1. Suppose the typical firm in a perfectly competitive industry has the following long-run total cost function: TC = 240Q – 6Q² + 0.08Qª| What is the long-run price for product Q?

1. Suppose the typical firm in a perfectly competitive industry has the following long-run total cost function: TC = 240Q – 6Q² + 0.08Qª| What is the long-run price for product Q?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter11: Price And Output Determination: Monopoly And Dominant Firms

Section: Chapter Questions

Problem 4E

Related questions

Question

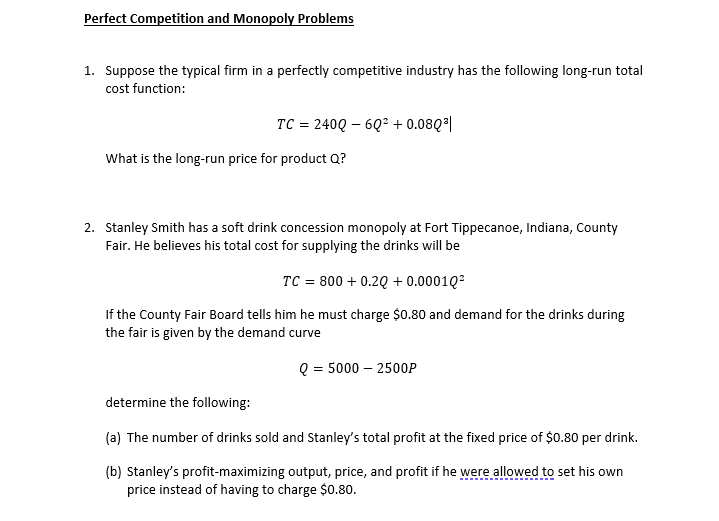

Transcribed Image Text:Perfect Competition and Monopoly Problems

1. Suppose the typical firm in a perfectly competitive industry has the following long-run total

cost function:

TC = 240Q – 6Q2 + 0.08Q*|

What is the long-run price for product Q?

2. Stanley Smith has a soft drink concession monopoly at Fort Tippecanoe, Indiana, County

Fair. He believes his total cost for supplying the drinks will be

TC = 800 + 0.2Q + 0.0001Q?

If the County Fair Board tells him he must charge $0.80 and demand for the drinks during

the fair is given by the demand curve

Q = 5000 – 2500P

determine the following:

(a) The number of drinks sold and Stanley's total profit at the fixed price of $0.80 per drink.

(b) Stanley's profit-maximizing output, price, and profit if he were allowed to set his own

price instead of having to charge $0.80.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning