1. Josh is not sure if he should attend college or not. Part of his decision will be based on the return on investment of college. He estimates that the per year cost to attend Texas Tech including room and board is $27,750. He also assumes the cost will rise by 5.5% per year. How much is a 4 year degree going to cost Josh? A. Josh recognizes that not only will he have the costs of attending school, but he will also be giving up a salary while he attends school. He figures the average salary for those with only a high school diploma is $30,000. He assumes he would receive a 2.4% cost of living raise each year. Determine how much money he will forgo while attending school. B. If Josh adds the cost of college with the salary he will forgo by attending college, he finds it will cost: in total. (Keep in mind that this does not include any interest on loans needed to pay for school.) C. To help him determine if it really is worth it to get a college education, Josh wants to see what the return on investment (ROI) will be 20 years after graduation. After some research, Josh discovers that for him career choice he can expect to earn $2 million with a degree and $900,000 without one. What is Josh's 20-year ROI? (Hint: Use TVM and solve for l/y.) D. Is this is a good ROI or not? List at least 3 other factors besides ROI that Josh should consider.

1. Josh is not sure if he should attend college or not. Part of his decision will be based on the return on investment of college. He estimates that the per year cost to attend Texas Tech including room and board is $27,750. He also assumes the cost will rise by 5.5% per year. How much is a 4 year degree going to cost Josh? A. Josh recognizes that not only will he have the costs of attending school, but he will also be giving up a salary while he attends school. He figures the average salary for those with only a high school diploma is $30,000. He assumes he would receive a 2.4% cost of living raise each year. Determine how much money he will forgo while attending school. B. If Josh adds the cost of college with the salary he will forgo by attending college, he finds it will cost: in total. (Keep in mind that this does not include any interest on loans needed to pay for school.) C. To help him determine if it really is worth it to get a college education, Josh wants to see what the return on investment (ROI) will be 20 years after graduation. After some research, Josh discovers that for him career choice he can expect to earn $2 million with a degree and $900,000 without one. What is Josh's 20-year ROI? (Hint: Use TVM and solve for l/y.) D. Is this is a good ROI or not? List at least 3 other factors besides ROI that Josh should consider.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

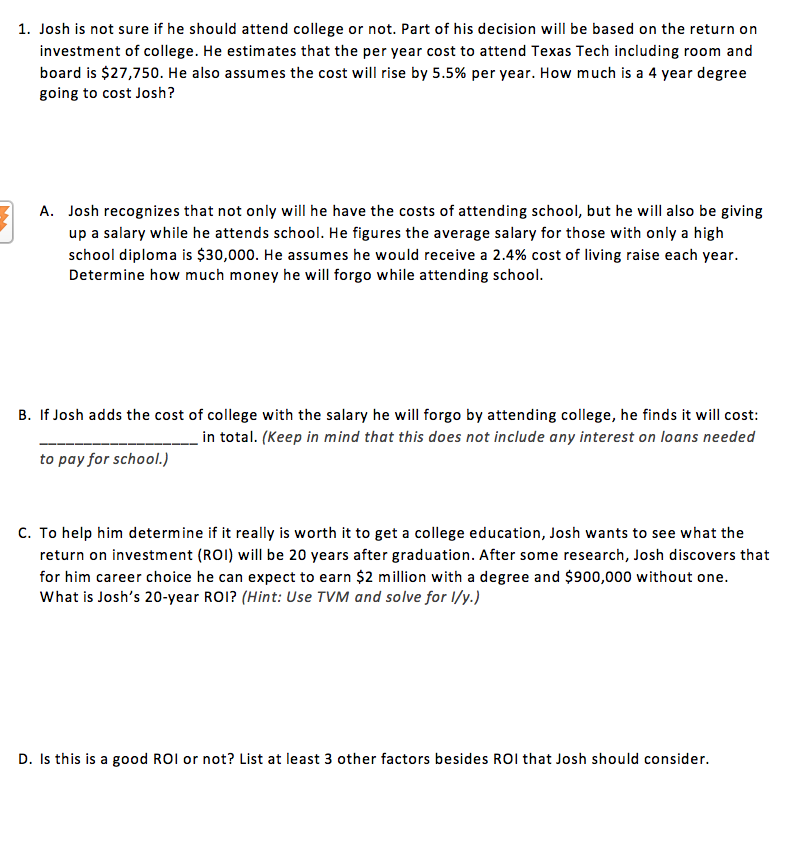

Transcribed Image Text:1. Josh is not sure if he should attend college or not. Part of his decision will be based on the return on

investment of college. He estimates that the per year cost to attend Texas Tech including room and

board is $27,750. He also assumes the cost will rise by 5.5% per year. How much is a 4 year degree

going to cost Josh?

A. Josh recognizes that not only will he have the costs of attending school, but he will also be giving

up a salary while he attends school. He figures the average salary for those with only a high

school diploma is $30,000. He assumes he would receive a 2.4% cost of living raise each year.

Determine how much money he will forgo while attending school.

B. If Josh adds the cost of college with the salary he will forgo by attending college, he finds it will cost:

in total. (Keep in mind that this does not include any interest on loans needed

to pay for school.)

C. To help him determine if it really is worth it to get a college education, Josh wants to see what the

return on investment (ROI) will be 20 years after graduation. After some research, Josh discovers that

for him career choice he can expect to earn $2 million with a degree and $900,000 without one.

What is Josh's 20-year ROI? (Hint: Use TVM and solve for l/y.)

D. Is this is a good ROI or not? List at least 3 other factors besides ROI that Josh should consider.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1: Introduction

VIEWStep 2: 1. Computation of Cost of Degree:

VIEWStep 3: A. Computation of The amount foregone by attending college:

VIEWStep 4: B. Computation of Total opportunity cost:

VIEWStep 5: C. Computation of 20-year ROI:

VIEWStep 6: D. Good ROI or not and other factors to be considered:

VIEWSolution

VIEWTrending now

This is a popular solution!

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning