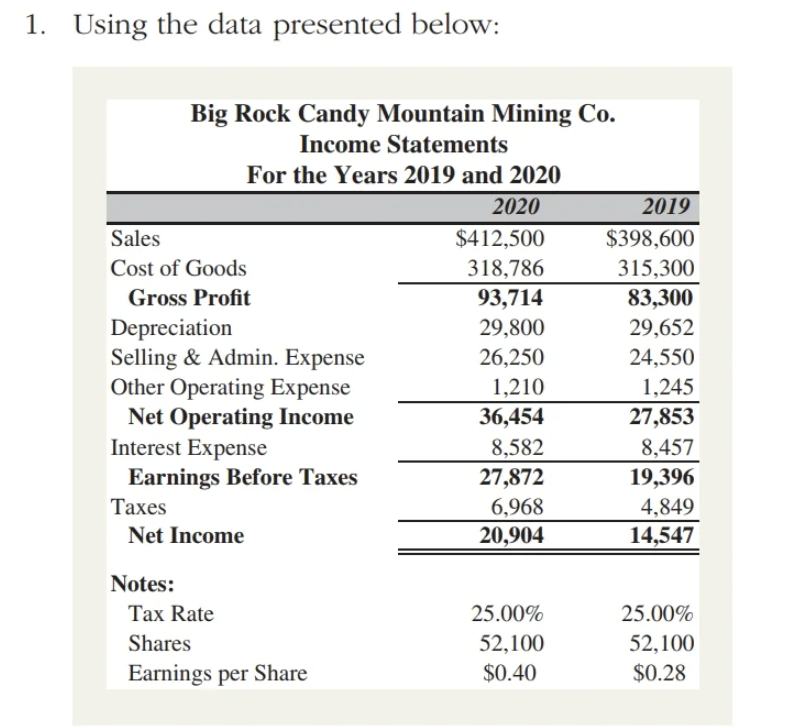

1. Using the data presented below: Sales Cost of Goods Gross Profit Big Rock Candy Mountain Mining Co. Income Statements For the Years 2019 and 2020 2020 $412,500 318,786 93,714 29,800 26,250 1,210 36,454 8,582 27,872 6,968 20,904 Depreciation Selling & Admin. Expense Other Operating Expense Net Operating Income Interest Expense Earnings Before Taxes Taxes Net Income Notes: Tax Rate Shares Earnings per Share 25.00% 52,100 $0.40 2019 $398,600 315,300 83,300 29,652 24,550 1,245 27,853 8,457 19,396 4,849 14,547 25.00% 52,100 $0.28

1. Using the data presented below: Sales Cost of Goods Gross Profit Big Rock Candy Mountain Mining Co. Income Statements For the Years 2019 and 2020 2020 $412,500 318,786 93,714 29,800 26,250 1,210 36,454 8,582 27,872 6,968 20,904 Depreciation Selling & Admin. Expense Other Operating Expense Net Operating Income Interest Expense Earnings Before Taxes Taxes Net Income Notes: Tax Rate Shares Earnings per Share 25.00% 52,100 $0.40 2019 $398,600 315,300 83,300 29,652 24,550 1,245 27,853 8,457 19,396 4,849 14,547 25.00% 52,100 $0.28

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 55CE

Related questions

Question

Create a common-size statement of cash flows for 2020 that can be switched between using sales and the 2019 cash balance in the denominator

Transcribed Image Text:1. Using the data presented below:

Sales

Cost of Goods

Gross Profit

Big Rock Candy Mountain Mining Co.

Income Statements

For the Years 2019 and 2020

2020

$412,500

318,786

93,714

29,800

26,250

1,210

36,454

8,582

27,872

6,968

20,904

Depreciation

Selling & Admin. Expense

Other Operating Expense

Net Operating Income

Interest Expense

Earnings Before Taxes

Taxes

Net Income

Notes:

Tax Rate

Shares

Earnings per Share

25.00%

52,100

$0.40

2019

$398,600

315,300

83,300

29,652

24,550

1,245

27,853

8,457

19,396

4,849

14,547

25.00%

52,100

$0.28

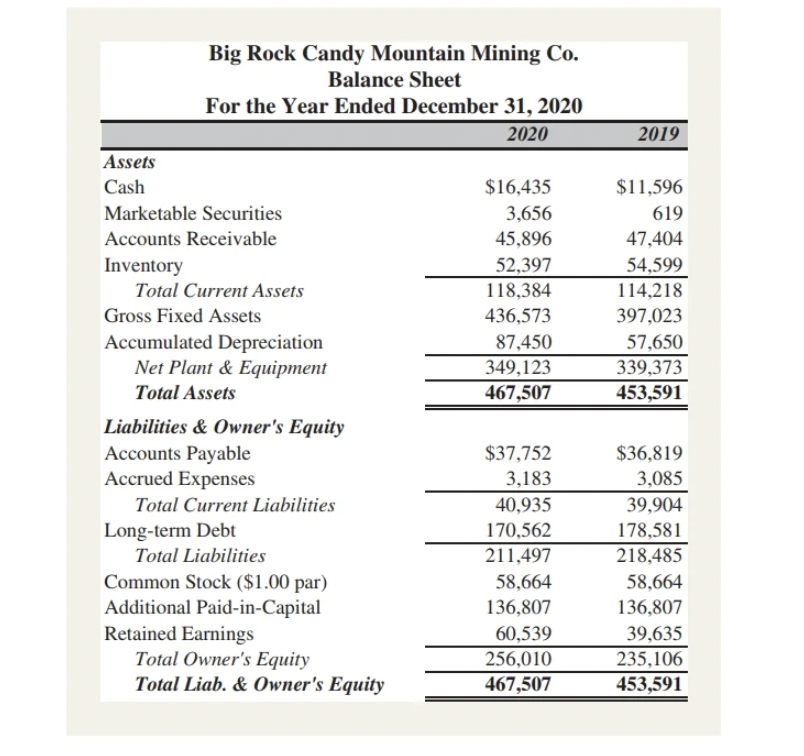

Transcribed Image Text:Assets

Cash

Big Rock Candy Mountain Mining Co.

Balance Sheet

For the Year Ended December 31, 2020

2020

Marketable Securities

Accounts Receivable

Inventory

Total Current Assets

Gross Fixed Assets

Accumulated Depreciation

Net Plant & Equipment

Total Assets

Liabilities & Owner's Equity

Accounts Payable

Accrued Expenses

Total Current Liabilities

Long-term Debt

Total Liabilities

Common Stock ($1.00 par)

Additional Paid-in-Capital

Retained Earnings

Total Owner's Equity

Total Liab. & Owner's Equity

$16,435

3,656

45,896

52,397

118,384

436,573

87,450

349,123

467,507

$37,752

3,183

40,935

170,562

211,497

58,664

136,807

60,539

256,010

467,507

2019

$11,596

619

47,404

54,599

114,218

397,023

57,650

339,373

453,591

$36,819

3,085

39,904

178,581

218,485

58,664

136,807

39,635

235,106

453,591

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College