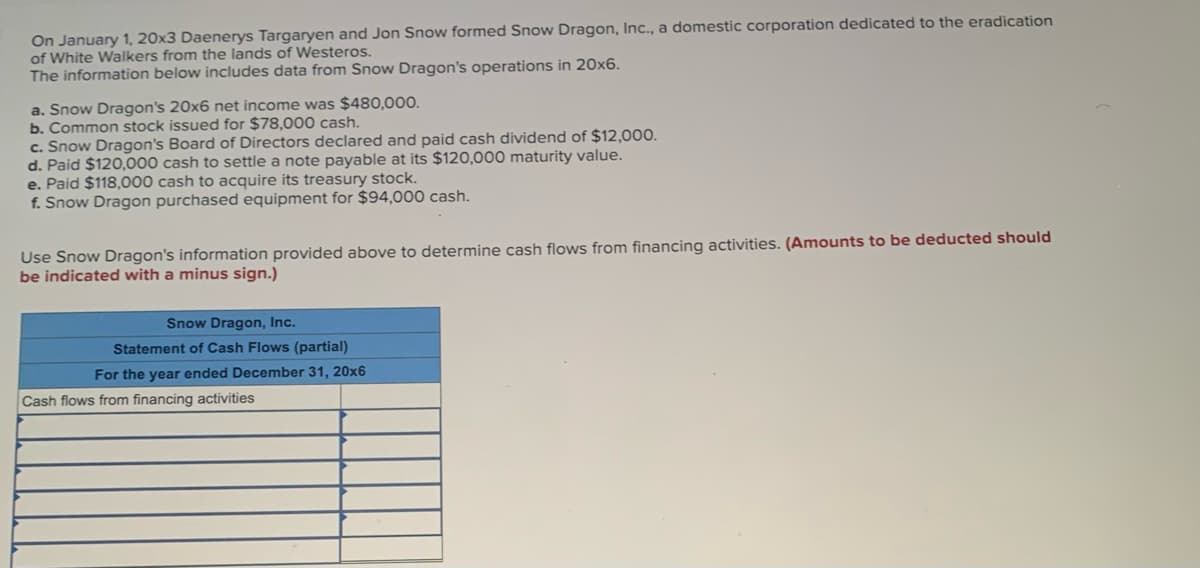

On January 1, 20x3 Daenerys Targaryen and Jon Snow formed Snow Dragon, Inc., a domestic corporation dedicated to the eradication of White Walkers from the lands of Westeros. The information below includes data from Snow Dragon's operations in 20x6. a. Snow Dragon's 20x6 net income was $480,000. b. Common stock issued for $78,000 cash. c. Snow Dragon's Board of Directors declared and paid cash dividend of $12,000. d. Paid $120,000 cash to settle a note payable at its $120,000 maturity value. e. Paid $118,000 cash to acquire its treasury stock. f. Snow Dragon purchased equipment for $94,000 cash. Use Snow Dragon's information provided above to determine cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Snow Dragon, Inc. Statement of Cash Flows (partial) For the year ended December 31, 20x6 Cash flows from financing activities

On January 1, 20x3 Daenerys Targaryen and Jon Snow formed Snow Dragon, Inc., a domestic corporation dedicated to the eradication of White Walkers from the lands of Westeros. The information below includes data from Snow Dragon's operations in 20x6. a. Snow Dragon's 20x6 net income was $480,000. b. Common stock issued for $78,000 cash. c. Snow Dragon's Board of Directors declared and paid cash dividend of $12,000. d. Paid $120,000 cash to settle a note payable at its $120,000 maturity value. e. Paid $118,000 cash to acquire its treasury stock. f. Snow Dragon purchased equipment for $94,000 cash. Use Snow Dragon's information provided above to determine cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Snow Dragon, Inc. Statement of Cash Flows (partial) For the year ended December 31, 20x6 Cash flows from financing activities

Chapter22: S Corporations

Section: Chapter Questions

Problem 36P

Related questions

Question

Transcribed Image Text:On January 1, 20x3 Daenerys Targaryen and Jon Snow formed Snow Dragon, Inc., a domestic corporation dedicated to the eradication

of White Walkers from the lands of Westeros.

The information below includes data from Snow Dragon's operations in 20x6.

a. Snow Dragon's 20x6 net income was $480,000.

b. Common stock issued for $78,000 cash.

c. Snow Dragon's Board of Directors declared and paid cash dividend of $12,000.

d. Paid $120,000 cash to settle a note payable at its $120,000 maturity value.

e. Paid $118,000 cash to acquire its treasury stock.

f. Snow Dragon purchased equipment for $94,000 cash.

Use Snow Dragon's information provided above to determine cash flows from financing activities. (Amounts to be deducted should

be indicated with a minus sign.)

Snow Dragon, Inc.

Statement of Cash Flows (partial)

For the year ended December 31, 20x6

Cash flows from financing activities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage