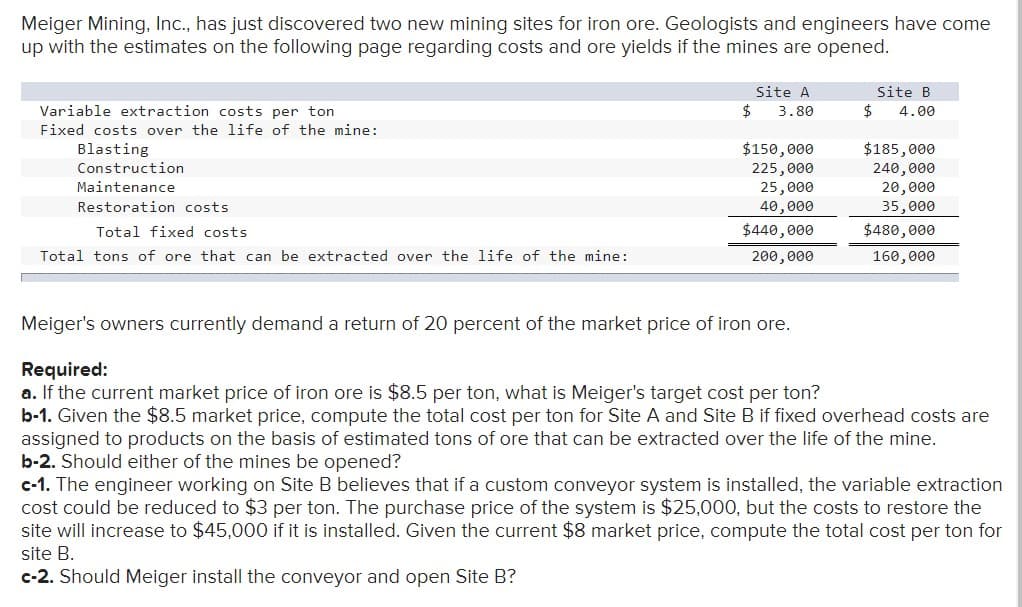

Meiger Mining, Inc., has just discovered two new mining sites for iron ore. Geologists and engineers have come up with the estimates on the following page regarding costs and ore yields if the mines are opened. Variable extraction costs per ton Fixed costs over the life of the mine: Blasting Construction Maintenance Restoration costs Total fixed costs Total tons of ore that can be extracted over the life of the mine: $ Site A 3.80 $150,000 225,000 25,000 40,000 $440,000 200,000 Site B $ 4.00 $185,000 240,000 20,000 35,000 $480,000 160,000 Meiger's owners currently demand a return of 20 percent of the market price of iron ore. Required: a. If the current market price of iron ore is $8.5 per ton, what is Meiger's target cost per ton? b-1. Given the $8.5 market price, compute the total cost per ton for Site A and Site B if fixed overhead costs are assigned to products on the basis of estimated tons of ore that can be extracted over the life of the mine. b-2. Should either of the mines be opened? c-1. The engineer working on Site B believes that if a custom conveyor system is installed, the variable extraction cost could be reduced to $3 per ton. The purchase price of the system is $25,000, but the costs to restore the site will increase to $45,000 if it is installed. Given the current $8 market price, compute the total cost per ton for site B. c-2. Should Meiger install the conveyor and open Site B?

Meiger Mining, Inc., has just discovered two new mining sites for iron ore. Geologists and engineers have come up with the estimates on the following page regarding costs and ore yields if the mines are opened. Variable extraction costs per ton Fixed costs over the life of the mine: Blasting Construction Maintenance Restoration costs Total fixed costs Total tons of ore that can be extracted over the life of the mine: $ Site A 3.80 $150,000 225,000 25,000 40,000 $440,000 200,000 Site B $ 4.00 $185,000 240,000 20,000 35,000 $480,000 160,000 Meiger's owners currently demand a return of 20 percent of the market price of iron ore. Required: a. If the current market price of iron ore is $8.5 per ton, what is Meiger's target cost per ton? b-1. Given the $8.5 market price, compute the total cost per ton for Site A and Site B if fixed overhead costs are assigned to products on the basis of estimated tons of ore that can be extracted over the life of the mine. b-2. Should either of the mines be opened? c-1. The engineer working on Site B believes that if a custom conveyor system is installed, the variable extraction cost could be reduced to $3 per ton. The purchase price of the system is $25,000, but the costs to restore the site will increase to $45,000 if it is installed. Given the current $8 market price, compute the total cost per ton for site B. c-2. Should Meiger install the conveyor and open Site B?

Chapter14: Capital Structure Management In Practice

Section14.A: Breakeven Analysis

Problem 8P

Related questions

Question

Transcribed Image Text:Meiger Mining, Inc., has just discovered two new mining sites for iron ore. Geologists and engineers have come

up with the estimates on the following page regarding costs and ore yields if the mines are opened.

Variable extraction costs per ton

Fixed costs over the life of the mine:

Blasting

Construction

Maintenance

Restoration costs

Total fixed costs

Total tons of ore that can be extracted over the life of the mine:

Site A

$ 3.80

$150,000

225,000

25,000

40,000

$440,000

200,000

Site B

$ 4.00

$185,000

240,000

20,000

35,000

$480,000

160,000

Meiger's owners currently demand a return of 20 percent of the market price of iron ore.

Required:

a. If the current market price of iron ore is $8.5 per ton, what is Meiger's target cost per ton?

b-1. Given the $8.5 market price, compute the total cost per ton for Site A and Site B if fixed overhead costs are

assigned to products on the basis of estimated tons of ore that can be extracted over the life of the mine.

b-2. Should either of the mines be opened?

c-1. The engineer working on Site B believes that if a custom conveyor system is installed, the variable extraction

cost could be reduced to $3 per ton. The purchase price of the system is $25,000, but the costs to restore the

site will increase to $45,000 if it is installed. Given the current $8 market price, compute the total cost per ton for

site B.

c-2. Should Meiger install the conveyor and open Site B?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning