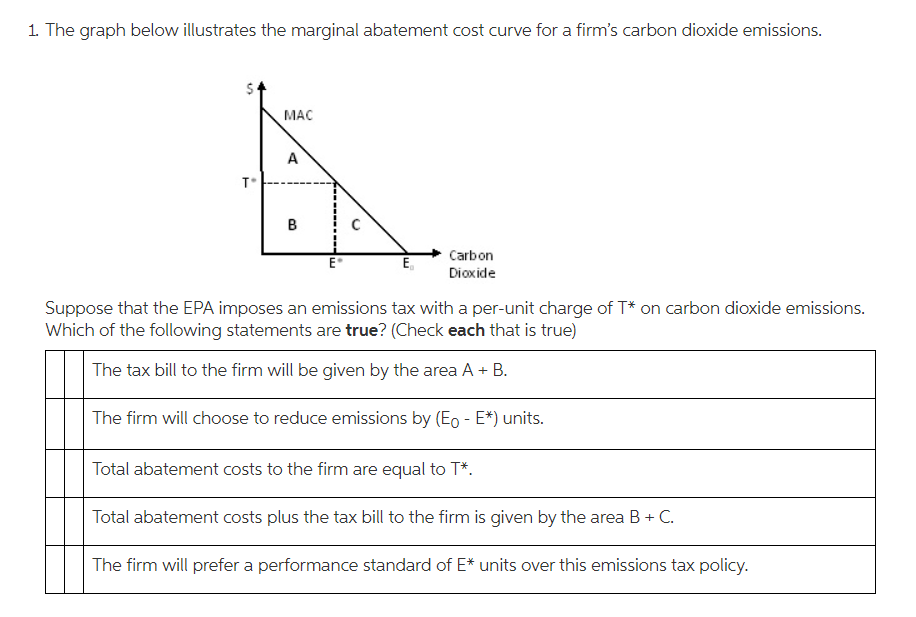

1. The graph below illustrates the marginal abatement cost curve for a firm's carbon dioxide emissions. Tº MAC A B E E₁ Carbon Dioxide Suppose that the EPA imposes an emissions tax with a per-unit charge of T* on carbon dioxide emissions. Which of the following statements are true? (Check each that is true) The tax bill to the firm will be given by the area A + B. The firm will choose to reduce emissions by (E。 - E*) units. Total abatement costs to the firm are equal to T*. Total abatement costs plus the tax bill to the firm is given by the area B + C. The firm will prefer a performance standard of E* units over this emissions tax policy.

1. The graph below illustrates the marginal abatement cost curve for a firm's carbon dioxide emissions. Tº MAC A B E E₁ Carbon Dioxide Suppose that the EPA imposes an emissions tax with a per-unit charge of T* on carbon dioxide emissions. Which of the following statements are true? (Check each that is true) The tax bill to the firm will be given by the area A + B. The firm will choose to reduce emissions by (E。 - E*) units. Total abatement costs to the firm are equal to T*. Total abatement costs plus the tax bill to the firm is given by the area B + C. The firm will prefer a performance standard of E* units over this emissions tax policy.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter12: Environmental Protection And Negative Externalities

Section: Chapter Questions

Problem 6SCQ: Classify the following pollution-control policies as command-and-control or market incentive based....

Related questions

Question

Transcribed Image Text:1. The graph below illustrates the marginal abatement cost curve for a firm's carbon dioxide emissions.

T°

MAC

A

B

E

E₁

Carbon

Dioxide

Suppose that the EPA imposes an emissions tax with a per-unit charge of T* on carbon dioxide emissions.

Which of the following statements are true? (Check each that is true)

The tax bill to the firm will be given by the area A + B.

The firm will choose to reduce emissions by (Eo - E*) units.

Total abatement costs to the firm are equal to T*.

Total abatement costs plus the tax bill to the firm is given by the area B + C.

The firm will prefer a performance standard of E* units over this emissions tax policy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning