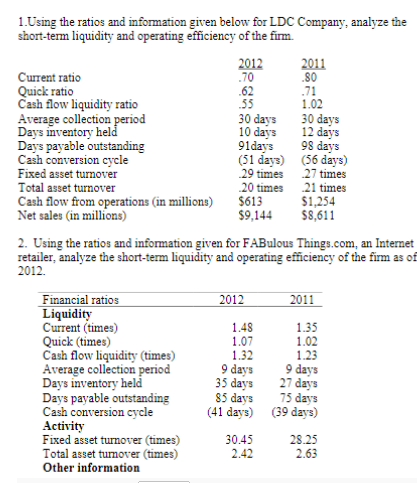

1.Using the ratios and information given below for LDC Company, analyze the short-term liquidity and operating efficiency of the firm. 2012 70 2011 80 .71 1.02 Current ratio Quick ratio Cash flow liquidity ratio Average collection period Days inventory held Days payable outstanding Cash conversion cycle Fixed asset turmover Total asset turnover Cash flow from operations (in millions) Net sales (in millions) .62 55 30 days 30 days 12 days 98 days (51 days) (56 days) 27 times 21 times $1,254 $8,611 10 days 91days 29 times 20 times $613 $9,144

1.Using the ratios and information given below for LDC Company, analyze the short-term liquidity and operating efficiency of the firm. 2012 70 2011 80 .71 1.02 Current ratio Quick ratio Cash flow liquidity ratio Average collection period Days inventory held Days payable outstanding Cash conversion cycle Fixed asset turmover Total asset turnover Cash flow from operations (in millions) Net sales (in millions) .62 55 30 days 30 days 12 days 98 days (51 days) (56 days) 27 times 21 times $1,254 $8,611 10 days 91days 29 times 20 times $613 $9,144

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 10P

Related questions

Question

Analyze the cases in the document attached and prosose solutions

Transcribed Image Text:1.Using the ratios and information given below for LDC Company, analyze the

short-term liquidity and operating efficiency of the firm.

2012

.70

2011

.80

Current ratio

Quick ratio

Cash flow liquidity ratio

Average collection period

Days inventory held

Days payable outstanding

Cash conversion cycle

Fixed asset turnover

Total asset turnover

.62

55

.71

1.02

30 days

10 days

91days

30 days

12 days

98 days

(51 days) (56 days)

29 times 27 times

21 times

$1,254

$8,611

20 times

Cash flow from operations (in millions)

Net sales (in millions)

$613

$9,144

2. Using the ratios and information given for FABulous Things.com, an Internet

retailer, analyze the short-term liquidity and operating efficiency of the firm as of

2012.

Financial ratios

Liquidity

Current (times)

Quick (times)

Cash flow liquidity (times)

Average collection period

Days inventory held

Days payable outstanding

Cash conversion cycle

Activity

Fixed asset turnover (times)

Total asset tumover (times)

Other information

2012

2011

1.48

1.07

1.32

9 days

35 days

85 days

(41 days) (39 day3)

1.35

1.02

1.23

9 days

27 days

75 days

30.45

28.25

2.42

2.63

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,