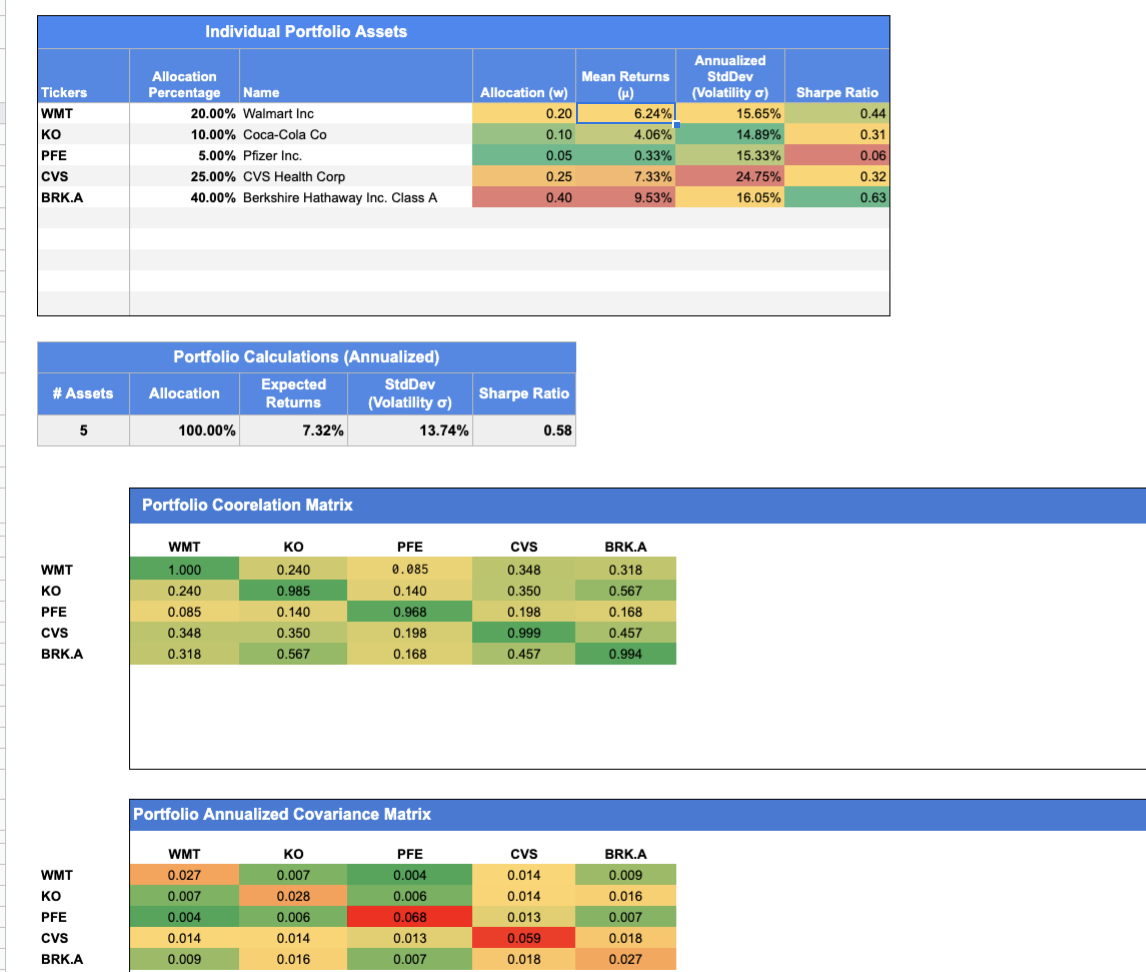

| Tickers WMT KO PFE CVS BRK.A # Assets WMT ко PFE CVS BRK.A WMT Ko 5 PFE CVS Allocation Percentage Name Individual Portfolio Assets 20.00% Walmart Inc 10.00% Coca-Cola Co 5.00% Pfizer Inc. 25.00% CVS Health Corp 40.00% Berkshire Hathaway Inc. Class A Portfolio Calculations (Annualized) Expected Returns Allocation 100.00% WMT 1.000 0.240 0.085 0.348 0.318 Portfolio Coorelation Matrix 7.32% WMT 0.027 0.007 0.004 0.014 КО 0.240 0.985 0.140 0.350 0.567 StdDev (Volatility o) 13.74% Portfolio Annualized Covariance Matrix КО 0.007 0.028 0.006 0.014 PFE 0.085 0.140 0.968 0.198 0.168 PFE 0.004 0.006 0.068 0.013 Allocation (w) 0.20 0.10 0.05 0.25 0.40 Sharpe Ratio 0.58 CVS 0.348 0.350 0.198 0.999 0.457 CVS 0.014 0.014 0.013 0.059 Mean Returns (μ) 6.24% 4.06% 0.33% 7.33% 9.53% BRK.A 0.318 0.567 0.168 0.457 0.994 BRK.A 0.009 0.016 0.007 0.018 Annualized StdDev (Volatility o) 15.65% 14.89% 15.33% 24.75% 16.05% Sharpe Ratio 0.44 0.31 0.06 0.32 0.63

| Tickers WMT KO PFE CVS BRK.A # Assets WMT ко PFE CVS BRK.A WMT Ko 5 PFE CVS Allocation Percentage Name Individual Portfolio Assets 20.00% Walmart Inc 10.00% Coca-Cola Co 5.00% Pfizer Inc. 25.00% CVS Health Corp 40.00% Berkshire Hathaway Inc. Class A Portfolio Calculations (Annualized) Expected Returns Allocation 100.00% WMT 1.000 0.240 0.085 0.348 0.318 Portfolio Coorelation Matrix 7.32% WMT 0.027 0.007 0.004 0.014 КО 0.240 0.985 0.140 0.350 0.567 StdDev (Volatility o) 13.74% Portfolio Annualized Covariance Matrix КО 0.007 0.028 0.006 0.014 PFE 0.085 0.140 0.968 0.198 0.168 PFE 0.004 0.006 0.068 0.013 Allocation (w) 0.20 0.10 0.05 0.25 0.40 Sharpe Ratio 0.58 CVS 0.348 0.350 0.198 0.999 0.457 CVS 0.014 0.014 0.013 0.059 Mean Returns (μ) 6.24% 4.06% 0.33% 7.33% 9.53% BRK.A 0.318 0.567 0.168 0.457 0.994 BRK.A 0.009 0.016 0.007 0.018 Annualized StdDev (Volatility o) 15.65% 14.89% 15.33% 24.75% 16.05% Sharpe Ratio 0.44 0.31 0.06 0.32 0.63

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.5.2MBA: Financial leverage Costco Wholesale Corporation (COST) and Wel-Mart Stroes Inc. (WMT)reported the...

Related questions

Question

I've a set of 5 securities and their individual and portfolio SD/Mean etc. i had to choose random weightings for them but then have a question around minimizing CV.

How do i find and graph of the distribution of the return of the portfolio?

(what i have so far attached for reference - but just wondering what formula/concept i use to do so)

Transcribed Image Text:Individual Portfolio Assets

Annualized

Allocation

Mean Returns

StdDev

Sharpe Ratio

0.44

Tickers

Percentage

Name

Allocation (w)

(Volatility a)

(H)

6.24%

WMT

20.00% Walmart Inc

0.20

15.65%

KO

10.00% Coca-Cola Co

0.10

4.06%

14.89%

0.31

PFE

5.00% Pfizer Inc.

0.05

0.33%

15.33%

0.06

cvs

25.00% CVS Health Corp

0.25

7.33%

24.75%

0.32

BRK.A

40.00% Berkshire Hathaway Inc. Class A

0.40

9.53%

16.05%

0.63

Portfolio Calculations (Annualized)

Expected

StdDev

# Assets

Allocation

Sharpe Ratio

Returns

(Volatility o)

100.00%

7.32%

13.74%

0.58

Portfolio Coorelation Matrix

WMT

ко

PFE

CVs

BRK.A

WMT

1.000

0.240

0.085

0,348

0.318

ко

0.240

0.985

0.140

0.350

0.567

PFE

0.085

0.140

0.968

0.198

0.168

CVs

0.348

0.350

0.198

0.999

0.457

BRK.A

0.318

0.567

0.168

0.457

0.994

Portfolio Annualized Covariance Matrix

WMT

ко

PFE

CVs

BRK.A

WMT

0.027

0.007

0.004

0.014

0.009

ко

0.007

0.028

0.006

0.014

0.016

PFE

0.004

0.006

0.068

0.013

0.007

CVs

0.014

0.014

0.013

0.059

0.018

BRK.A

0.009

0.016

0.007

0.018

0.027

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning