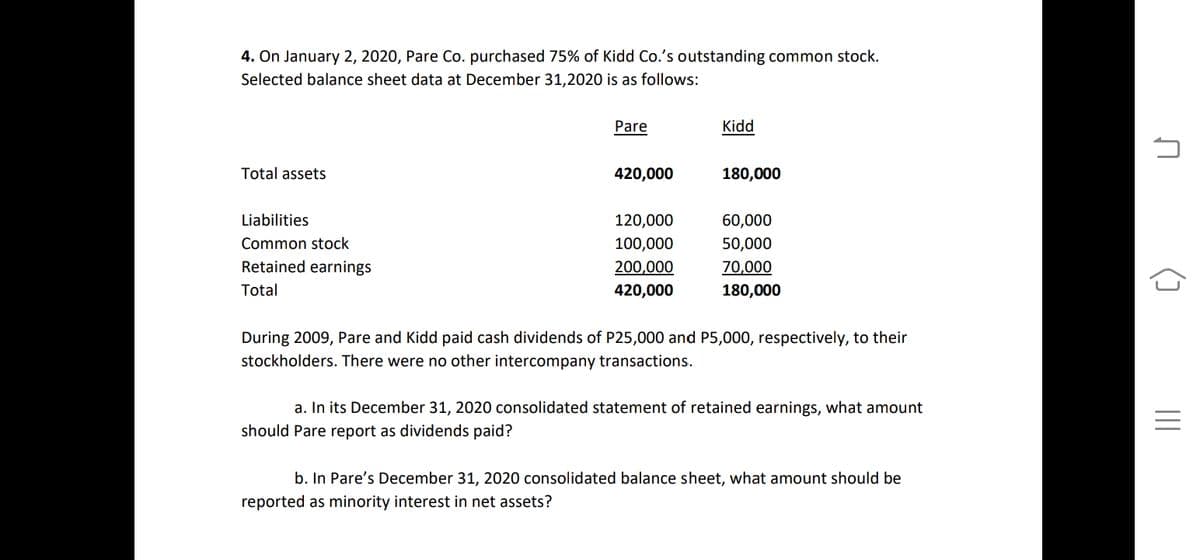

a. In its December 31, 2020 consolidated statement of retained earnings, what amount should Pare report as dividends paid? b. In Pare's December 31, 2020 consolidated balance sheet, what amount should be reported as minority interest in net assets?

Q: True or False: If Company Accumulates Common Stock in Company B such that it acquires a 51% stake…

A: Consolidated financial statements - Consolidated financial statements will contain the financials of…

Q: Which of the following is not normally found in the total equity section of a company's statement…

A: Answer: Correct Option is C Dividends payable to the ordinary shareholders is not found in the…

Q: According to the law, dividends may be funded from A. past earnings. B. current earnings. C. past…

A: The dividend distribution decision is an important decision for an organization. The dividend is a…

Q: What is the correct amount that must be disclosed as proceeds from issue of shares in the cash flows…

A: Working Note (WN): WN#1 Computation of capitalization of shares (in Number and in Value): On 31st…

Q: For fi nancial assets classifi ed as available for sale, how are unrealized gains and losses refl…

A: Shareholder's equity: It is the amount of the money that can be returned to the shareholders and it…

Q: When a small, share capital dividend is declared, Retained Earnings is debited for the a. par value…

A: when small share capital dividend is declared, it is recorded at FV of stock as at the declaration…

Q: 1. How much will be the Non-controlling interest net income for 2020? 2. How much will be the…

A: Consolidated Statement: It is statement which present all income, expenses, assets and liability of…

Q: Which of the following transactions does not affect the Total Contributed Capital of the company?…

A: The total contributed capital of a company includes the total amount paid by the investors for their…

Q: Which of the following correctly reflects the effect of dividend? a. On the date of payment of…

A: Solution: Option a, b and c are incorrect due to following: a. On the date of payment of property…

Q: Instructions: Based on the given information, compute for each of the items listed belC 1. Balance…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: ch of the following is not correct relative to an appropriation of Retained Earnings? a. Retaine

A: The amount of profit after paying all the costs incomes taxes and dividends to shareholders is known…

Q: Present the Total Shareholders Equity Section of the Balance Sheet of Simpson Limited at 31 July…

A: An accounting cycle refers to the different stages in the preparation of the final accounts. Final…

Q: As a minimum, the face of the income statement shall include line items that present the following…

A: The format of income statement is not prescribed, but some items need to be presented on the face of…

Q: Which one or more of the following would you not include within the heading Equity and Reserves in a…

A: Equity and reserves that are shown under statement of financial position means all amount…

Q: Shareholders wealth is calculated as Select one: a. Number of shareholders X Current market price b.…

A: Shareholder's wealth is collective wealth created by the company and represented by its market…

Q: Discuss the accounting treatment or disclosure that should be accorded a declared but unpaid cash…

A:

Q: In the December 21, 2021 consolidated statement of financial position, the net income attributable…

A: In the consolidated financial statement, the unrealized gain and loss in the inter-group transaction…

Q: Which one of the following statements is NOT true relating to dividends? 1. Dividends are a portion…

A: 5. 2. Dividends need not be declared solely from the profit of the current year include profits from…

Q: Required: What total unrealized gain or loss would the company report in its 2021 income statement…

A: 1) Held to maturity debt investment: If the debt instrument held to maturity, it is recorded by…

Q: . If an entity declares a small share dividend, what amount shall be debited to retained earnings?

A: Solution: There are two type of share dividends as under: 1. Small share dividend (20-25%) 2. Large…

Q: Required: 1. Prepare the ordinary share capital account for the year. Prepare the Retained Earnings…

A: Finance is blood for Every Business Organization. Business Entities need finance to start its…

Q: . If the board of directors has the authority to declare the dividends within the current fiscal…

A: Statement of appropriation of retained earnings is a statement that shows the funds which have been…

Q: al b) C) d) Prepare the journal entries to record the transactions and net income. Show the…

A: Share holders Equity Shareholders equity which consist of equity and preference shares which are…

Q: Which among the following statement is correct: Interim dividend is usually approved by the…

A: The question is multiple choice Required Choose the Correct Option

Q: Which item would NOT form part of the shareholders' equity of a company on the statement of…

A: Shareholders' equity is the amount payable by the business to the owner of the business.

Q: 1. A company declared a cash dividend on its ordinary shares in December 2020 payable in January…

A: Hi student Since there are multiple questions, we will answer only first question. Dividend is the…

Q: 5. An entity provided the following data for the year ended December 1, 2019: Retained earnings…

A: Unappropriated preserved earnings area unit the portion of preserved earnings not assigned to a…

Q: rdinary share capitalOrdinary share capitalWhich of the following items would not form part of the…

A: Trade payables are third party liability which are shown as liabilities and not as shareholders…

Q: Under IFRS, share dividends declared after the statement of financial position date but before the…

A: Answer: Option c

Q: For fi nancial assets classifi ed as held to maturity, how are unrealized gains and losses refl…

A: Securities held to maturity (HTM) are bought for ownership before they expire. For instance, the…

Q: Which of the following is not reported in the statement of changes in shareholders' equity? a.…

A: Shareholders' equity (or corporate net worth) is a measure of how much a company's owners had put…

Q: What is the correct balance of ordinary share capital on December 31, 2021

A: We are given an extract of shareholder's equity from the statement of financial position of Rudolph…

Q: How would the declaration of a 15% share dividend by a corporation affect the retained earnings and…

A: Share dividend: It can be defined as the payment of dividends to the shareholders in the form of…

Q: For fi nancial assets classifi ed as held to maturity, how are unrealized gains and losses refl…

A: Trading securities are debt or equity assets that management expects to aggressively sell for gain…

Q: Prepare the shar (b) financial position at Decen to shareholders' equity 1. The following…

A: Comment - Multiple Questions Asked. Shares- The business's financial resources are its shares.…

Q: What is the adjusted amount of shareholders’ equity that should be reported by REBOND in its…

A: The question is related Shareholder's equity as on December 31st, 2021. Inventory will be Valued at…

Q: how much is the investment income to be reported by Nezuko Company in relation to the joint venture?…

A: Step 1 Joint venture is a contractual arrangement whereby two or more parties undertake an economic…

Q: 1. What is the amount of dividend per share that MOONSTONE paid on March 31, 2021? 2. How much is…

A: The dividend is that portion of income that is distributed amongst shareholders (equity or…

Q: When using the equity method of accounting, when is revenue recorded on the books of the investor…

A: Investment in stock for significant influence: The investments in stock securities which claim…

Q: Discuss the accounting treatment, if any, that should be given to each of the following items in…

A: Earnings per share (EPS): The amount of net income available to each shareholder per common share…

Q: A company declared a cash dividend on its common stock in December 2020, payable in January 2021.…

A: GIVEN A company declared a cash dividend on its common stock in December 2020, payable in January…

Q: accounting treatment or disclosure that should be accorded a declared but unpaid cash dividend; an…

A:

Q: Which of the following might appear as an item in a statement of changes in equity? 1. Gain on…

A: The statement of changes in equity is a reconciliation of the beginning and ending balances in a…

Q: 1) Identify any three (3) earnings per share (EPS) information required to be disclosed in financial…

A: The Malaysian Accounting Standards Board issued MFRS 133 Earnings per share for determination and…

Q: Equity securities acquired by a corporation which are accounted for by recognizing unrealized…

A: When some investments are made in some other company or corporation, then it depends on the quantum…

With solution

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossHyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000

- Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Tama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?