s paid during the year 475 nt, net of accumulated depreciation 1,220 сах ехрense caxes payable 265 265 expense 400 967 1,600 m debt expenses | earnings, beginning 3,500 12 1,600 evenue 9,600 xpenses 310 otmonto 200

Q: Please Solve In 20mins

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Nagy Industries reported a net income of $600,360 on December 31, 2021. At the beginning of the…

A: Basic EPS is the earnings per share which only includes the effect of common shares while…

Q: Balance sheet and income statement data indicate the following: Bonds payable, 7% (due in 15 years)…

A: Interest coverage ratio is a financial ratio which shows the ability of the company to pay its…

Q: HH Auto Repair reports the following information for the coming year Labor rate, including fringe…

A: Labor rate per hour is the charge of labor for one hour of work. Markup is the additional amount…

Q: Kyle, a local entrepreneur, is planning to sell 10 liter bottled water in his sari- sari store. A…

A: Introduction:- The following basic information as follows under:- A local water purifying business…

Q: Calculate the turning point of economic efficiency!

A: Efficiency is calculated when output is divided by input and multiplied by 100. Input = revenue = 18…

Q: Golden Inc. produces swimsuits. The following budgeted and actual amounts are for 2020: Cost Budget…

A: Budget is the estimate made for future period of time. Budgets are compared with actual results in…

Q: The market price of a stock is $35.00. An investor has purchased a call option for 100 shares of…

A: Intrinsic Value:- It measures the true value of assets or stock means it is the maximum value of a…

Q: Pizza Inc. reported the following balances: December 31 Inventory 5,200,000 Accounts payable…

A: Accrual basis: Under accrual basis accounting, revenue and expenses are recognized when they are…

Q: At year-end 2021, Wallace Landscaping's total assets, all of which are used in operations, were…

A: Total Assets: Total Assets are the amounts reported in company's balance sheet in the secondary head…

Q: Today is 1 July, 2019. Hélène has a portfolio which consists of two different types of financial…

A: Bond: - Bond is the written promise made by the borrower to pay a fixed amount of money as stated…

Q: Equarter by month. Cash sales are 10% of total sales each month. Historically, sales on ccount lave…

A: The cash collection schedule is prepared to estimate the cadh collection during the period.

Q: ssued credit memorandum to Dial Corp. for defective merchandise –$315, including 5% GST. Inventory…

A: Sales returns and allowances are a type of sales deduction that represents the selling price of…

Q: Javvi land s a amall country Sectos microchips and computis. This with anly tiuo yar the total…

A: GDP of Jarvilland from Computer sector: As per the Value-added Approach = Gross value of output -…

Q: the city sells 20 liters bottled water for 25 pesos eacn. Phncess wants to add 30% mark-up from the…

A: Selling price = Cost per unit + Mark up Cost per unit = $25 Mark up =30% of original cost Selling…

Q: On January 2, 2018, Archer Company, a skateboard manufacturer, installed a computerized machine in…

A: 1. Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of…

Q: lease help

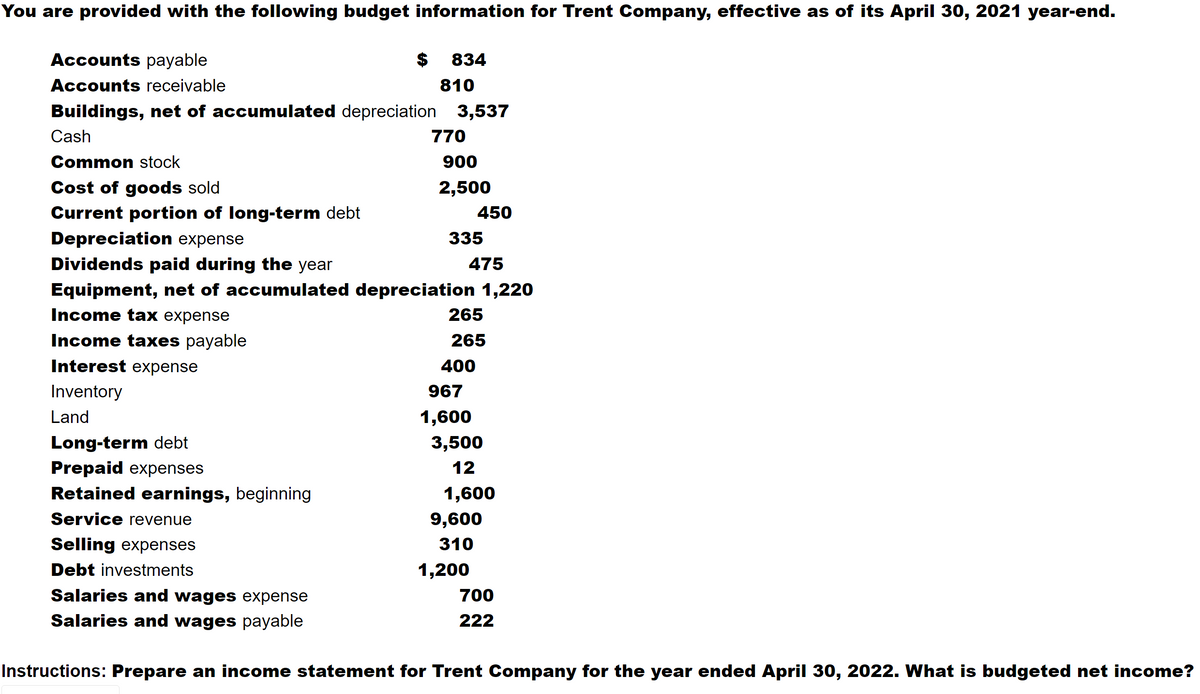

A: In this question, we have to make an income statement and find out the financial advantage or…

Q: * 00 V R 23 Complete the following data taken from the condensed income statements for merchandising…

A: Since, Sales - cost of goods sold = Gross profit And Net Income/(net loss) = Gross profit -…

Q: The Real Estate Products Division of Blossom Co. is operated as a profit center. Sales for the…

A: Introduction Responsibility accounting performance report collect all the responsibility accounting…

Q: In 2014,Craig and Kathy Koehler owned a small business which was held as a proprietorship in Kathy's…

A: Tax liability is an amount levied on the taxpayer's income on the basis of applicable slab rates.…

Q: For MACRS, goodwill has what useful life

A: MACRS is an acronym and stands for the modified accelerated cost recovery system is a method of…

Q: ine will generate 568,000 per year in revenue and the direct o 7. Compute the payback period using…

A: Payback period = initial investment/cash flow per year

Q: l grid, they lost their vacation home to fire. The ome last year, and received insurance proceeds…

A: Given as, The 2021 tax year as,

Q: In the preparation of the worksheet of a merchandising business, the ending balance of the…

A: Merchandise inventory is the current assets, goods purchased or manufactured with the purpose of…

Q: Concerning the Federal tax on generation-skipping transfers: A. The charitable deduction is allowed…

A: Introduction:- The generation-skipping transfer tax is a federal tax It occurred when there is a…

Q: stockholders equity Additional Information for 2022: 1. Land of $820,000 was obtained by issuing a…

A: Cash Flow Statement - Statement of Cash Flow shows the movement of cash in the financial year. It…

Q: PROBLEM 11-21 Return on Investment (ROI) and Residual Income LO11-1, LO11-2 "I know headquarters…

A: The return on investment is a measure to evaluate the performance because it helps in identifying…

Q: Question 4 The main objective of XBRL is to: A. Produce a comprehensive body of accounting…

A: Introduction:- XBRL stands for Extensible Business Reporting Language. It used for business…

Q: Dec. 31 Insurance Expense

A: A Journal entry is a primary entry that records the financial transactions initially. The financial…

Q: Hofburg's standard quantities for 1 unit of product include 2 pounds of materials and 1.5 labor…

A: = Working Cost per Unit Direct Material 2*2 4 Direct Material 7*1.5 10.5 Overhead 8*1.5…

Q: Exercise 7-2 (Algo) Net Present Value Analysis (LO7-2] The management of Kunkel Company is…

A: Net Present Value- Net present value (NPV) is a tool used to calculate the current value of…

Q: The Laura Company has the following errors on its books as of December 31, 2020. The books for 2020…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: Pilger Corporation has cash on hand at year-end of $201,000 and a negative cash flow from operations…

A: Formulas: Monthly Cash Expenses = Negative cash Flow / Number of Months in a year Ratio of cash to…

Q: An employee receives an hourly rate of $18, with time and a half for all hours worked in excess of…

A: Introduction:- The following basic information as follows under:- Federal income tax withheld, $144…

Q: Your Company reported the following: Year 1 Year 2 Year 3 Year 4 Margin 4% 6% 5% 8% Turnover ?…

A: ROI means the return on investment which is calculated by dividing the net operating income with…

Q: The Japanese tsunami disaster of March 2011 had a negative effect on the automobile industry. With…

A: Planning is the process of thinking regarding the activities required to achieve a desired goal.…

Q: Thomas C. Company holds a 15% equity investment in Kayak Zone and treats to its stockholders. How…

A: An associate company is a company that holds a minimum of 20% of shares in another company. If the…

Q: Marchant Urban Diner is a charity supported by donations that provides free meals to the homeless.…

A: Calculation of Groceries Expenses Groceries = 1,800 meals X $ 3.85 per meal Groceries = $ 6,930…

Q: Mortgage Interest is a common: Select one: O a. None of these O b. Exclusion from gross income Oc.…

A: Mortgage interest is the amount of interest which is charged on the loan taken for the purpose of…

Q: The management of Your Corporation is considering dropping a product. Data from the company's…

A: Increase (decrease) in overall net operating income if product is dropped = Savings in avoidable…

Q: A building with an appraisal value of $132,331 is made available at an offer price of $151,729. The…

A: Note payable is a liability posted to the balance sheet of the company that has to be repaid within…

Q: The Sunstate Bank has asked Dell Printing Co. for a budgeted balance sheet for the year ended…

A: Introduction:- Unclassified balance sheet lists all assets in their order of liquidity. Most of…

Q: On January 1, 2018, Kefauver Company purchased a piece of equipment for $375,000. The equipment had…

A: 1. Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of…

Q: Problem 12.1A (Static) Recording adjustments for accrued and prepaid items and unearned income. LO…

A: The adjustment entries are prepared at year end to adjust the revenue and expenses for the current…

Q: 101- Final Exam Part The Boxwood Company sells blankets for $34 each. The following was taken from…

A: Units in ending inventory = 10 - 4 + 14 - 4 - 3 + 12 = 25 units

Q: An S corporation shareholder's basis may be affected by some or all business liabilities a. Never b.…

A: S corporation shareholders are those who own interest in a business entity designated as a…

Q: Chapter 7 (Topics 7.4 &7.5) Little Sluggers Inc., manufacturer of aluminum bats, estimates sales of…

A: A flexible budget is one based on different volumes of sales. A flexible budget flexes the static…

Q: On January 1, 2018, Kefauver Company purchased a piece of equipment for $375,000. The equipment had…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Merchandise is sold for cash. The selling price of the merchandise is $1,100 and the sale is subject…

A: When we do sales,we need pay sales tax on sales made at a percentage given.That sales tax is…

Q: Regarding the need to pay preferred stock dividends, which of the following statements is NOT…

A: Preferred stock receive priority over common shares with respect to dividend and capital repayments.…

Step by step

Solved in 2 steps

- A. Discuss the purpose of the cash budget. B. If the cash for the first quarter of the fiscal year indicates excess cash at the end of each of the first two months, how might the excess cash be used?What is the amount of budgeted cash payments if purchases are budgeted for $420,000 and the beginning and ending balances of accounts payable are $95,000 and $92,000, respectively?What is the amount of budgeted cash payments if purchases are budgeted for $190,500 and the beginning and ending balances of accounts payable are $21,000 and $25,000, respectively?

- Prepare a revenue budget for the year ending December 31, 2016.Capital expenditures budget On August 1, 20Y4. the controller of Handy Dan Tools Inc. is planning capital expenditures for the years 20Y5-20Y8. The controller interviewed several Handy Dan executives to collect the necessary information for the capital expenditures budget. Excerpts of the interviews are as follows: Director of Facilities: A construction contract was signed in May 20Y4 for the construction of a new factory building at a contract cost of $9,000,000. The construction is scheduled to begin in 20Y5 and completed in 20Y6. Vice President of Manufacturing: Once the new factor)' building is finished, we plan to purchase $3-6 million in equipment in late 20Y6. I expect that an additional $500,000 will lx-needed early in the following year (20Y7) to test and install the equipment before we can begin production. If sales continue to grow, I expect we'll need to invest another half million in equipment in 20Y8. Vice President of Marketing: We have really been growing lately. I wouldn't be surprised if we need to expand the size of our new factory building in 20YS by at least 25%. Fortunately, we expect inflation to have minimal impact on construction costs over the next four years. Additionally, 1 would expect the cost of the expansion to Ik- proportional to the size of the expansion. Director of Information Systems: We need to upgrade our information systems to wireless network technology. It doesn't make sense to do this until after the new factory building is completed and producing product. During 20Y7, once the factor)' is up and running, we should equip the whole facility with wireless technology. I think it would cost us $400,000 today to install the technology. However, prices have been dropping by 10% per year, so it should be less expensive at a later date. President: I am excited about our long-term prospects. My only short-term concern is financing the $5,000,000 of construction costs on the portion of the new factor)' building scheduled to be completed in 20Y5. Use the interview information above to prepare a capital expenditures budget for Handy Dan Tools Inc. for the years 20Y5-20Y8.Prepare a Budgeted Statement of Financial Position as at 31 December 2022 using the below information: Statement of comprehensive income for the year ended 31 December 2021Sales 10 000 000Cost of sales (5 750 000)Gross profit 4 250 000Variable selling and administrative expenses (1 500 000)Fixed selling and administrative expenses (500 000)Net profit 2 250 000 Statement of financial position as at 31 December 2021ASSETSNon-current assets 800 000Property, plant and equipment 800 000Current assets 3 400 000Inventories 1 600 000Accounts receivable 600 000Cash 1 200 000 4 200…

- The following information pertains to Yoyo Projects for the three months ended 31 May 2020: Actual Budgeted March R April R May R Revenue (20% for cash and 80% on credit) 360 000 380 000 400 000 Purchases (10% for cash 90% on credit) 240 000 280 000 320 000 Salaries and wages paid 40 000 60 000 60 000 Cash expenses 24 000 28 000 32 000 Depreciation 2 000 2 000 2 000 Additional Information: It is expected that debtors will settle their accounts as follows: 20 % in the month of invoice 70% in the month after the month of invoice, and 5% in the second month after the month of invoice The remaining 5% is usually written off as bad Trade creditors are paid in the month after purchase at a discount of 5%. 50% of the salaries and wages are weekly wages. Since wages are paid weekly, usually 10% of the wages are paid in the month following the month in which they were Expenses are paid as they The favourable…The following information was extracted from NOVO cash budget for July 2019. The following data are as follows: Excess of cash available over disbursements is P700; cash balance as of July 1, 2019 is P 5,000 and a total cash disbursement for July is P22,500. The business can only borrow in round figures of P1,000 amounts. If the business is required to maintain a minimum cash balance of P100,000, how much money should be borrowed in July?Zito Inc operates under effective budgeting management techniques and it has reported the following balances for the year December 31 2020: Prepare closing entries at December 31, 2020. Retained earnings =$30,000 Dividends= $2,000 Service revenue= $50,000 Salaries expense =$27,000 Supplies expense= $4,000

- ere are some important figures from the budget of Crenshaw, Inc., for the second quarter of 2019. April May June Credit sales $ 689,000 $ 598,000 $ 751,000 Credit purchases 302,000 282,000 338,000 Cash disbursements Wages, taxes, and expenses 137,000 129,000 179,000 Interest 15,600 15,600 15,600 Equipment purchases 53,500 6,600 248,000 The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sale, and the remaining 60 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2019, credit sales were $561,000. Using this information, complete the following cash budget: (Do not round intermediate calculations and round your answers to the nearest whole number,…The following information pertains to Omega Projects Ltd for the three months ended 31 December 2020. Actual Budgeted October November December R R R Revenue (20% for cash and 80% on credit) 360 000 380 000 400 000 Purchases (10% for cash 90% on credit) 240 000 280 000 320 000 Salaries and wages paid 40 000 60 000 60 000 Cash expenses 24 000 28 000 32 000 Depreciation 2 000 2 000 2 000 Additional information: It is expected that debtors will settle their accounts as follows: 20% in the month of invoice 70% in the month after the month of invoice, and 5% in the second month after the month of The remaining 5% is usually written off as bad Trade creditors are paid in the month after the purchases at a discount of 5%. 50% of the salaries and wages are weekly wages. Because wages are paid weekly, usually 10% of the wages are paid in the month following the month in which they were…Here are some important figures from the budget of Crenshaw, Inc., for the second quarter of 2019. April May June Credit sales $ 689,000 $ 598,000 $ 751,000 Credit purchases 302,000 282,000 338,000 Cash disbursements Wages, taxes, and expenses 137,000 129,000 179,000 Interest 15,600 15,600 15,600 Equipment purchases 53,500 6,600 248,000 The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sale, and the remaining 60 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2019, credit sales were $561,000. Using this information, complete the following cash budget: (Do not round intermediate calculations and round your answers to the nearest whole number,…