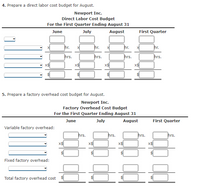

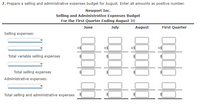

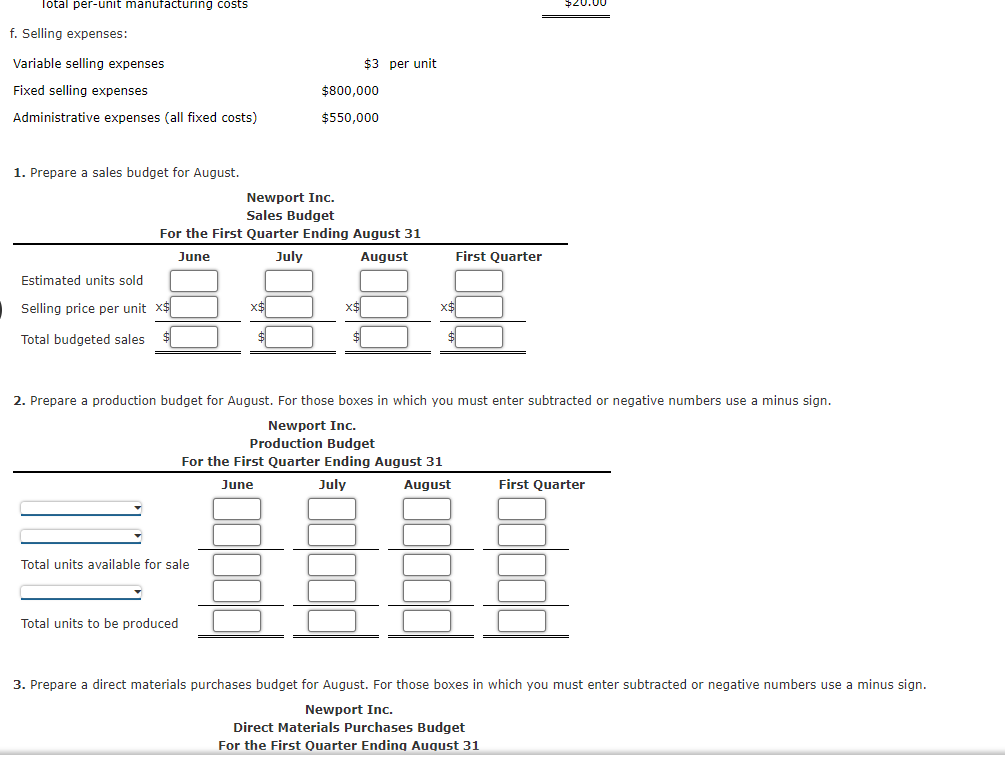

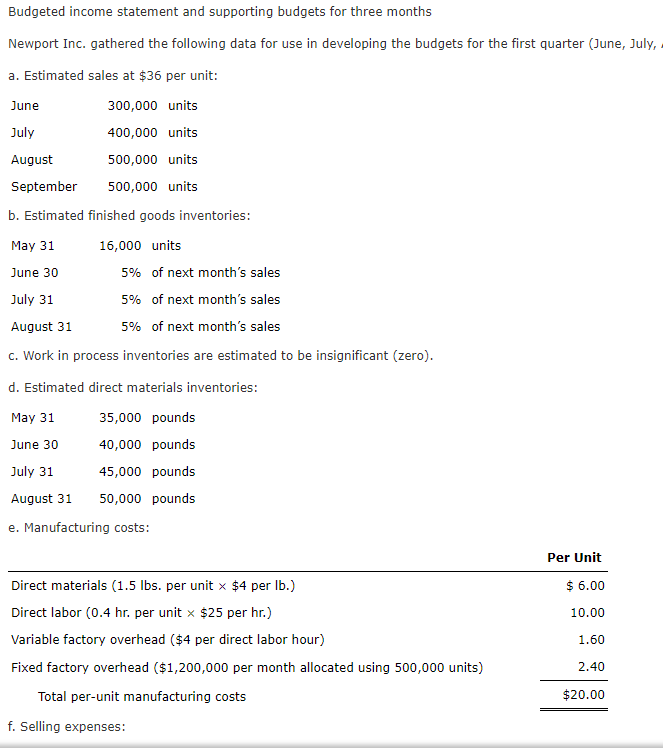

1. Prepare a sales budget for August. Newport Inc. Sales Budget For the First Quarter Ending August 31 June July August First Quarter Estimated units sold Selling price per unit x$ X$ Total budgeted sales 2. Prepare a production budget for August. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Newport Inc. Production Budget For the First Quarter Ending August 31 June July August First Quarter Total units available for sale Total units to be produced 3. Prepare a direct materials purchases budget for August. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 2 steps with 6 images