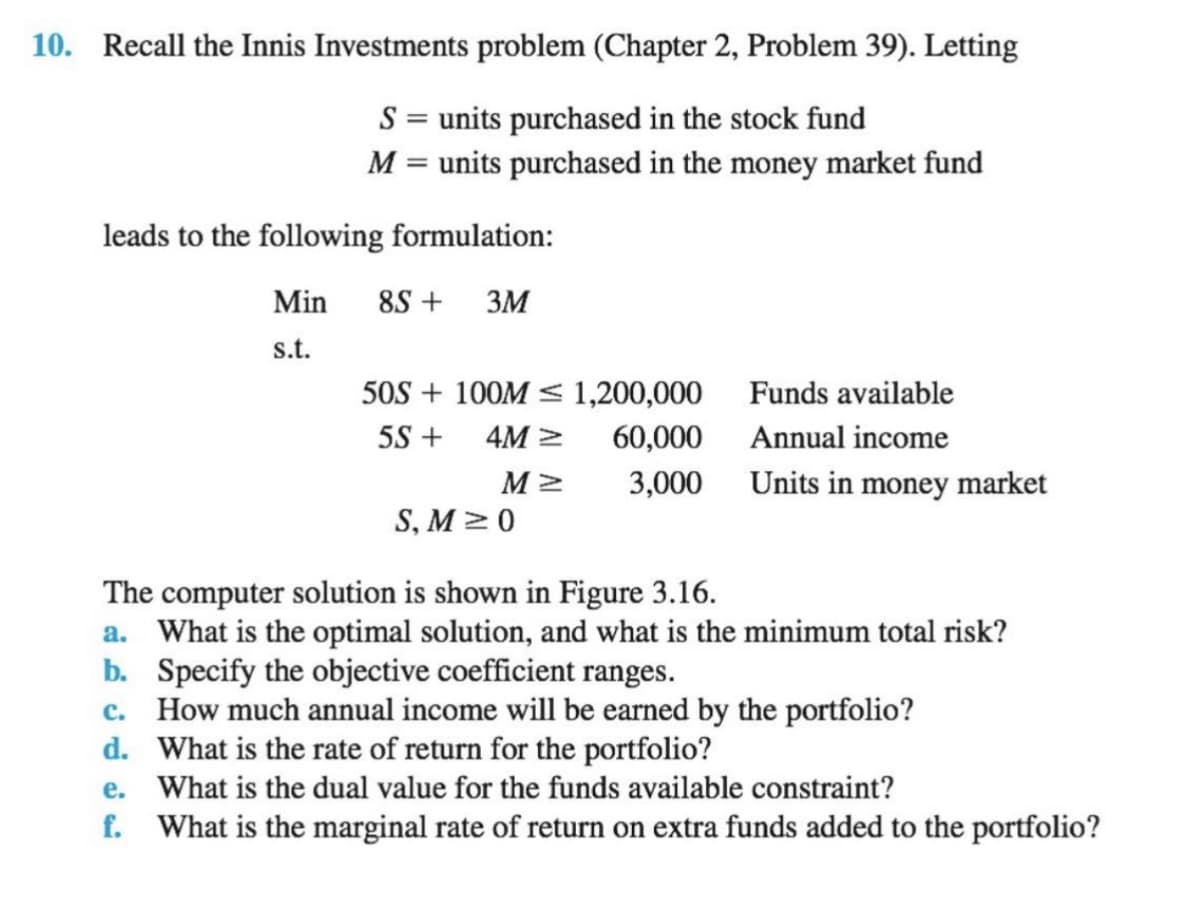

10. Recall the Innis Investments problem (Chapter 2, Problem 39). Letting S = units purchased in the stock fund M = units purchased in the money market fund leads to the following formulation: Min 8S + 3M s.t. 50S + 100M < 1,200,000 Funds available 5S + 4M > 60,000 Annual income 3,000 Units in money market S, M > 0 The computer solution is shown in Figure 3.16. a. What is the optimal solution, and what is the minimum total risk? b. Specify the objective coefficient ranges. c. How much annual income will be earned by the portfolio?

10. Recall the Innis Investments problem (Chapter 2, Problem 39). Letting S = units purchased in the stock fund M = units purchased in the money market fund leads to the following formulation: Min 8S + 3M s.t. 50S + 100M < 1,200,000 Funds available 5S + 4M > 60,000 Annual income 3,000 Units in money market S, M > 0 The computer solution is shown in Figure 3.16. a. What is the optimal solution, and what is the minimum total risk? b. Specify the objective coefficient ranges. c. How much annual income will be earned by the portfolio?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter8: Evolutionary Solver: An Alternative Optimization Procedure

Section8.7: Portfolio Optimization

Problem 14P

Related questions

Question

Transcribed Image Text:10. Recall the Innis Investments problem (Chapter 2, Problem 39). Letting

S = units purchased in the stock fund

M = units purchased in the money market fund

leads to the following formulation:

Min

8S +

3M

s.t.

50S + 100M < 1,200,000

Funds available

5S +

4M >

60,000

Annual income

3,000

Units in money market

S, M > 0

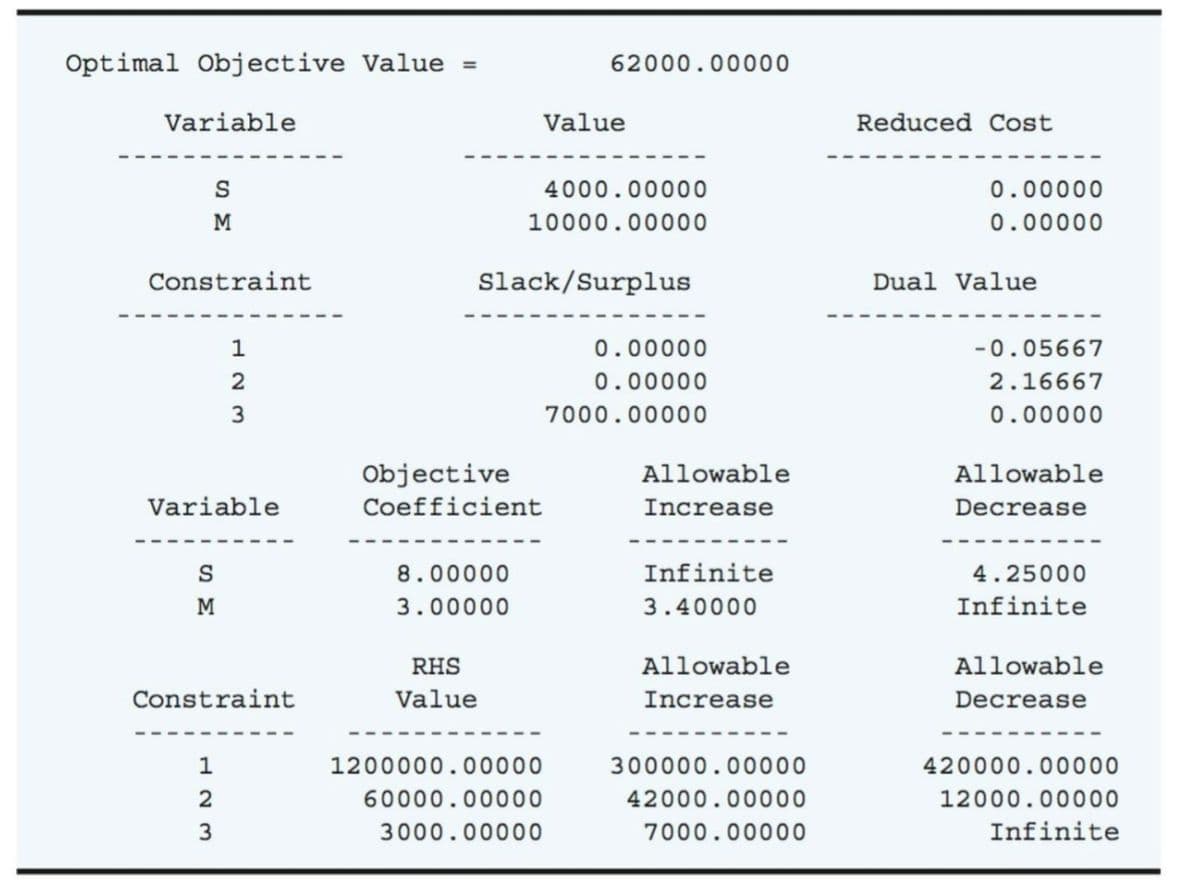

The computer solution is shown in Figure 3.16.

a. What is the optimal solution, and what is the minimum total risk?

b. Specify the objective coefficient ranges.

c. How much annual income will be earned by the portfolio?

d. What is the rate of return for the portfolio?

e. What is the dual value for the funds available constraint?

f. What is the marginal rate of return on extra funds added to the portfolio?

Transcribed Image Text:Optimal Objective Value =

62000.00000

Variable

Value

Reduced Cost

S

4000.00000

0.00000

M

10000.00000

0.00000

Constraint

Slack/Surplus

Dual Value

1

0.00000

-0.05667

2

0.00000

2.16667

7000.00000

0.00000

Objective

Allowable

Allowable

Variable

Coefficient

Increase

Decrease

8.00000

Infinite

4.25000

M

3.00000

3.40000

Infinite

RHS

Allowable

Allowable

Constraint

Value

Increase

Decrease

1

1200000.00000

300000.00000

420000.00000

2

60000.00000

42000.00000

12000.00000

3

3000.00000

7000.00000

Infinite

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,