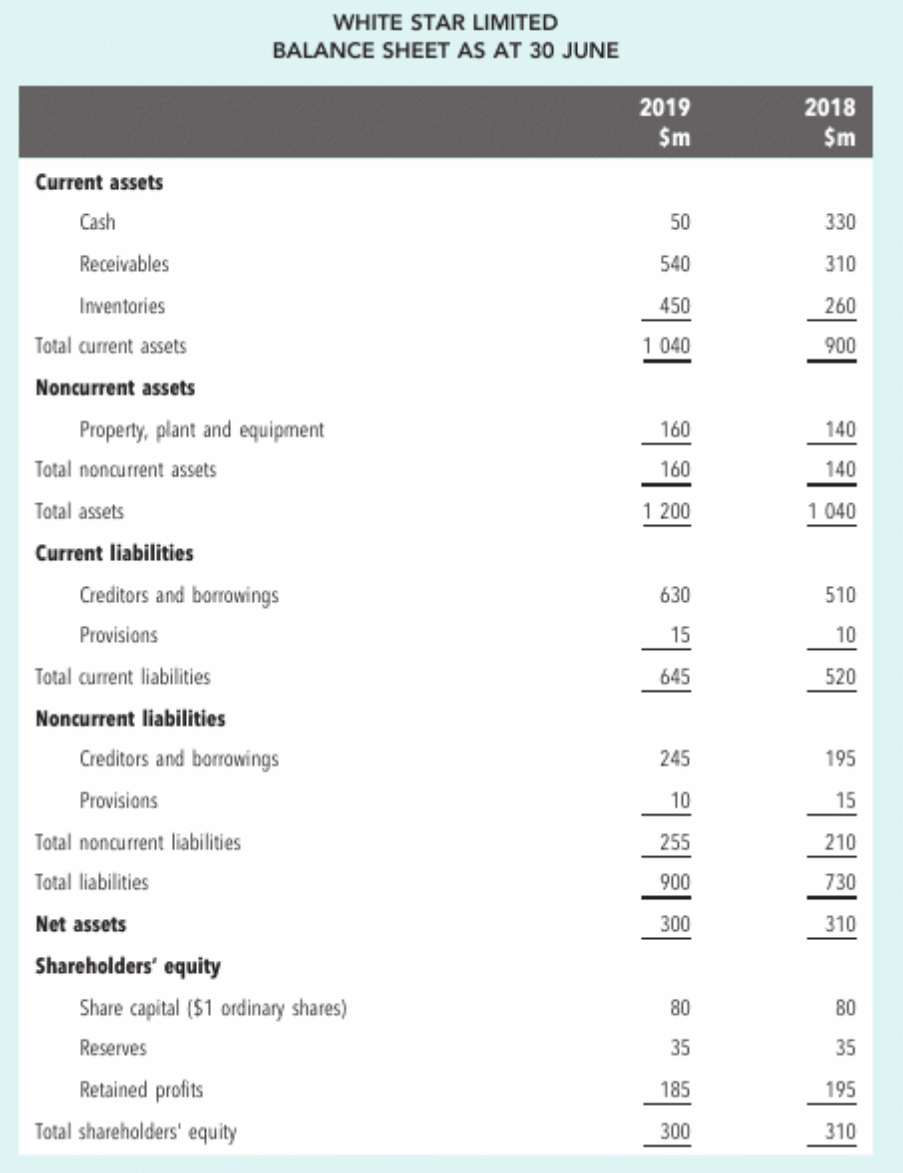

Calculation and interpretation of ratios. Data for White Star Limited: Net operating profit after tax is $25 million (2018: $38 million). 1. Use the information above to calculate for 2019 and 2018: a working capital b current ratio c quick ratio

Calculation and interpretation of ratios.

Data for White Star Limited:

1. Use the information above to calculate for 2019 and 2018:

a

b

c quick ratio

d debt-to-equity ratio

e return on equity ratio

f earnings per share ratio.

2. Identify two warning signals that could have negative implications with respect to the company ’ s ability to generate cash flows to meet its future needs. In each case, explain why the signal you have identified could reflect a cash flow problem.

3. At the annual general meeting of White Star, the managing director, Ms Rose Dawson, made the following statement: ‘ Recently a number of articles in the financial press have questioned the financial position of our company. This criticism is totally unjustified. Net profit was $25 million and total assets have increased by $160 million. These results show that 2019 was a very successful year for White Star. ’

Comment on Ms Dawson ’ s statement.

Step by step

Solved in 2 steps