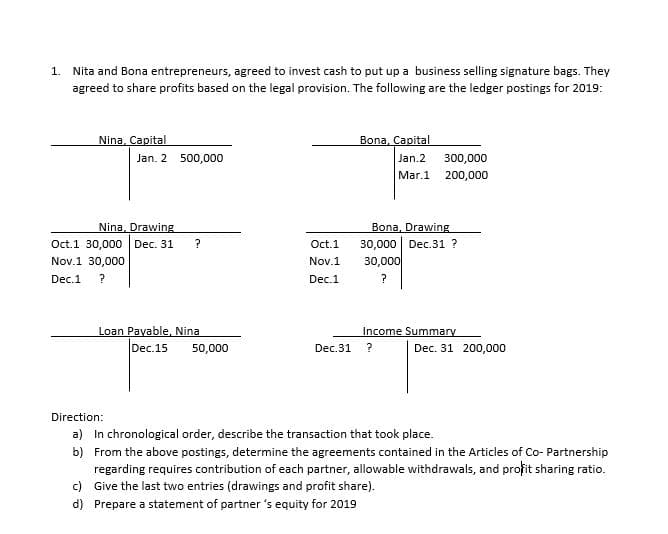

1. Nita and Bona entrepreneurs, agreed to invest cash to put up a business selling signature bags. They agreed to share profits based on the legal provision. The following are the ledger postings for 2019: Bona, Capital Jan.2 300,000 Mar.1 200,000 Nina, Capital Jan. 2 500,000 Bona, Drawing 30,000 Dec.31 ? 30,000 Nina, Drawing Oct.1 30,000 Dec. 31 Oct.1 Nov.1 30,000 Nov.1 Dec.1 Dec.1 Loan Payable, Nina Dec.15 Income Summary 50,000 Dec.31 ? Dec. 31 200,000 Direction: a) In chronological order, describe the transaction that took place. b) From the above postings, determine the agreements contained in the Articles of Co- Partnership regarding requires contribution of each partner, allowable withdrawals, and profit sharing ratio. c) Give the last two entries (drawings and profit share). d) Prepare a statement of partner 's equity for 2019

1. Nita and Bona entrepreneurs, agreed to invest cash to put up a business selling signature bags. They agreed to share profits based on the legal provision. The following are the ledger postings for 2019: Bona, Capital Jan.2 300,000 Mar.1 200,000 Nina, Capital Jan. 2 500,000 Bona, Drawing 30,000 Dec.31 ? 30,000 Nina, Drawing Oct.1 30,000 Dec. 31 Oct.1 Nov.1 30,000 Nov.1 Dec.1 Dec.1 Loan Payable, Nina Dec.15 Income Summary 50,000 Dec.31 ? Dec. 31 200,000 Direction: a) In chronological order, describe the transaction that took place. b) From the above postings, determine the agreements contained in the Articles of Co- Partnership regarding requires contribution of each partner, allowable withdrawals, and profit sharing ratio. c) Give the last two entries (drawings and profit share). d) Prepare a statement of partner 's equity for 2019

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 55P

Related questions

Question

100%

Transcribed Image Text:1. Nita and Bona entrepreneurs, agreed to invest cash to put up a business selling signature bags. They

agreed to share profits based on the legal provision. The following are the ledger postings for 2019:

Nina, Capital

Bona, Capital

Jan. 2 500,000

Jan.2

300,000

Mar.1 200,000

Bona, Drawing

30,000 Dec.31 ?

30,000

Nina, Drawing

Oct.1 30,000 Dec. 31

?

Oct.1

Nov.1 30,000

Nov.1

Dec.1

?

Dec.1

Loan Payable, Nina

Dec.15

Income Summary

50,000

Dec.31 ?

Dec. 31 200,000

Direction:

a) In chronological order, describe the transaction that took place.

b) From the above postings, determine the agreements contained in the Articles of Co- Partnership

regarding requires contribution of each partner, allowable withdrawals, and profit sharing ratio.

c) Give the last two entries (drawings and profit share).

d) Prepare a statement of partner 's equity for 2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT