s $1,800, and land in whic as $25,000. s on the distribution?

Chapter4: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 19CE

Related questions

Question

Please solve part C

Transcribed Image Text:10

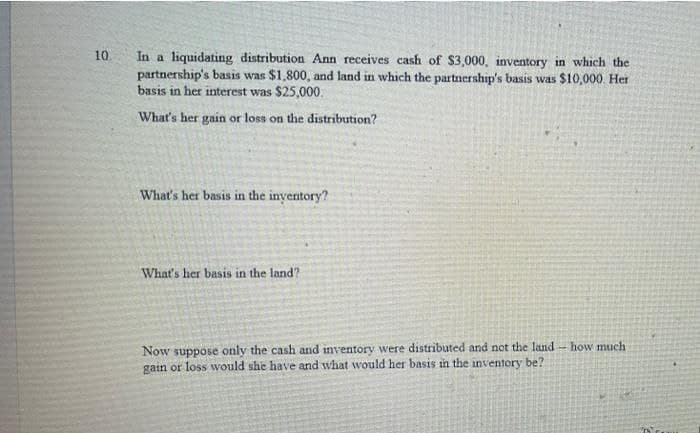

In a liquidating distribution Ann receives cash of $3,000, inventory in which the

partnership's basis was $1,800, and land in which the partnership's basis was $10,000. Her

basis in her interest was $25,000.

What's her gain or loss on the distribution?

What's her basis in the inyentory?

What's her basis in the land?

Now suppose only the cash and inventory were distributed and not the land-how much

gain or loss wvould she have and what would her basis in the inventory be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you