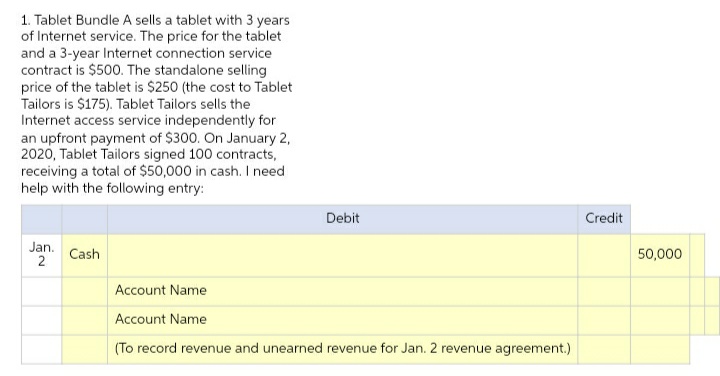

з уears of Internet service. The price for the tablet and a 3-year Internet connection service contract is $500. The standalone selling price of the tablet is $250 (the cost to Tablet Tailors is $175). Tablet Tailors sells the Internet access service independently for an upfront payment of $300. On January 2, 2020, Tablet Tailors signed 100 contracts, receiving a total of $50,000 in cash. I need help with the following entry: Debit Credit Jan. Cash 50,000 Account Name Account Name (To record revenue and unearned revenue for Jan. 2 revenue agreement.)

з уears of Internet service. The price for the tablet and a 3-year Internet connection service contract is $500. The standalone selling price of the tablet is $250 (the cost to Tablet Tailors is $175). Tablet Tailors sells the Internet access service independently for an upfront payment of $300. On January 2, 2020, Tablet Tailors signed 100 contracts, receiving a total of $50,000 in cash. I need help with the following entry: Debit Credit Jan. Cash 50,000 Account Name Account Name (To record revenue and unearned revenue for Jan. 2 revenue agreement.)

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 1EA: On March 1, Bates Board Shop sells 300 surfboards to a local lifeguard station at a sales price of...

Related questions

Question

100%

Transcribed Image Text:1. Tablet Bundle A sells a tablet with 3 years

of Internet service. The price for the tablet

and a 3-year Internet connection service

contract is $500. The standalone selling

price of the tablet is $250 (the cost to Tablet

Tailors is $175). Tablet Tailors sells the

Internet access service independently for

an upfront payment of $300. On January 2,

2020, Tablet Tailors signed 100 contracts,

receiving a total of $50,000 in cash. I need

help with the following entry:

Debit

Credit

Jan.

Cash

2

50,000

Account Name

Account Name

(To record revenue and unearned revenue for Jan. 2 revenue agreement.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning