1. Prepare comparative balance sheets for 20 x 2 and 20 x 1, showing peso and percentage increases or decreases (Horizontal Analysis). 2. Prepare income statement for the year ended December 31, 20 x 2 with common size percentages (Vertical Analysis). 3. Prepare comparative common-size balance sheets as of December 31, 20 x 2 and 20 x 1 (Vertical Analysis)

1. Prepare comparative balance sheets for 20 x 2 and 20 x 1, showing peso and percentage increases or decreases (Horizontal Analysis). 2. Prepare income statement for the year ended December 31, 20 x 2 with common size percentages (Vertical Analysis). 3. Prepare comparative common-size balance sheets as of December 31, 20 x 2 and 20 x 1 (Vertical Analysis)

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PA: Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall...

Related questions

Question

please answer as soon as possible. thanks

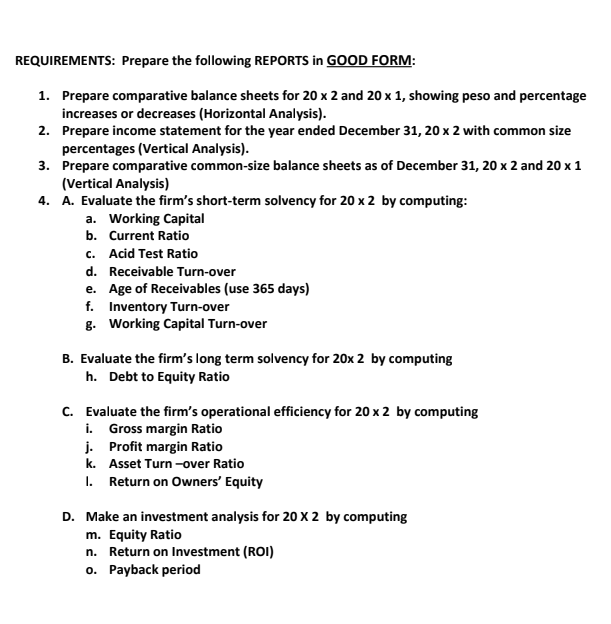

Transcribed Image Text:REQUIREMENTS: Prepare the following REPORTS in GOOD FORM:

1. Prepare comparative balance sheets for 20 x 2 and 20 x 1, showing peso and percentage

increases or decreases (Horizontal Analysis).

2. Prepare income statement for the year ended December 31, 20 x 2 with common size

percentages (Vertical Analysis).

3. Prepare comparative common-size balance sheets as of December 31, 20 x 2 and 20 x 1

(Vertical Analysis)

4. A. Evaluate the firm's short-term solvency for 20 x 2 by computing:

a. Working Capital

b. Current Ratio

c. Acid Test Ratio

d. Receivable Turn-over

e. Age of Receivables (use 365 days)

f. Inventory Turn-over

g. Working Capital Turn-over

B. Evaluate the firm's long term solvency for 20x 2 by computing

h. Debt to Equity Ratio

c. Evaluate the firm's operational efficiency for 20 x 2 by computing

i. Gross margin Ratio

j. Profit margin Ratio

k. Asset Turn -over Ratio

1. Return on Owners' Equity

D. Make an investment analysis for 20 X 2 by computing

m. Equity Ratio

n. Return on Investment (ROI)

o. Payback period

Transcribed Image Text:NAME

Year and Section_

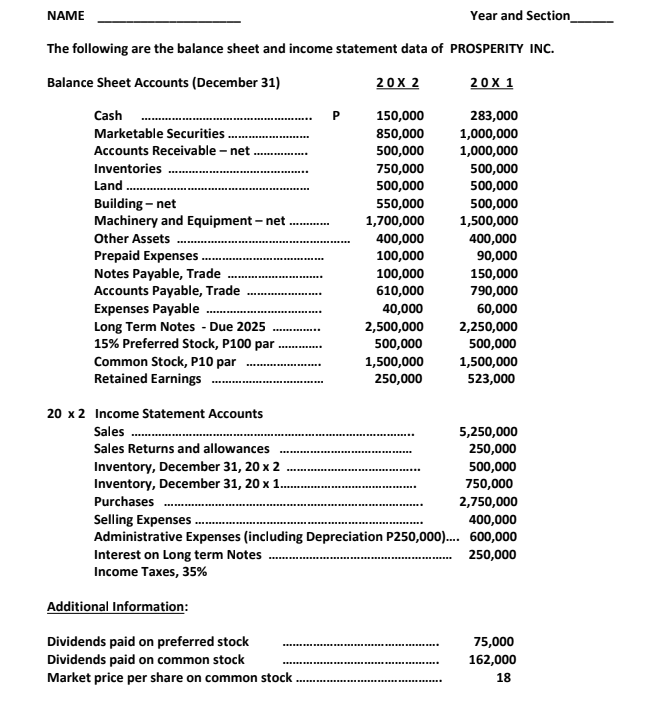

The following are the balance sheet and income statement data of PROSPERITY INC.

Balance Sheet Accounts (December 31)

20X 2

20 X 1

Cash

150,000

283,000

Marketable Securities .

850,000

1,000,000

Accounts Receivable - net

500,000

1,000,000

Inventories

750,000

500,000

Land .

500,000

500,000

Building – net

Machinery and Equipment – net

550,000

500,000

1,700,000

1,500,000

Other Assets

400,000

90,000

400,000

Prepaid Expenses.

Notes Payable, Trade

Accounts Payable, Trade

Expenses Payable

100,000

100,000

150,000

610,000

790,000

40,000

60,000

Long Term Notes - Due 2025

2,500,000

2,250,000

15% Preferred Stock, P100 par

Common Stock, P10 par

Retained Earnings

500,000

1,500,000

250,000

500,000

1,500,000

.... .

523,000

20 x2 Income Statement Accounts

Sales .

5,250,000

250,000

Sales Returns and allowances

Inventory, December 31, 20 x 2

500,000

Inventory, December 31, 20 x 1.

750,000

Purchases

2,750,000

....

Selling Expenses

Administrative Expenses (including Depreciation P250,000).. 600,000

400,000

Interest on Long term Notes

Income Taxes, 35%

250,000

Additional Information:

Dividends paid on preferred stock

Dividends paid on common stock

Market price per share on common stock.

75,000

162,000

18

........**....

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning