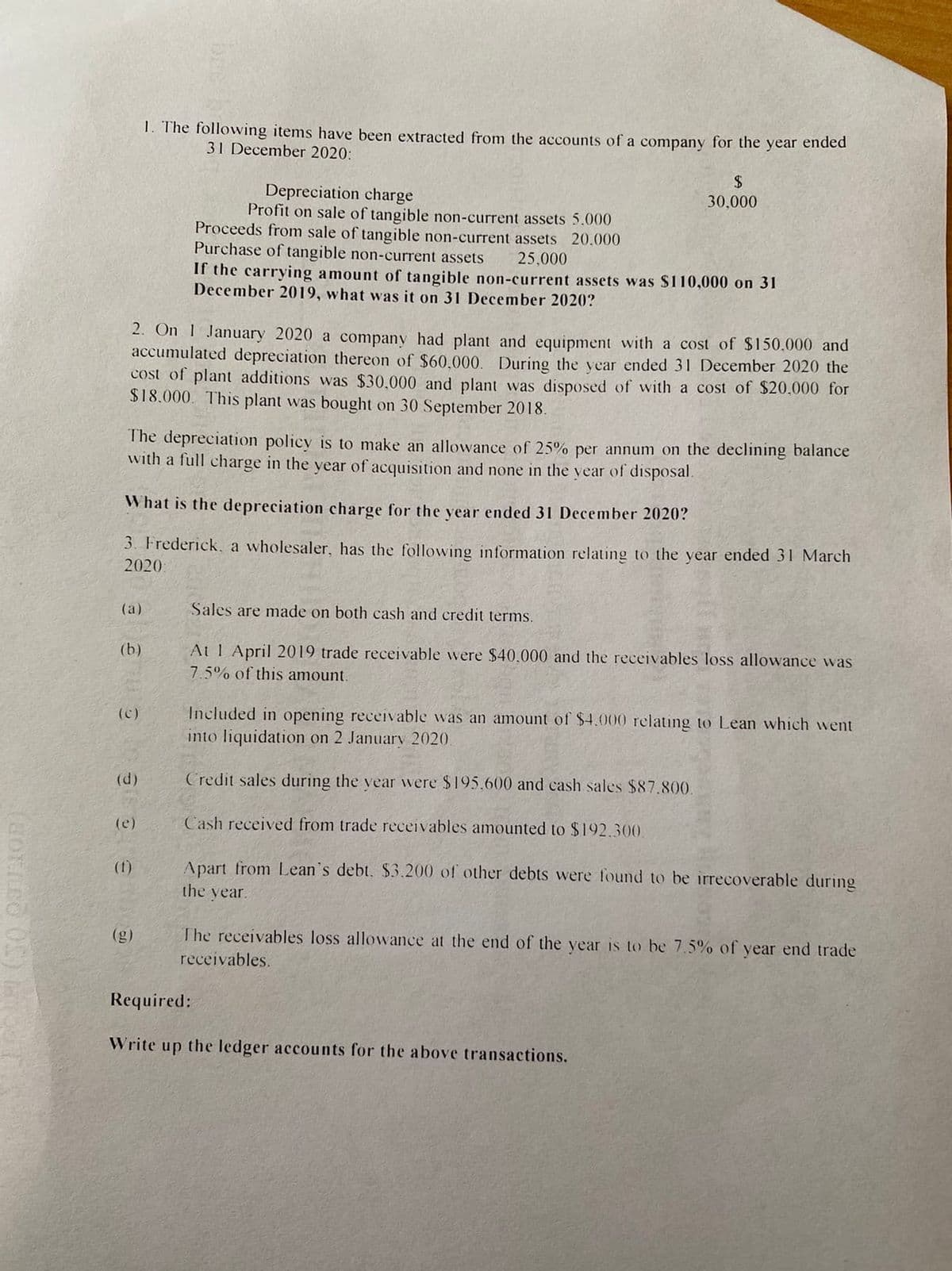

1. The following items have been extracted from the accounts of a company for the year ended 31 December 2020: 2$ Depreciation charge Profit on sale of tangible non-current assets 5.000 30,000 Proceeds from sale of tangible non-current assets 20.000 Purchase of tangible non-current assets 25,000 If the carrying amount of tangible non-current assets was $110,000 on 31 December 2019, what was it on 31 December 2020?

1. The following items have been extracted from the accounts of a company for the year ended 31 December 2020: 2$ Depreciation charge Profit on sale of tangible non-current assets 5.000 30,000 Proceeds from sale of tangible non-current assets 20.000 Purchase of tangible non-current assets 25,000 If the carrying amount of tangible non-current assets was $110,000 on 31 December 2019, what was it on 31 December 2020?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

Solve the first task, with explanation

Transcribed Image Text:1. The following items have been extracted from the accounts of a company for the

31 December 2020:

ended

year

Depreciation charge

Profit on sale of tangible non-current assets 5.000

2$

30,000

Proceeds from sale of tangible non-current assets 20000

Purchase of tangible non-current assets

25,000

If the carrying amount of tangible non-current assets was $110,000 on 31

December 2019, what was it on 31 December 2020?

2. On I January 2020 a company had plant and equipment with a cost of $150.000 and

accumulated depreciation thereon of $60,000. During the year ended 31 December 2020 the

cost of plant additions was $30,000 and plant was disposed of with a cost of $20,000 for

$18.000. This plant was bought on 30 September 2018.

The depreciation policy is to make an allowance of 25% per annum on the declining balance

with a full charge in the year of acquisition and none in the vear of disposal.

What is the depreciation charge for the vear ended 31 December 2020?

3. Frederick. a wholesaler, has the following information relating to the year ended 31 March

2020

(a)

Sales are made on both cash and credit terms.

(b)

At 1 April 2019 trade receivable were $40.000 and the receivables loss allowance was

7.5% of this amount.

(c)

Included in opening receivable was an amount of $4.000 relating to Lean which went

into liquidation on 2 January 2020

(d)

Credit sales during the vear were $195.600 and cash sales $87.800.

(e)

Cash received from trade receivables amounted to $192.300.

(1)

Apart from Lean's debt. $3.200 of other debts were found to be irrecoverable during

the year.

(g)

The receivables loss allowance at the end of the year is to be 7.5% of year end trade

receivables.

Required:

Write

the ledger accounts for the above transactions.

up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning