Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 4E

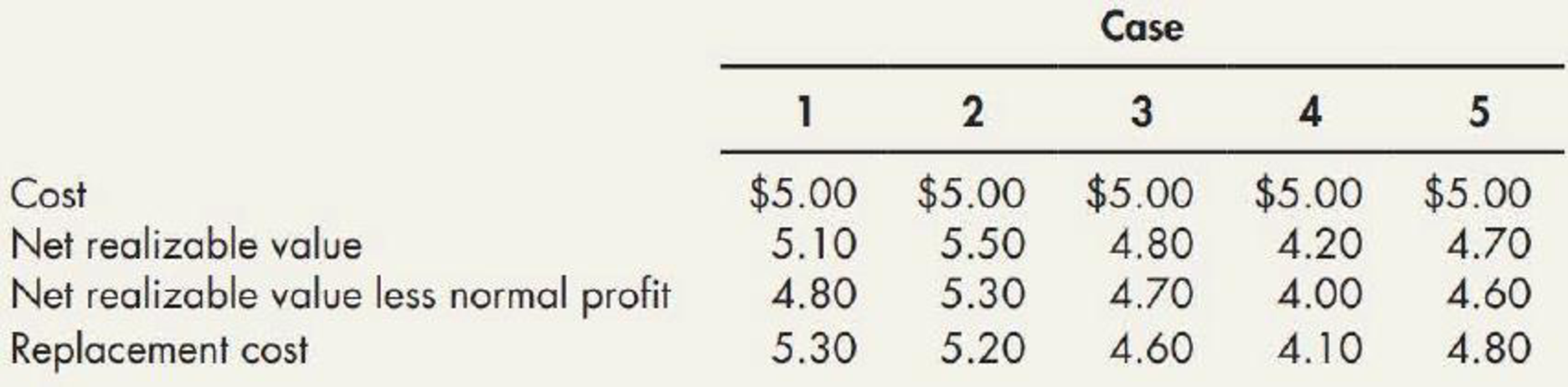

Inventory Write-Down The following information for Tuell Company is available:

Required:

- 1. Assume Tuell uses the LIFO cost flow assumption. What is the correct inventory value in each of the preceding situations under U.S. GAAP?

- 2. Assume Tuell uses the average cost inventory cost flow assumption. What is the correct inventory value in each of the preceding situations under U.S. GAAP?

- 3. Assume that Tuell uses the average cost inventory cost flow assumption. What is the correct inventory value in each of the preceding situations if Tuell uses IFRS?

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 8 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 8 - Under what circumstances will a company value...Ch. 8 - What is the conceptual justification for reducing...Ch. 8 - Define the terms cost, net realizable value, and...Ch. 8 - For companies that use either LIFO or the retail...Ch. 8 - What three implementation approaches may a company...Ch. 8 - Describe the two approaches to recording the...Ch. 8 - Prob. 7GICh. 8 - In applying the inventory valuation rules to...Ch. 8 - Prob. 9GICh. 8 - What are the exceptions to historical cost...

Ch. 8 - Prob. 11GICh. 8 - Prob. 12GICh. 8 - What is the basic assumption underlying the gross...Ch. 8 - Prob. 14GICh. 8 - Prob. 15GICh. 8 - Explain the meaning of the following terms:...Ch. 8 - Prob. 17GICh. 8 - Prob. 18GICh. 8 - The retail inventory method indicated an inventory...Ch. 8 - Prob. 20GICh. 8 - Indicate the effect of each of the following...Ch. 8 - Sienna Company uses the FIFO cost flow assumption....Ch. 8 - Moore Company uses the LIFO cost flow assumption...Ch. 8 - A company uses the LIFO cost flow assumption. The...Ch. 8 - Prob. 4MCCh. 8 - Hestor Companys records indicate the following...Ch. 8 - Under the retail inventory method, freight-in...Ch. 8 - The retail inventory method would include which of...Ch. 8 - At December 31, 2019, the following information...Ch. 8 - Estimates of price-level changes for specific...Ch. 8 - A company forgets to record a purchase on credit...Ch. 8 - Brown Company has the following information...Ch. 8 - Black Corporation uses the LIFO cost flow...Ch. 8 - Blue Corporation uses the FIFO cost flow...Ch. 8 - Paul Corporation uses FIFO and reports the...Ch. 8 - Using the information provided in RE8-4, prepare...Ch. 8 - Kays Beauty Supply uses the gross profit method to...Ch. 8 - Uncle Butchs Hunting Supply Shop reports the...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Johnson Corporation had beginning inventory of...Ch. 8 - Borys Companys periodic inventory at December 31,...Ch. 8 - Refer to the information provided in RE8-4. If...Ch. 8 - Refer to the information provided in RE8-4. If...Ch. 8 - Inventory Write-Down Stiles Corporation uses the...Ch. 8 - Inventory Write-Down Stiles Corporation uses the...Ch. 8 - Inventory Write-Down Byron Company has five...Ch. 8 - Inventory Write-Down The following information for...Ch. 8 - Inventory Write-Down The following information is...Ch. 8 - Inventory Write-Down The inventories of Berry...Ch. 8 - Prob. 7ECh. 8 - Gross Profit Method: Estimation of Flood Loss On...Ch. 8 - Prob. 9ECh. 8 - Gross Profit Method: Estimation of Theft Loss You...Ch. 8 - Retail Inventory Method Harmes Company is a...Ch. 8 - Retail Inventory Method The following data were...Ch. 8 - Retail Inventory Method The following information...Ch. 8 - Dollar-Value LIFO Retail Johns Company adopts the...Ch. 8 - Dollar-Value LIFO Retail Wyatt Company adopts the...Ch. 8 - Dollar-Value LIFO Retail On December 31, 2018,...Ch. 8 - Errors A company that uses the periodic inventory...Ch. 8 - Errors During the course of your examination of...Ch. 8 - (Appendix 8.1) Inventory Write-Down The...Ch. 8 - Inventory Write-Down Palmquist Company has five...Ch. 8 - Inventory Write-Down The following are the...Ch. 8 - Inventory Write-Down The inventory records of...Ch. 8 - Gross Profit Method: Estimation of Fire Loss On...Ch. 8 - Gross Profit Method: Estimation of Flood Loss On...Ch. 8 - Retail Inventory Method Turner Corporation uses...Ch. 8 - Retail Inventory Method EKC Company uses the...Ch. 8 - Retail Inventory Method Red Department Store uses...Ch. 8 - Retail Inventory Method Weber Corporation uses the...Ch. 8 - Dollar-Value LIFO Retail The following information...Ch. 8 - Dollar-Value LIFO Retail Intella Inc. adopted the...Ch. 8 - Prob. 12PCh. 8 - Errors As controller of Lerner Company, which uses...Ch. 8 - Comprehensive: Inventory Adjustments Layne...Ch. 8 - (Appendix 8.1) Inventory Write-Down The following...Ch. 8 - (Appendix 8.1) Inventory Write-Down Frost Companys...Ch. 8 - Prob. 1CCh. 8 - Sandberg Paint Company, your client, manufactures...Ch. 8 - Prob. 3CCh. 8 - Inventory Valuation Issues Hanlon Company...Ch. 8 - Gross Profit Shelly Corporation is an importer and...Ch. 8 - Prob. 6CCh. 8 - Prob. 7CCh. 8 - Various Inventory Issues Hudson Company, which is...Ch. 8 - Analyzing Starbucks Inventory Disclosures Obtain...Ch. 8 - Analyzing Moet Hennessy Louis Vuittons (LVMH)...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Inventory Write-Down The following information is taken from Aden Companys records: Required: 1. What is the correct inventory value if the company applies the LCNRV rule to each of the following? a. individual items b. groups of items c. the inventory as a whole 2. Next Level Are there any conditions under which a company may ignore the decline in the value of inventory below its cost?arrow_forwardInventory Valuation Specific identification method Weighted average cost method FIFO method LIFO method LIFO liquidation LIFO conformity rule LIFO reserve Replacement cost Inventory profit Lower-of-cost-or-market (LCM) rule Inventory turnover ratio Number of days sales in inventory Moving average (Appendix) The name given to an average cost method when a weighted average cost assumption is used with a perpetual inventory system. An inventory costing method that assigns the same unit cost to all units available for sale during the period. A conservative inventory valuation approach that is an attempt to anticipate declines in the value of inventory before its actual sale. An inventory costing method that assigns the most recent costs to ending inventory. The current cost of a unit of inventory. An inventory costing method that assigns the most recent costs to cost of goods sold. A measure of how long it takes to sell inventory. The IRS requirement that when LIFO is used on a tax return, it must also be used in reporting income to stockholders. An inventory costing method that relies on matching unit costs with the actual units sold. The portion of the gross profit that results from holding inventory during a period of rising prices. The result of selling more units than are purchased during the period, which can have negative tax consequences if a company is using LIFO. The excess of the value of a companys inventory stated at FIFO over the value stated at LIFO. A measure of the number of times inventory is sold during the period.arrow_forwardRetail Inventory Method The following information relates to the retail inventory method used by Jeffress Company: Required: 1. Compute the ending inventory by the retail inventory method using the following cost flow' assumptions (round the cost-to-retail ratio to 3 decimal places): a. FIFO b. average cost c. LIFO d. lower of cost or market (based on average cost) 2. Next Level What assumptions are necessary for the retail inventory method to produce accurate estimates of ending inventory?arrow_forward

