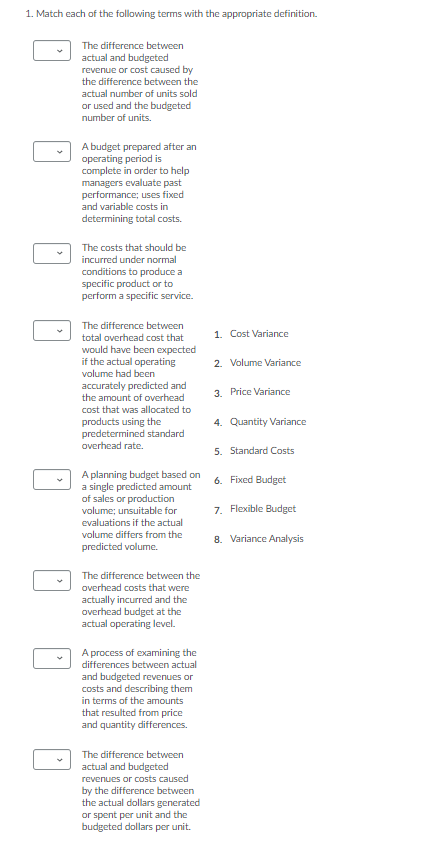

1. Match cach of the following terms with the appropriate definition. The difference between actual and budgeted revenue or cost caused by the difference between the actual number of units sold or used and the budgeted number of units. A budget prepared after an operating period is complete in order to help managers evaluate past performance; uses fixed and variable costs in determining total costs. The costs that should be incurred under normal conditions to produce a specific product or to perform a specific service. The difference between total overhead cost that 1. Cost Variance would have been expected if the actual operating volume had been 2. Volume Variance accurately predicted and the amount of overhead cost that was allocated to 3. Price Variance 4. Quantity Variance products using the predetermined standard overhead rate. 5. Standard Costs A planning budget based on a single predicted amount of sales or production volume; unsuitable for evaluations if the actual volume differs from the 6. Fixed Budget 7. Flexible Budget 8. Variance Analysis predicted volume. The difference between the overhead costs that were actually incurred and the overhead budget at the actual operating level. A process of examining the differences between actual and budgeted revenues or costs and describing them in terms of the amounts that resulted from price and quantity differences. The difference between actual and budgeted revenues or costs caused by the difference between the actual dollars generated or spent per unit and the budgeted dollars per unit.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps