10-Exam 3-Chapter X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-gr am 3-Chapter 15, 16, and 17 20 Dints 8012335 Skipped eBook References Saved Help Save & Exit Sub Before considering a net operating loss carryforward of $77 million, Fama Corporation reported $270 million of pretax accounting and taxable income in the current year. The income tax rate for all previous years was 34%. On January 1 of the current year, a new tax law was enacted, reducing the rate to 28% effective immediately. Fama's income tax payable for the current year would be: Note: Round your answer to the nearest whole million. Mc Graw Mill Type here to search W S # 3 Multiple Choice $66 million. $118 million. $64 million. 00 F8 < Prev. 20 of 38 Next > 10:35 PM 73°F Partly cloudy 4/14/2024 F10 F11

10-Exam 3-Chapter X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-gr am 3-Chapter 15, 16, and 17 20 Dints 8012335 Skipped eBook References Saved Help Save & Exit Sub Before considering a net operating loss carryforward of $77 million, Fama Corporation reported $270 million of pretax accounting and taxable income in the current year. The income tax rate for all previous years was 34%. On January 1 of the current year, a new tax law was enacted, reducing the rate to 28% effective immediately. Fama's income tax payable for the current year would be: Note: Round your answer to the nearest whole million. Mc Graw Mill Type here to search W S # 3 Multiple Choice $66 million. $118 million. $64 million. 00 F8 < Prev. 20 of 38 Next > 10:35 PM 73°F Partly cloudy 4/14/2024 F10 F11

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 3RP

Related questions

Question

Transcribed Image Text:10-Exam 3-Chapter X

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-gr

am 3-Chapter 15, 16, and 17

20

Dints

8012335

Skipped

eBook

References

Saved

Help

Save & Exit

Sub

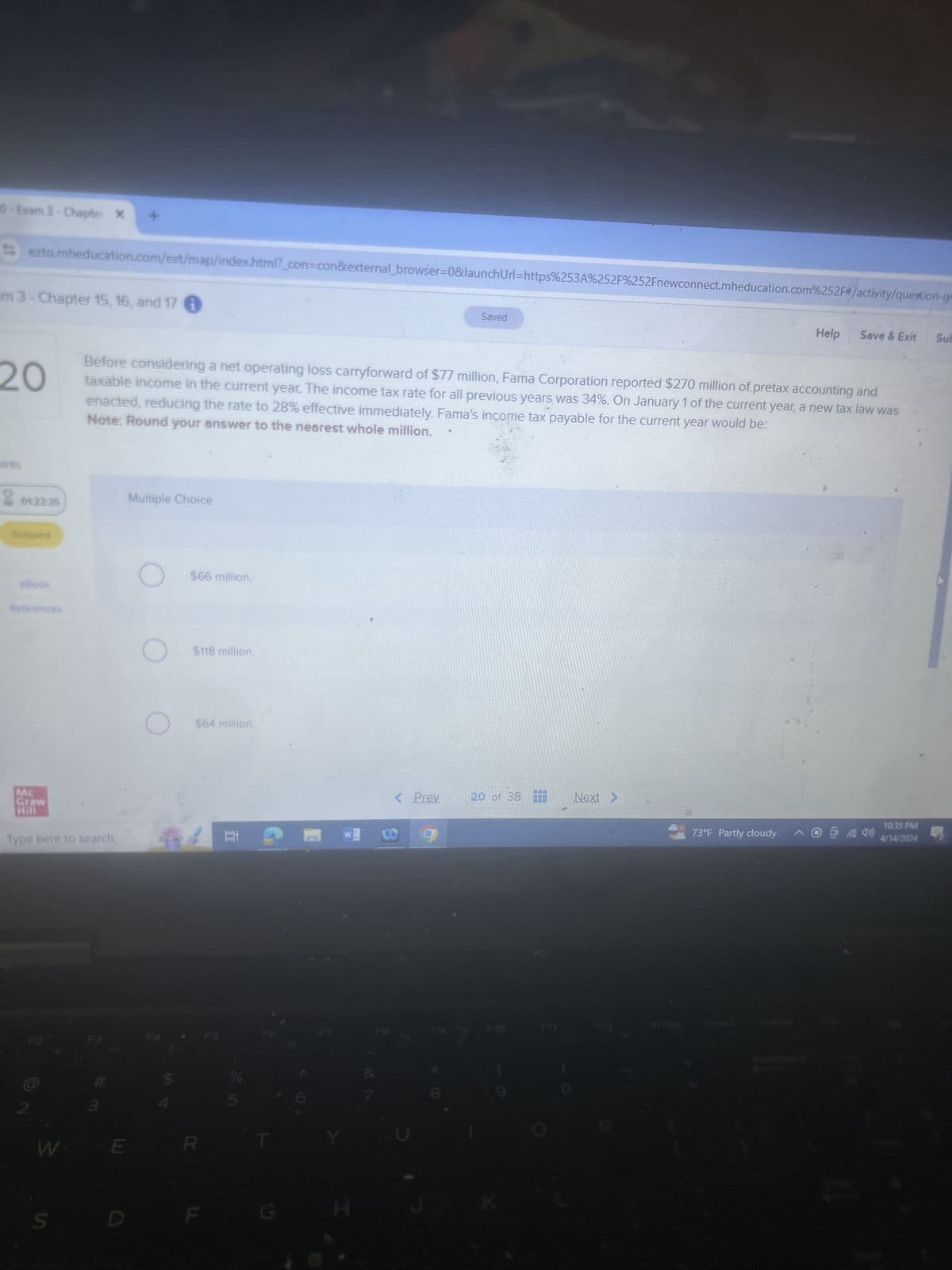

Before considering a net operating loss carryforward of $77 million, Fama Corporation reported $270 million of pretax accounting and

taxable income in the current year. The income tax rate for all previous years was 34%. On January 1 of the current year, a new tax law was

enacted, reducing the rate to 28% effective immediately. Fama's income tax payable for the current year would be:

Note: Round your answer to the nearest whole million.

Mc

Graw

Mill

Type here to search

W

S

#

3

Multiple Choice

$66 million.

$118 million.

$64 million.

00

F8

< Prev.

20 of 38

Next >

10:35 PM

73°F Partly cloudy

4/14/2024

F10

F11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you