- Inventory Write-Down Stiles Corporation uses the FIFO cost flow assumption and is in the process of applying the LCNRV rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific data for each product are as follows: Inventory Write-Down Use the information in E8-1. Assume that Stiles uses the LIFO cost flow assumption and is applying the LCM rule. Required: 1. What is the correct inventory value for each product? 2. Next Level With regard to requirement 1, what effect does the imposition of the constraints on market value have on the inventory valuations?arrow_forwardEffects of Inventory Costing Methods Refer to the information for Tyler Company above. Required: 1. Which inventory costing method produces the highest amount for net income? 2. Which inventory costing method produces the lowest amount for taxes? 3. Which inventory costing method produces the highest amount for ending inventory? 4. How would your answers to Requirements 1-3 change if inventory prices declined during the period?arrow_forwardPerpetual and Periodic Inventory Systems Below is a list of inventory systems options. a. Perpetual inventory system b. Periodic inventory system c. Both perpetual and periodic inventory systems Required: Match each option with one of the following: 1. Only revenue is recorded as sales are made during the period; the cost of goods sold is recorded at the end of the period. 2. Cost of goods sold is determined as each sale is made. 3. Inventory purchases are recorded in an inventory account. 4. Inventory purchases are recorded in a purchases account. 5. Cost of goods sold is determined only at the end of the period by subtracting the cost of ending inventory from the cost of goods available for sale. 6. Both revenue and cost of goods sold are recorded during the period as sales are made. 7. The inventory is verified by a physical count.arrow_forward

- Inventory Write-Down Byron Company has five products in its inventory and uses the FIFO cost flow assumption. Specific data for each product are as follows: Required: 1. What is the correct inventory value, assuming the LCNRV rule is applied to each item of inventory? 2. What is the correct inventory value, assuming the LCNRV rule is applied to the total of inventory? 3. Next Level Comment on any differences that result from applying the LCNRV rule to individual items compared to the total of inventory.arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forward

- ( Appendix 6B) For each inventory costing method, perpetual and periodic systems yield the same amounts for ending inventory and cost of goods sold. Do you agree or disagree with this statement? Explain.arrow_forwardInventory Write-Down Stiles Corporation uses the FIFO cost flow assumption and is in the process of applying the LCNRV rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific data for each product are as follows:arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License