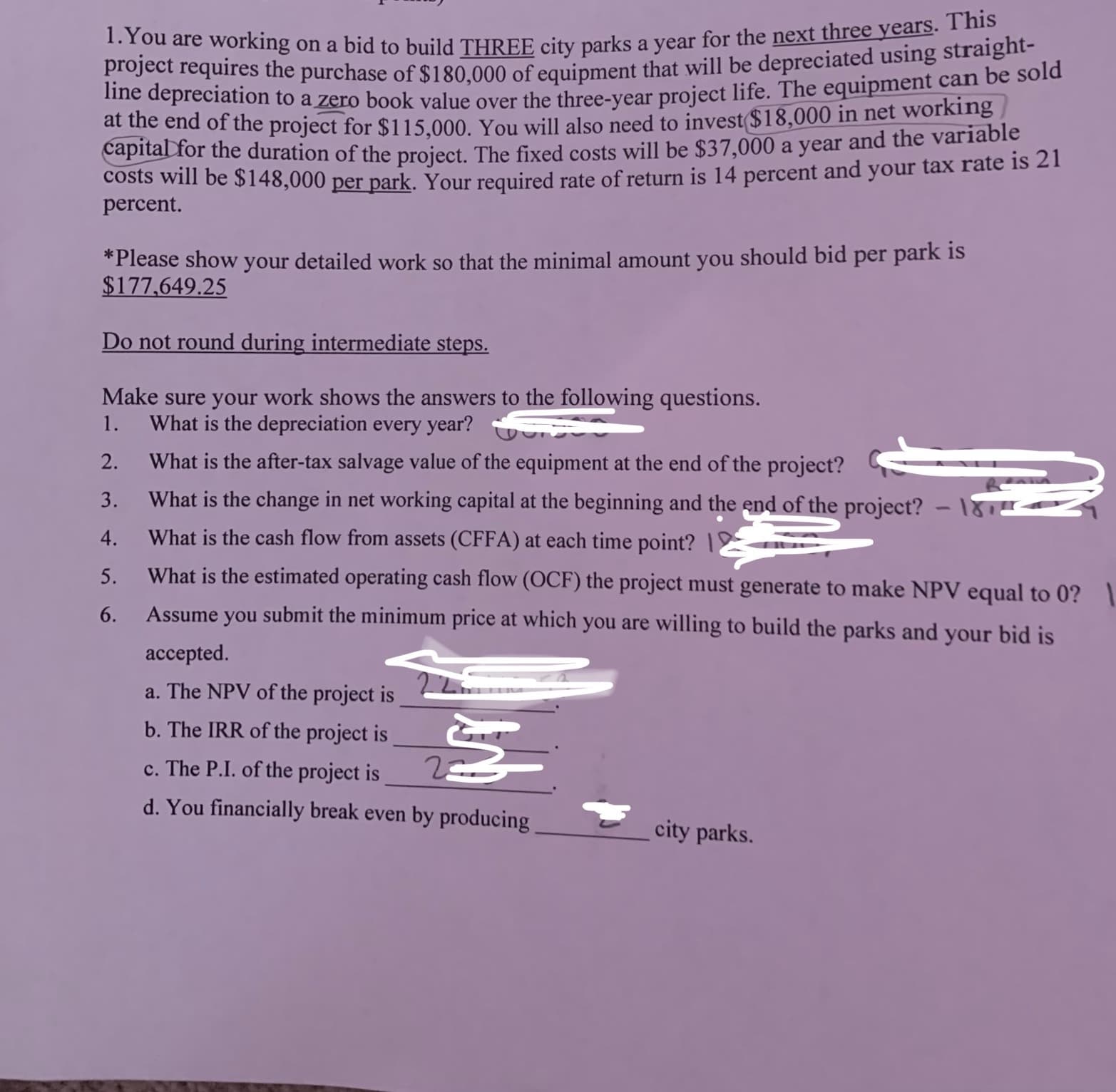

1.You are working on a bid to build THREE city parks a year for the next three years. This lingdrequires the purchase of $180.000 of equipment that will be depreciated using straight- ot sepreciation to a zero book value over the three-vear proiect life. The equipment can be sold at the end of the project for $115.000, You will also need to invest($18,000 in net working capital for the duration of the project. The fixed costs will be $37,000 a year and the variable Costs will be $148,000 per park. Your required rate of return is 14 percent and your tax rate is 21 percent. *Please show your detailed work so that the minimal amount you should bid per park is $177,649.25 Do not round during intermediate steps. Make sure your work shows the answers to the following questions. What is the depreciation every year? 1. 2. What is the after-tax salvage value of the equipment at the end of the project? 3. What is the change in net working capital at the beginning and the end of the project? 4. What is the cash flow from assets (CFFA) at each time point? |2 5. What is the estimated operating cash flow (OCF) the project must generate to make NPV equal to 0? 1 6. Assume you submit the minimum price at which you are willing to build the parks and your bid is accepted. a. The NPV of the project is b. The IRR of the project is c. The P.I. of the project is d. You financially break even by producing city parks.

1.You are working on a bid to build THREE city parks a year for the next three years. This lingdrequires the purchase of $180.000 of equipment that will be depreciated using straight- ot sepreciation to a zero book value over the three-vear proiect life. The equipment can be sold at the end of the project for $115.000, You will also need to invest($18,000 in net working capital for the duration of the project. The fixed costs will be $37,000 a year and the variable Costs will be $148,000 per park. Your required rate of return is 14 percent and your tax rate is 21 percent. *Please show your detailed work so that the minimal amount you should bid per park is $177,649.25 Do not round during intermediate steps. Make sure your work shows the answers to the following questions. What is the depreciation every year? 1. 2. What is the after-tax salvage value of the equipment at the end of the project? 3. What is the change in net working capital at the beginning and the end of the project? 4. What is the cash flow from assets (CFFA) at each time point? |2 5. What is the estimated operating cash flow (OCF) the project must generate to make NPV equal to 0? 1 6. Assume you submit the minimum price at which you are willing to build the parks and your bid is accepted. a. The NPV of the project is b. The IRR of the project is c. The P.I. of the project is d. You financially break even by producing city parks.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:1.You are working on a bid to build THREE city parks a year for the next three years. This

lingdrequires the purchase of $180.000 of equipment that will be depreciated using straight-

ot sepreciation to a zero book value over the three-vear proiect life. The equipment can be sold

at the end of the project for $115.000, You will also need to invest($18,000 in net working

capital for the duration of the project. The fixed costs will be $37,000 a year and the variable

Costs will be $148,000 per park. Your required rate of return is 14 percent and your tax rate is 21

percent.

*Please show your detailed work so that the minimal amount you should bid per park is

$177,649.25

Do not round during intermediate steps.

Make sure your work shows the answers to the following questions.

What is the depreciation every year?

1.

2.

What is the after-tax salvage value of the equipment at the end of the project?

3.

What is the change in net working capital at the beginning and the end of the project?

4.

What is the cash flow from assets (CFFA) at each time point? |2

5.

What is the estimated operating cash flow (OCF) the project must generate to make NPV equal to 0? 1

6.

Assume you submit the minimum price at which you are willing to build the parks and your bid is

accepted.

a. The NPV of the project is

b. The IRR of the project is

c. The P.I. of the project is

d. You financially break even by producing

city parks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning