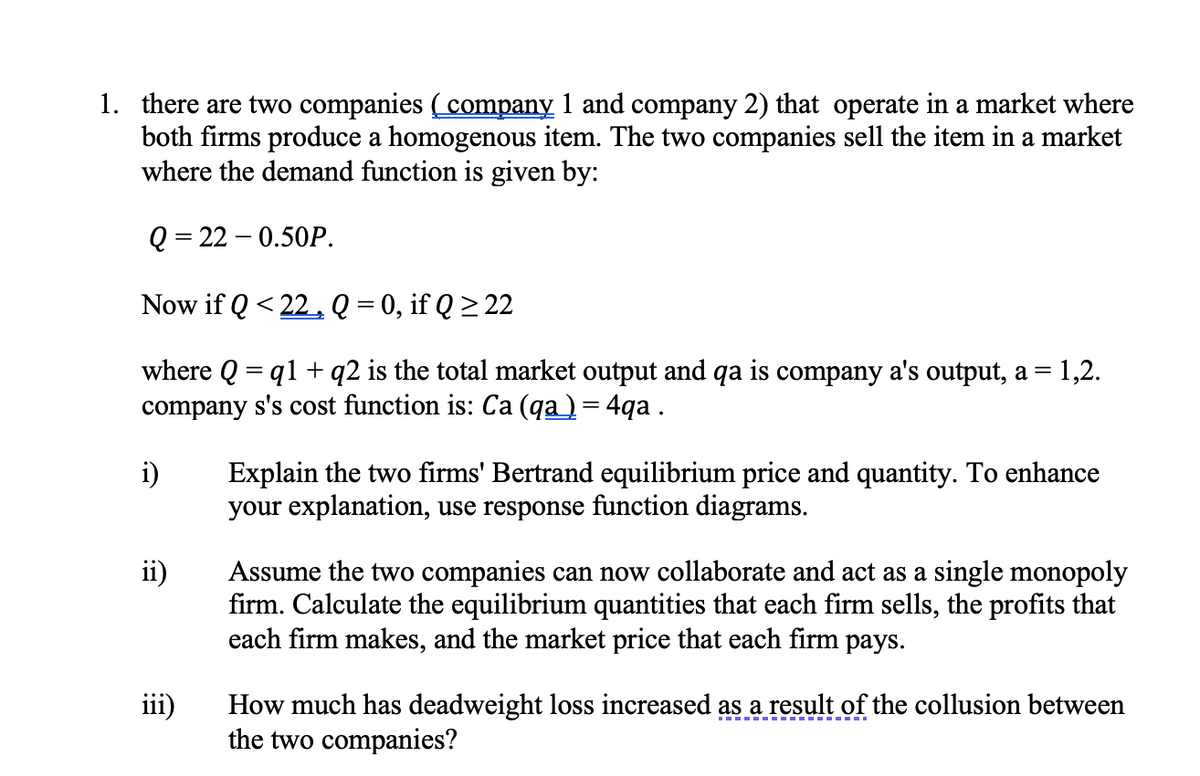

1. there are two companies (company 1 and company 2) that operate in a market where both firms produce a homogenous item. The two companies sell the item in a market where the demand function is given by: Q = 22 – 0.50P. Now if Q < 22, Q = 0, if Q > 22 where Q = q1 + q2 is the total market output and qa is company a's output, a = 1,2. company s's cost function is: Ca (qa)= 4qa . Explain the two firms' Bertrand equilibrium price and quantity. To enhance your explanation, use response function diagrams. i) ii) Assume the two companies can now collaborate and act as a single monopoly firm. Calculate the equilibrium quantities that each firm sells, the profits that each firm makes, and the market price that each firm pays. How much has deadweight loss increased as a result of the collusion between the two companies? iii)

1. there are two companies (company 1 and company 2) that operate in a market where both firms produce a homogenous item. The two companies sell the item in a market where the demand function is given by: Q = 22 – 0.50P. Now if Q < 22, Q = 0, if Q > 22 where Q = q1 + q2 is the total market output and qa is company a's output, a = 1,2. company s's cost function is: Ca (qa)= 4qa . Explain the two firms' Bertrand equilibrium price and quantity. To enhance your explanation, use response function diagrams. i) ii) Assume the two companies can now collaborate and act as a single monopoly firm. Calculate the equilibrium quantities that each firm sells, the profits that each firm makes, and the market price that each firm pays. How much has deadweight loss increased as a result of the collusion between the two companies? iii)

Chapter15: Imperfect Competition

Section: Chapter Questions

Problem 15.3P

Related questions

Question

Transcribed Image Text:1. there are two companies (company 1 and company 2) that operate in a market where

both firms produce a homogenous item. The two companies sell the item in a market

where the demand function is given by:

Q = 22 – 0.50P.

Now if Q < 22,Q = 0, if Q > 22

where Q = q1 + q2 is the total market output and qa is company a's output, a = 1,2.

company s's cost function is: Ca (qa) = 4qa.

i)

Explain the two firms' Bertrand equilibrium price and quantity. To enhance

your explanation, use response function diagrams.

ii)

Assume the two companies can now collaborate and act as a single monopoly

firm. Calculate the equilibrium quantities that each firm sells, the profits that

each firm makes, and the market price that each firm pays.

iii)

How much has deadweight loss increased as a result of the collusion between

the two companies?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning