1.1 REQUIRED Complete the table for the transactions provided for each of the following methods of inventory valuation: FIFO Weighted Average Cost. (Round off the weighted average cost per unit to the nearest cent and all other amounts to the nearest Rand.) Date Quantity Price Value Quantity Price Purchased Issued/Returned Stock on hand Price Value Value Quantity INFORMATION The following information for March 2020 was extracted from the records of Monalisa Limited, a manufacturing company, for an inventory item used in one of its projects. Date Transaction details Opening inventory 01 2 000 units @ R17 each Purchased 48 000 units @ R18 each 10 000 units at R19.05 each 20 000 units @ R20 each Returned to supplier 10 000 damaged units (purchased 02 March) Transferred to the production department 02 15 22 03 04 30 000 units 17 15 000 units 25 20 000 units

1.1 REQUIRED Complete the table for the transactions provided for each of the following methods of inventory valuation: FIFO Weighted Average Cost. (Round off the weighted average cost per unit to the nearest cent and all other amounts to the nearest Rand.) Date Quantity Price Value Quantity Price Purchased Issued/Returned Stock on hand Price Value Value Quantity INFORMATION The following information for March 2020 was extracted from the records of Monalisa Limited, a manufacturing company, for an inventory item used in one of its projects. Date Transaction details Opening inventory 01 2 000 units @ R17 each Purchased 48 000 units @ R18 each 10 000 units at R19.05 each 20 000 units @ R20 each Returned to supplier 10 000 damaged units (purchased 02 March) Transferred to the production department 02 15 22 03 04 30 000 units 17 15 000 units 25 20 000 units

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 15P: (Appendix 8.1) Inventory Write-Down The following are the inventories for the years 2019, 2020, and...

Related questions

Topic Video

Question

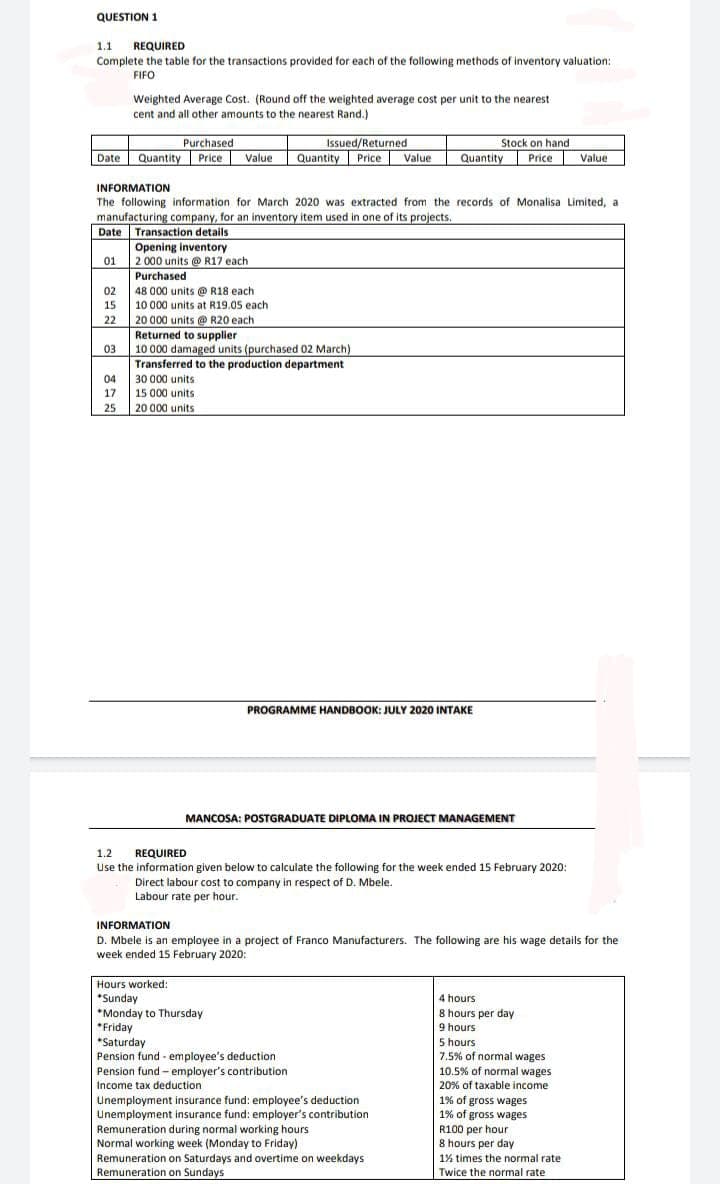

Transcribed Image Text:QUESTION 1

1.1 REQUIRED

Complete the table for the transactions provided for each of the following methods of inventory valuation:

FIFO

Weighted Average Cost. (Round off the weighted average cost per unit to the nearest

cent and all other amounts to the nearest Rand.)

Purchased

Date Quantity Price Value

Issued/Returned

Stock on hand

Quantity

Price

Quantity Price

Value

Value

INFORMATION

The following information for March 2020 was extracted from the records of Monalisa Limited, a

manufacturing company, for an inventory item used in one of its projects.

Date Transaction details

Opening inventory

01

2 000 units @ R17 each

Purchased

02

48 000 units @ R18 each

15

10 000 units at R19.05 each

20 000 units @ R20 each

Returned to supplier

10 000 damaged units (purchased 02 March)

Transferred to the production department

30 000 units

22

03

04

17

15 000 units

25

20 000 units

PROGRAMME HANDBOOK: JULY 2020 INTAKE

MANCOSA: POSTGRADUATE DIPLOMA IN PROJECT MANAGEMENT

1.2

REQUIRED

Use the information given below to calculate the following for the week ended 15 February 2020:

Direct labour cost to company in respect of D. Mbele.

Labour rate per hour.

INFORMATION

D. Mbele is an employee in a project of Franco Manufacturers. The following are his wage details for the

week ended 15 February 2020:

Hours worked:

*Sunday

*Monday to Thursday

*Friday

*Saturday

Pension fund - employee's deduction

Pension fund - employer's contribution

Income tax deduction

Unemployment insurance fund: employee's deduction

Unemployment insurance fund: employer's contribution

Remuneration during normal working hours

Normal working week (Monday to Friday)

4 hours

8 hours per day

9 hours

5 hours

7.5% of normal wages

10.5% of normal wages

20% of taxable income

1% of gross wages

1% of gross wages

R100 per hour

8 hours per day

1% times the normal rate

Remuneration on Saturdays and overtime on weekdays

Remuneration on Sundays

Twice the normal rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning