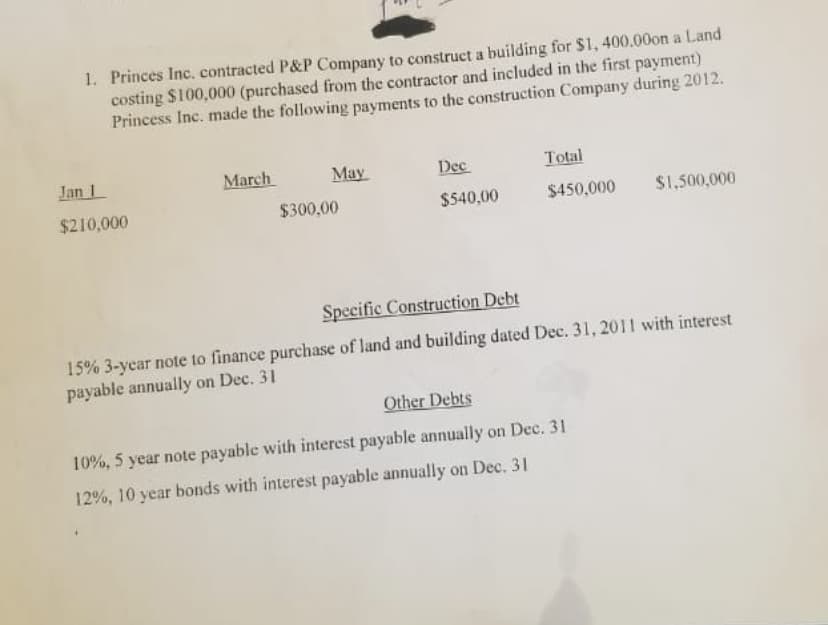

1. Princes Inc. contracted P&P Company to construct a building for $1, 400.000n a Land costing $100,000 (purchased from the contractor and included in the first payment) Princess Inc. made the following payments to the construction Company during 2012. Jan 1 $210,000 March May Dec Total $300,00 $540,00 $450,000 $1,500,000 Specific Construction Debt 15% 3-year note to finance purchase of land and building dated Dec. 31, 2011 with interest payable annually on Dec. 31 Other Debts 10%, 5 year note payable with interest payable annually on Dec. 31 12%, 10 year bonds with interest payable annually on Dec. 31

1. Princes Inc. contracted P&P Company to construct a building for $1, 400.000n a Land costing $100,000 (purchased from the contractor and included in the first payment) Princess Inc. made the following payments to the construction Company during 2012. Jan 1 $210,000 March May Dec Total $300,00 $540,00 $450,000 $1,500,000 Specific Construction Debt 15% 3-year note to finance purchase of land and building dated Dec. 31, 2011 with interest payable annually on Dec. 31 Other Debts 10%, 5 year note payable with interest payable annually on Dec. 31 12%, 10 year bonds with interest payable annually on Dec. 31

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:1. Princes Inc. contracted P&P Company to construct a building for $1, 400.000n a Land

costing $100,000 (purchased from the contractor and included in the first payment)

Princess Inc. made the following payments to the construction Company during 2012.

Jan 1

$210,000

March

May

Dec

Total

$300,00

$540,00

$450,000

$1,500,000

Specific Construction Debt

15% 3-year note to finance purchase of land and building dated Dec. 31, 2011 with interest

payable annually on Dec. 31

Other Debts

10%, 5 year note payable with interest payable annually on Dec. 31

12%, 10 year bonds with interest payable annually on Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College