I lay admits K. Kho as a partner in his business. Accounts in the ledger of Jay on December 31,2019. just before the admission of K. Kho show the following balances Cash P 26,000 Accounts receivable 120,000 Merchandise Inventory 180,000 Accounts payable 62.000 Hay. Capital 264,000 Ik is agreed that for purposes of establishing JJay's interest, the following adjustments should be made: an allowance for uncollecible accounts of 2% of accounts receivable is to be established. The merchandise inventory is to be valued at P 202.000 Prepaid Expenses of P 6.500 and accrued liabilicies of P 4,000 are to be recognized. K. Kho is to invest sufficient cash to obrain a 1/3 interest in the partnership. The partnership will use a new set of books. REQUIRED: a) Give the entries to adjust and close the books of J Jay. b.) Give the necessary entries in the new set of books of the partnership.

I lay admits K. Kho as a partner in his business. Accounts in the ledger of Jay on December 31,2019. just before the admission of K. Kho show the following balances Cash P 26,000 Accounts receivable 120,000 Merchandise Inventory 180,000 Accounts payable 62.000 Hay. Capital 264,000 Ik is agreed that for purposes of establishing JJay's interest, the following adjustments should be made: an allowance for uncollecible accounts of 2% of accounts receivable is to be established. The merchandise inventory is to be valued at P 202.000 Prepaid Expenses of P 6.500 and accrued liabilicies of P 4,000 are to be recognized. K. Kho is to invest sufficient cash to obrain a 1/3 interest in the partnership. The partnership will use a new set of books. REQUIRED: a) Give the entries to adjust and close the books of J Jay. b.) Give the necessary entries in the new set of books of the partnership.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 30CE: LO.2 In 2019, Chaya Corporation, an accrual basis, calendar year taxpayer, provided services to...

Related questions

Question

please answer all the questions immediately thankyou

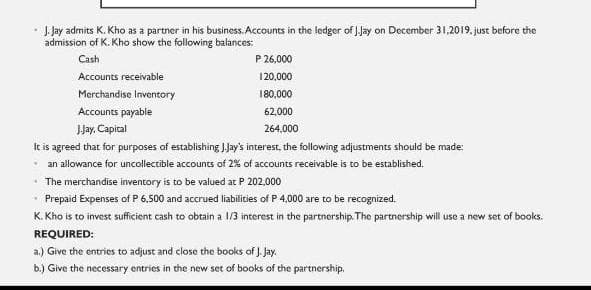

Transcribed Image Text:· J Jay admits K. Kho as a partner in his business. Accounts in the ledger of JJay on December 31,2019. just before the

admission of K. Kho show the following balances:

Cash

P 26,000

Accounts receivable

120,000

Merchandise Inventory

180,000

Accounts payable

62,000

Jay. Capital

264.000

It is agreed that for purposes of establishing JJay's interest, the following adjustments should be made:

- an allowance for uncollectible accounts of 2% of accounts receivable is to be established.

• The merchandise inventory is to be valued at P 202.000

• Prepaid Expenses of P 6,500 and accrued liabilities of P 4,000 are to be recognized.

K. Kho is to invest sufficient cash to obtain a 1/3 interest in the partnership. The partnership will use a new set of books.

REQUIRED:

a.) Give the entries to adjust and close the books of J. Jay.

b.) Give the necessary entries in the new set of books of the partnership.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning