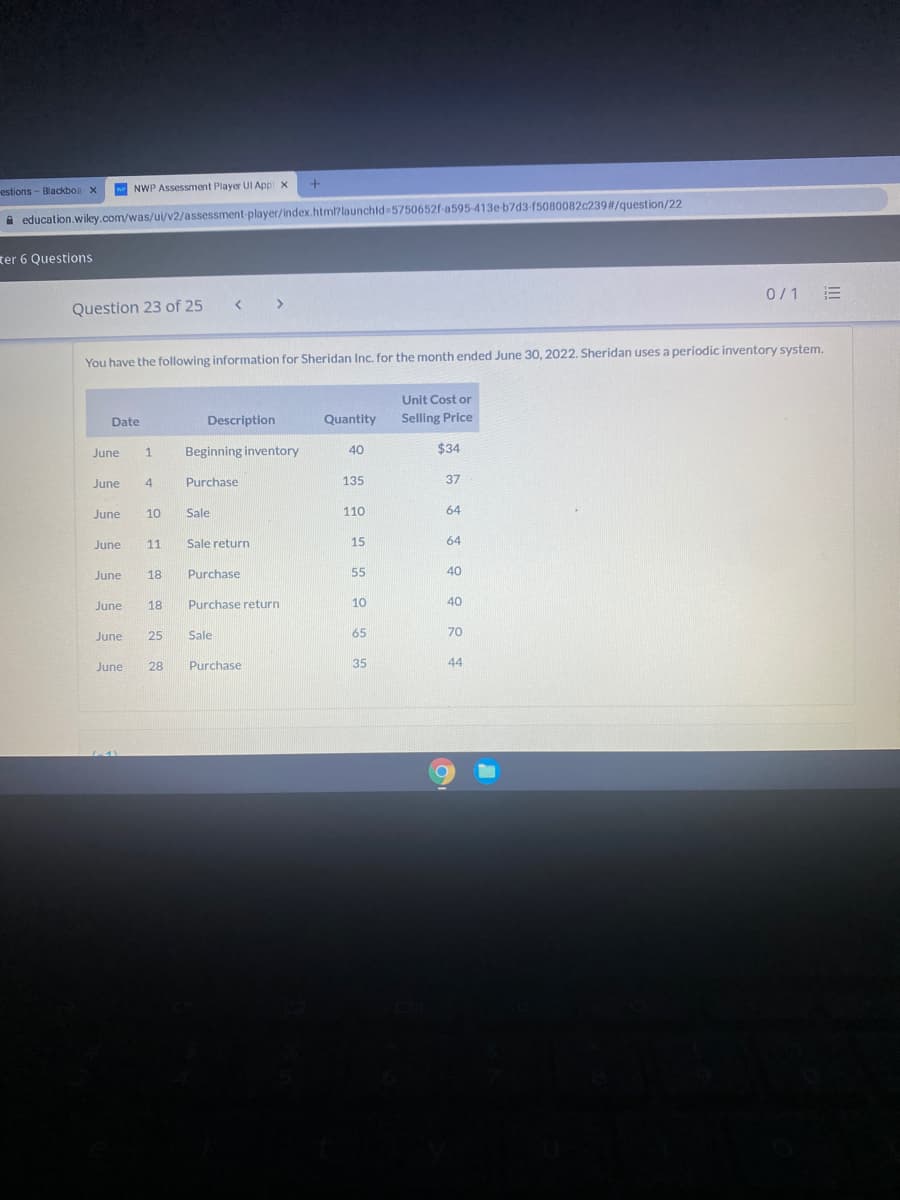

Weighted-average cost per unit

Inventory: Inventory means to stock it may be raw materials, work-in-process or finished goods

Goods available for sale: it is the total of finished goods that can be sold.

Ending inventory: it is the total of inventory that are unsold in the period.

Periodic inventory system: A periodic inventory system is a system of measuring inventory which is calculated at the end of a period using physical count used in normal retail stores

Perpetual inventory system: A perpetual inventory system is a system of measuring inventory which is calculated using continues estimating the inventory using electronic records not physical calculations

Methods in inventory calculation

- FIFO- the FIFO or first in first out is a method where the firstly bought goods are sold firstly

- LIFO- the LIFO or Last In Last Out is a method where the last purchased items are sold firstly

- Weighted average– here the average cost of inventory is taken and it is used in the cost of goods sold and ending inventory calculation.

Under the weighted-average method, the cost per unit is calculated as the total cost of units available for sale divided by the number of units available for sale

Trending now

This is a popular solution!

Step by step

Solved in 3 steps