Black Limited sells inventory to its parent, White Limited at cost price plus 125% mark-up. • Closing inventories in the records of White Limited on 30 June 2022 amount to R157 500. Net realisable value of inventory on hand in the books of While limited amounts to R107 500 on 30 June 2022. • Ignore tax implications Required 1.1 Clearly illustrate how write-down of inventory will be with regard to the above information, showing inventory at selling price, value according to the group, net realisable value, write-down in White Limited's records, Unrealised profit from the group's perspective and additional elimination of unrealised profit required through pro forma consolidation journal. 1.2 Show how the journal entry would be recorded in the books of White Limited on 30 June 2022 in accordance with IAS 2. And also show pro forma consolidation journal for the group. 1.3 Show how the pro forma journal entry/ies would be in the books of White Limited Group as of 30 June 2022, assuming that White Limited did not recognise the write- down to net realisable value in its individual records

Black Limited sells inventory to its parent, White Limited at cost price plus 125% mark-up. • Closing inventories in the records of White Limited on 30 June 2022 amount to R157 500. Net realisable value of inventory on hand in the books of While limited amounts to R107 500 on 30 June 2022. • Ignore tax implications Required 1.1 Clearly illustrate how write-down of inventory will be with regard to the above information, showing inventory at selling price, value according to the group, net realisable value, write-down in White Limited's records, Unrealised profit from the group's perspective and additional elimination of unrealised profit required through pro forma consolidation journal. 1.2 Show how the journal entry would be recorded in the books of White Limited on 30 June 2022 in accordance with IAS 2. And also show pro forma consolidation journal for the group. 1.3 Show how the pro forma journal entry/ies would be in the books of White Limited Group as of 30 June 2022, assuming that White Limited did not recognise the write- down to net realisable value in its individual records

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterMJ: Mornin's Joe

Section: Chapter Questions

Problem 3IFRS

Related questions

Question

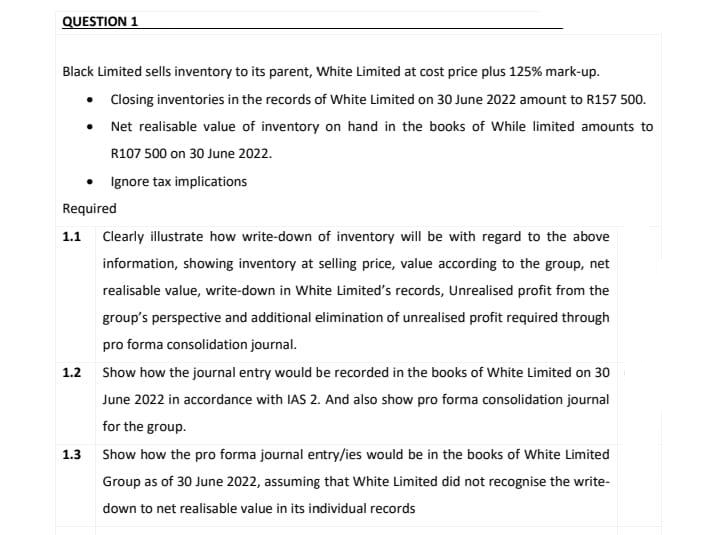

Transcribed Image Text:QUESTION 1

Black Limited sells inventory to its parent, White Limited at cost price plus 125% mark-up.

Closing inventories in the records of White Limited on 30 June 2022 amount to R157 500.

Net realisable value of inventory on hand in the books of While limited amounts to

R107 500 on 30 June 2022.

•

•

• Ignore tax implications

Required

1.3

1.1 Clearly illustrate how write-down of inventory will be with regard to the above

information, showing inventory at selling price, value according to the group, net

realisable value, write-down in White Limited's records, Unrealised profit from the

group's perspective and additional elimination of unrealised profit required through

pro forma consolidation journal.

1.2 Show how the journal entry would be recorded in the books of White Limited on 30

June 2022 in accordance with IAS 2. And also show pro forma consolidation journal

for the group.

Show how the pro forma journal entry/ies would be in the books of White Limited

Group as of 30 June 2022, assuming that White Limited did not recognise the write-

down to net realisable value in its individual records

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning