1. The profit attributable to equity holders of Power for 2019 is 2. The consolidated Net income for 2019 should be

Q: 56. What is the gross profit to be reported by the Filipino entity for the year ended December 31,…

A: As per our protocol we provide solution to the one question only but you have asked two multiple…

Q: В. Determine the Interest Expense relat will be reported in P' Income Statement for 2020 would be.…

A: In financial statments, interest expense is always charged in books of accounts at closing value or…

Q: a. How much is the ForEx gain or Loss on February 1, 2017? b. How much is the Net ForEx gain or…

A: Foreign exchange contracts are contracts which are entered in one currency and settled in other…

Q: How much is the Gross Profit/Loss Realized in 2019?

A: A company has to recognize revenue and expenses in the year they are earned and incurred,…

Q: According to the law, dividends may be funded from A. past earnings. B. current earnings. C. past…

A: The dividend distribution decision is an important decision for an organization. The dividend is a…

Q: Use the information provided (first picture) to calculate the Dividend per share ratios for 2021 and…

A: Dividend Per Share Dividend per share which is described as total amount of dividend which is…

Q: Consider the following data for 2019 from an after tax cash flow analysis.What is the after tax cash…

A: After tax cash flow: It can be defined as the cash generated by a business from its main operations…

Q: benefits of a loss carryforward, assume that it is probable that the related benefits will be…

A: Hi student, Since there are multiple subparts, we will answer only first three subparts. Deferred…

Q: The net adjustments to compute 2019 and 2020 Profit Attributable to Holders of Parent or CNI…

A: Consolidated net income related to the income earned by parent company and the subsidiary company.

Q: In working with Schedule M-2 (analysis of unappropriated retained earnings per books) of Form 1120,…

A: Retained earning means amount of profit remain after all the adjustment of expense and adjustments.

Q: What is the amount of income tax payable for 2019? 2. What is the company's financial income…

A: Answer are as follows

Q: from the business: 2017 2018 2019 2020 ss income 500,000 600,000 700,000 800,000 luctions income…

A: solution : provision NOLCO means net operating loss carryover The net operating loss can be carried…

Q: Net capital loss carry-over from 2019 is $30, Non capital loss carry-over from 2019 is $70 Required…

A: Pay as you earn system or tax deduction at source in some countries are the advance tax payment…

Q: a. In its December 31, 2020 consolidated statement of retained earnings, what amount should Pare…

A: When a company buys majority of shares in another company, the other company becomes the minority…

Q: The unadjusted net income for the year 2019 is?

A: Net income before any adjustment is known as unadjusted income. Any expense or revenue which is not…

Q: Compute all taxes payable by Mr. Goodwill for year of assessment 2021 showing all relevant…

A: The total tax payable by Mr. Goodwill is $137,524 Explanation for the same: Under Jamaican Taxation…

Q: A company had interest expense in 2019 of $325,000 and is in a 21% tax bracket. What is the after…

A: Interest expenses provides tax savings. Interest expenses are eligible for tax deduction. Given:…

Q: 3. Ignoring income tax, by what amount should shareholders' equity be increased for 2021 and 2022 in…

A: The question is related to the Accounting for Property, Plant and Equipment Revaluation method.…

Q: 1. What is the correct net income for the year 2021? 2. What is the correct net income for the year…

A: 1. As it is mentioned in the question that Year End Inventory is understated by 25000 for the year…

Q: The Gloria Corporation's comparative statements of comprehensive income lor ale years 2021 and 2020…

A:

Q: Compute for the Profit attributable to Equity Holders of Parent or Controlling Interest in Net…

A: Consolidation is termed as merger of two or more entities where one company acquire more than 50% of…

Q: How much is the Gross Profit/Loss Realized in 2019?

A: Gross Profit realized in 2019 (end of the contract)= Revenue - Cost incurred till date

Q: 1. How much of the transactions below should be charged against CELESTINE's Net Income for the year…

A: Non Cash items- A non-cash item has two dissimilar meanings. In banking, the word is used to express…

Q: b. Of the total amount of dividends declared during 2020, how much will be received by preferred…

A: b. Preferred Dividends are paid out cumulative first, before paying common share holders. Preferred…

Q: what is the Retained earnings for 2020 (restated)

A: Retained earnings are the earnings of the company that are left after paying dividends to the share…

Q: *see attached What amount of interest income should be recognized by Ripple for the year ended…

A: Lease means giving out the assets by lessor to lessee to use that assets in return of rent.…

Q: in/loss should be shown as component of other comprehensive income in the 2021 statement of…

A: The calculation is given as,

Q: Based only on the information given, how much was BLUE’s 2021 net income

A: Net cash provided by operating activities is the amount received in excess of payments relating to…

Q: List the four general categories of adjustments that a corporation makes to taxable incomes or net…

A: The motive of every company will be to increase the profitability. Every company has to pay taxes…

Q: A domestic corporation presented the following information in 2019: REQUIRED: 1. Compute the net…

A: OSD : It stands for Optional Standard Deduction, means the deductions available to the…

Q: What amount should Dona Company report as dividend income in its 2022 income statement?

A: On 01.01.2021 Dona Company purchased 10% of another entity o/s ordinary shares for 6000000…

Q: What is the Retained earnings - 2020 (restated)?

A: The part of shareholders' equity determined by considering the net income of last year, net profit…

Q: Requirea: In relation to the folowing intro-group transactions, prepare the consoliaation worksheet…

A: Adjusting Entries are the form of journal entries being prepared at the end of the financial period.…

Q: How much should be reclassified to Retained Earnings as a result of derecognizing the investment in…

A: Any increase or decrease in investment is an increase or decrease in revenue of the company and has…

Q: B. As Marion Enterprises' tax advisor, indicate how much CCA you would advise the Company to take…

A: Taxation refers to the procedure through which the government or the tax authority taxes and taxes…

Q: Assuming in 2021, the investee earned a net income of P3 million, how much must be recognized by…

A: Step 1 As per US GAAP, investor entity share in investee entity profit or loss is adjust…

Q: ne effect of the disposition on the Company's 020 net business income? In addition, etermine the…

A: Step 1 Deposition of assets over the opening UCC balance leads to increase or decrease in net…

Q: Sophie Industries Inc. was a C-corporation that filed an S-election effective January 1, 2019. Which…

A: Which item has an impact on S-corporation’s AAA in 2019?

Q: TATEMENTS OF COMPREHENSIVE INCOME R THE FINANCIAL YEAR ENDED 31 AUGUST 2020 Group Compa 2020 RM'000…

A: The ratio helps in analyzing the financial statement of the company.

Q: prehensive inc

A: The calculation is given as,

Q: During 2021, Thomas has a net Section 1231 gain of $57,000. In 2020, Thomas reported a net Section…

A: Tax is the liability posted in the balance sheet of the company calculated on the income earned by…

Q: . In relation to this transaction, the total income to be recognized in LIBAGO's 2021 profit or loss…

A: Profit or loss of the company is measured by preparing income statement which shows the difference…

Q: revaluation deficit/impairment loss

A: Revaluation deficit/impairment loss = New revalued amount - (Last revalued amount - Accumulated…

Q: For each of the following cases, determine the amount of capital gain or loss to report in each year…

A: Losses can be offset against capital gain.

Q: X derived the following income in 2020, shade A if the income is subject to regular income tax, B if…

A: Answer 1. Capital gain on the sale of stock directly to buyer = C. It is subject to Capital gain…

Q: What amount of unrealized gain/loss should be shown as component of other comprehensive income in…

A:

Q: How much should be shown as capitalized interest on Pearl's financial statements at April 30, 2021?…

A: Financial accounting: Financial accounting is the process of recording, summarizing, and reporting…

Q: 1. What amount of equity income should Akron report for 2021? 2. On Akron's December 31, 2021,…

A: A balance sheet is a financial statement that shows how much money a company has and how much money…

Q: What amount was recognized as actuarial gain on PBO during the year? 100 000 200 000 240 000 0…

A: Introduction As per relevant IAS, Employee benefit if there is any loss or gain in defined benefit…

Q: Which of the following items increases return on beginning equity (ROBE), holding all else equal?…

A: The accounting ratios are the accounting tools for evaluation of firm's performance in various…

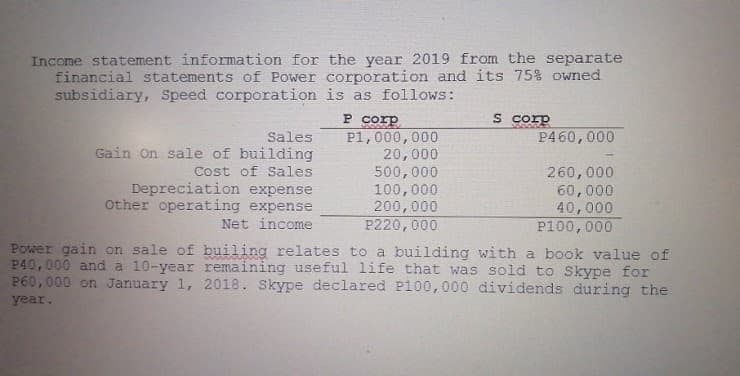

1. The profit attributable to equity holders of Power for 2019 is

2. The consolidated Net income for 2019 should be

Step by step

Solved in 3 steps with 1 images

- Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________Comparative income statements of Sub Corporation for the calendar years 2019, 2020, and 2021 are as follows (in thousands): 2019 2020 2021Sales $22,000 $18,500 $19,250Cost of sales 10,600 9,900 10,100Gross profit 11400 8600 9150Operating expenses 5,700 5,500 6,000Net income $ 5700 $ 3100 $ 3150ADDITIONAL INFORMATION1. Sub was an 80 percent-owned subsidiary of Pub Corporation throughout the 2019–2021 period. Pub’s separate income (excludes income from Sub) was $7,200,000, $6,600,000, and $7,500,000 in 2019, 2020, and 2021, respectively. Pub acquired its interest in Sub at its underlying book value, which was equal to fair value on July 1, 2017.2. Pub sold inventory items to Sub during 2019 at a gross profit to Pub of $720,000. Half the merchandise remained in Sub’s inventory at December 31, 2019. Total sales by Pub to Sub in 2019 were $1,800,000. The remaining merchandise was sold by Sub in 2020.3. Pub’s inventory at December 31, 2020, included items acquired from Sub on…Comparative income statements of Sub Corporation for the calendar years 2019, 2020, and 2021 are as follows (in thousands): 2019 2020 2021Sales $22,000 $18,500 $19,250Cost of sales 10,600 9,900 10,100Gross profit 11400 8600 9150Operating expenses 5,700 5,500 6,000Net income $ 5700 $ 3100 $ 3150ADDITIONAL INFORMATION1. Sub was an 80 percent-owned subsidiary of Pub Corporation throughout the 2019–2021 period. Pub’s…

- Comparative income statements of Sub Corporation for the calendar years 2019, 2020, and 2021 are as follows (in thousands): 2019 2020 2021Sales $22,000 $18,500 $19,250Cost of sales 10,600 9,900 10,100Gross profit 11400 8600 9150Operating expenses 5,700 5,500 6,000Net income $ 5700 $ 3100 $ 3150ADDITIONAL INFORMATION1. Sub was an 80 percent-owned subsidiary of Pub Corporation throughout the 2019–2021 period. Pub’s separate income (excludes income from Sub) was $7,200,000, $6,600,000, and $7,500,000 in 2019, 2020, and 2021, respectively. Pub acquired its interest in Sub at its underlying book value, which was equal to fair value on July 1, 2017.2. Pub sold inventory items to Sub during 2019 at a gross profit to Pub of $720,000. Half the merchandise remained in Sub’s inventory at December 31, 2019. Total sales by Pub to Sub in 2019 were $1,800,000. The remaining merchandise was sold by Sub in 2020.3. Pub’s inventory at December 31, 2020, included items acquired from Sub on which Sub made…Income information for 2019 taken from the separate company financial statements of Marinette corporation and its 75% old subsidiary Adrian corporation is presented as follows Marinette Adrian Sales 1,000,000 460,0000 Gain on sale of Building 20,000 Dividend Income 75,000 Cost of Goods Sold -500,000 -260,000 Depreciation Expense -100,000 -60,000 Other Expense -200,000 -40,000 Net Income 295,000 100,000 Marinette gain on sale of building relates to a building with a book value of 40,000 and a 10 year remaining useful life that was sold to Adrian for 60,000 of January 1,2019. The profit attributable to equity holders of parent or CNA contributable controlling interest for 2019 should be: a.295,000 b. 277,000 c. 275,000 d. 220,000Income information for 2019 taken from the separate company financial statements of Marinette corporation and its 75% old subsidiary Adrian corporation is presented as follows Marinette Adrian Sales 1,000,000 460,0000 Gain on sale of Building 20,000 Dividend Income 75,000 Cost of Goods Sold -500,000 -260,000 Depreciation Expense -100,000 -60,000 Other Expense -200,000 -40,000 Net Income 295,000 100,000 Marinette gain on sale of building relates to a building with a book value of 40,000 and a 10 year remaining useful life that was sold to Adrian for 60,000 of January 1,2019. The consolidated group depreciation expense for 2019 should be a. 158,000 b. 160,000 c. 162,000 d. 180,000

- Income information for 2019 taken from the separate company financial statements of Marinette corporation and its 75% old subsidiary Adrian corporation is presented as follows Marinette Adrian Sales 1,000,000 460,0000 Gain on sale of Building 20,000 Dividend Income 75,000 Cost of Goods Sold -500,000 -260,000 Depreciation Expense -100,000 -60,000 Other Expense -200,000 -40,000 Net Income 295,000 100,000 Marinette gain on sale of building relates to a building with a book value of 40,000 and a 10 year remaining useful life that was sold to Adrian for 60,000 of January 1,2019. At what amount will the gain on sale of building appear under consolidated/group income statement of Marinette and Adrian what the year 2019 should be a. 0 b. 5,000 c. 15,000 d. 20,000Income information for 2019 taken from the separate company financial statements of Paris corporation and its 75% old subsidiary San Antonio corporation is shown in the image. Paris gain on sale of building relates to a building with a book value of 40,000 and a 10 year remaining useful life that was sold to San Antonio for 60,000 of January 1,2019. At what amount will the gain on sale of building appear under consolidated/group income statement of Paris and San Antonio what the year 2019 should be a. zero b. 5,000 c. 15,000 d. 20,000 The consolidated group depreciation expense for 2019 should be a. 158K b. 160K c. 162K d. 180K The profit attributable to equity holders of parent or CNA contributable controlling interest for 2019 should be: a. 295K b. 277K c. 275K d. 220KComparative income statements of Sub Corporation for the calendar years 2019, 2020, and 2021 are as follows (in thousands): 2019 2020 2021 Sales $22,000 $18,500 $19,250 Cost of sales 10,600 9,900 10,100 Gross profit 11400 8600 9150 Operating expenses 5,700 5,500 6,000 Net income $ 5700 $ 3100 $ 3150 ADDITIONAL INFORMATION Sub was an 80 percent-owned subsidiary of Pub Corporation throughout the 2019–2021 period. Pub’s separate income (excludes income from Sub) was $7,200,000, $6,600,000, and $7,500,000 in 2019, 2020, and 2021, respectively. Pub acquired its interest in Sub at its underlying book value, which was equal to fair value on July 1, 2017. Pub sold inventory items to Sub during…

- Below are Lebnas Corp.’s 2019 income statement and comparative balance sheet at 12/31/2019 and 12/31/2018. Additional information: On December 31, 2018, Lebnas acquired 25% of Island ’s common stock for $609,000. On that date, the carrying value of Island’s assets and liabilities, which approximated their fair values, was $2,435,000. Island reported income of $319,000 for the year ended December 31, 2019. No dividend income was received by Lebnas on Island’s common stock during the year 2019. During 2018, Lebnas loaned $797,500 to POI , an unrelated company. POI made the first semi-annual principal repayment of $72,500, plus interest at 10%, on December 31, 2018. POI is current on the loan as of December 31, 2019. On January 2, 2019, Lebnas sold equipment costing $145,000, with a carrying amount of $44,950 for cash. On December 31, 2019, Lebnas entered into a finance lease for a new The present value of the annual rental…On January 1, 2021, PUP CAF acquired a 10% interest in an investee for P3,000,000. The investment was accounted for under the cost method. During 2021, the investee reported net income of P4,000,000 and paid dividend of P1,000,000. On January 1, 2021, the entity acquired a further 15% interest in the investee for P8,500,000. On such date, the carrying amount of the net assets of the investee was P36,000,000 and the fair value of the 10% existing interest was P3,500,000. The fair value of the net assets of the investee is equal to carrying amount except for an equipment whose fair value was P4,000,000 greater than carrying amount. The equipment had a remaining life of 5 years. The investee reported net income of P8,000,000 for 2021 and paid dividend of P5,000,000 on December 31, 2021. What total amount of income should be recognized by the investor in 2021The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2019, just after the parent had purchased 90% of the subsidiary's stock: Case I Case II P Company S Company P Company S Company Current assets $ 880,000 $260,000 $ 780,000 $280,000 Investment in S Company 190,000 190,000 Long‐term assets 1,400,000 400,000 1,200,000 400,000 Other assets 90,000 40,000 70,000 70,000 Total $2,560,000 $700,000 $2,240,000 $750,000 Current liabilities $ 640,000 $270,000 $ 700,000 $260,000 Long‐term liabilities 850,000 290,000 920,000 270,000 Common stock 600,000 180,000 600,000 180,000 Retained earnings 470,000 (40,000) 20,000 40,000 Total $2,560,000 $700,000 $2,240,000 $750,000…