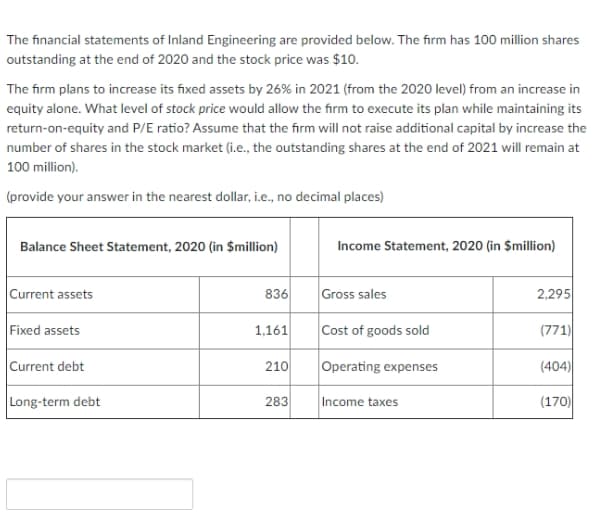

100 million). (provide your answer in the nearest dollar, i.e., no decimal places) Balance Sheet Statement, 2020 (in $million) Income Statement, 2020 Current assets 836 Gross sales Fixed assets 1,161 Cost of goods sold Current debt 210 Operating expenses Long-term debt 283 Income taxes

Q: ABC Inc. reported revenue of P1,980,000 in its income statement for the year ended December 31,…

A: Accounts receivable are credit accounts lawfully enforceable retained by the company for the…

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: Solution: Ratio Formula Target Walmart (1) Current ratio = CURRENT ASSETS/CURRENT…

Q: LOCKDOWN Corp. has the ending balances as December 31, 2020: Cash - 110,000 Fixed Assets - 155. 000;…

A: "Since you have asked multiple questions, we will solve the first question for you". If you want any…

Q: Wallace Driving School's 2020 balance sheet showed net fixed assets of $5.4 million, and the 2021…

A: Net Capital Spending is the net amount the company pays to acquire the fixed assets during a…

Q: uring 2019, Rainbow Umbrella Corp. had sales of $630,000. Cost of goods sold, administrative and…

A: Profit before tax = Sales - Cost of goods sold - all expenses Net income (Profit after tax) =…

Q: This information was taken from the books of XYZ Co. for 2020: Sales…

A: Comprehensive financial gain is that the variation in an exceedingly company's web assets from…

Q: Power Company's income statement for 2021 is given below. If inventory balances are 10000 in 2021…

A: Cost of goods sold means that value of opening stock plus purchases minus closing stock.

Q: _1. On 2020, an entity made cash sales of P3,000,000. It paid P1,000,000 in expenses and owed…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Power Company's income statement for 2021 is given below. If inventory balances are 10000 in 2021…

A: Cost of goods sold in the business means how much cost has, been incurred on goods that are being…

Q: Kingbird, Inc. reported income taxes of $421,800,000 on its 2022 income statement and income taxes…

A: Tax means the mandatory payment made by assesse to the government without expecting anything…

Q: This information was taken from the books of XYZ Co. for 2020: P 9,500,000 350,000 100,000 50,000…

A: Comprehensive income is the income where unrealised gain or loss, gain on foreign operations and…

Q: Ramakrishnan, Inc., reported 2021 net income of $20 million and depreciation of $3,400,000. The top…

A: Net cash flow from operating activities represents the net cash inflow and net cash outflow due to…

Q: te payable, bank – due June 30, 2021 1,300,000 Note payable, bank – due June 30, 2022 2,100,000…

A: The statement of comprehensive income details the revenue, income, costs, or loss of the company…

Q: Ayayai Ltd. had the following 2020 income statement data: Sales $205,600 Cost of goods sold 119,400…

A: The Cash Flow statement shows the flows of cash and cash equivalent during the period under report.…

Q: #210 BALJEET Company reported the following information for the year ended December 31, 2020:…

A: Solution:- Preparation of the income statement of "BALJEET" Company for the year ended December 31,…

Q: The accounting records of Colton Industries, Inc., provided the data below for the year ended…

A: The cash flow statement is helpful for the stakeholders that they can identify the organization's…

Q: Power Company's income statement for 2021 is given below. If inventory balances are 10000 in 2021…

A: The question is multiple choice question Required Choose the Correct Option.

Q: During 2020, A Company, a service organization, had P200,000 in cash sales and P3,000,000 in credit…

A: Cash basis of accounting is an accounting method where an entity recognizes revenues and expenses…

Q: The table below contains data on Fincorp Inc. The balance sheet items correspond to values at…

A: Revenue is an income and statement item and is used to calculate profit and loss. We have the cost…

Q: 1.Positivity Company provided the following information on December 31, 2020 ( in their normal…

A: Assets section of balance sheet can be categorized in two parts, current assets or non-current…

Q: The top part of Ramakrishnan, Inc.’s 2021 and 2020 balance sheets is listed below (in millions of…

A: Please see the white board for the understanding of the three ratios we have to calculate.

Q: Presented below are a number of balance sheet items for Montoya, Inc., for 2019. Unsecured notes…

A: Statement of financial position is one of the financial statement, which shows all assets,…

Q: Fragile Express Delivery Company’s earnings before interest and taxes (EBIT) was $725 million.…

A: NOPAT or net operating profit after taxes is calculated as EBIT less taxes on EBIT

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Below are summary numbers for 2020 and 2021 for S-Mart Ltd. (in million dollars). 2020 2021e…

A: Free cash flow- FCF (free cash flow) is a measure of how much cash a company generates after…

Q: An entity reported the following information for the year ended December 31, 2020: Sales 7,750,000…

A: Income from continuing operations means income generated after deducting all the operating expenses…

Q: Ramakrishnan, Inc., reported 2021 net income of $20 million and depreciation of $2,700,000. The top…

A: Net Income = 20 million Depreciation = 2.7 million Increase in Cash and Marketable securities = 13…

Q: Hammond's net working capital in 2020 is closest to: A) $2.3 million B) $3.8 million C) $6.5…

A: Working capital or net working capital is equals to firm’s current assets minus current liabilities,…

Q: In 2020, Ted Baker had total assets of S510.31 million, of which $219.92 million were total…

A: Lets understand the basics. Current asset to total assets is a ratio in which current asset is…

Q: SABM Co. reported net income of P2,100,000 for 2020 . It incurred operating expenses other than…

A: Relationship between Operating Expense and Gross Profit Cost of sales = Net sales - Gross profit We…

Q: Suppose McDonald’s 2022 financial statements contain the following selected data (in millions).…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: The XYZ Company had the following income statement on 31.12.2020 Deprecation 12000 Net income 85000…

A: working notes: Net Cash Provided by Operating Activities =85,000…

Q: Prepare a classified balance sheet in good form. Common stock authorized was 400,000 shares, and…

A: Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder's equity…

Q: The income statement of Barela Corporation for 2020 included the following items: Interest income…

A: Cash received from interest means the actual cash received from the interest revenue. This amount…

Q: Milton, Inc. provides the following income statement for 2025: Net Sales $240,000 Cost of Goods…

A: Ratio analysis: This is the quantitative analysis of financial statements of a business enterprise.…

Q: Use the following information to answer this question. Windswept, Incorporated 2022 Income…

A: Quick ratio measures the short term liquidity of the firm. It can be calculated Quick ratio…

Q: An entity reported the following information for the year ended December 31, 2020:

A: Solution: In simple terms, net income is the income that comes after deducting all expenses from the…

Q: During 2021, Cavite Coffee had profit of P8,200,000. Included on its income statement was…

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flow statements.…

Q: The adjusted account balances of UTV Corp. for the year ended December 31, 2020 are as follows: Cash…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: d charges in 2023?

A: Changes are a part of business. The business that is changing itself, with the change in trend or…

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: The income statement of Barela Corporation for 2020 included the following items: Interest income…

A: The Question requires us to calculate the cash paid for Salaries during 2020.

Q: What is the statement of comprehensive income for the year Dec. 2020 showing the ratio of each item…

A: Horizontal analysis means where the analysis is made with regard with two different period where as…

Q: Bank overdraft 100,000 Accounts receivable 900,000 Allowance for doubtful accounts 40,000 Raw…

A: The statement of comprehensive income details the revenue, income, costs, or loss of the company…

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: Solution- Income Statement Target…

Q: GHIST Co. reported a net income of P2,100,000 for 2020. It incurred operating expenses other than…

A: Relationship between Operating Expense and Gross Profit Cost of sales = Net sales - Gross profit We…

Q: · Sales revenue- P500,000 · Cost of Goods Sold- P350,000 · Operating Expenses-…

A: Solution: Other comprehensive income before tax will include all revenues or expenses taken before…

Q: The following information is from Dejlah, Inc.s, financial statements. Sales (all credit) were AED…

A: Balance sheet refers to the kind of financial statement of a company which is prepared at the end of…

Step by step

Solved in 3 steps

- CALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skyes earnings per share last year were 3.20. The common stock sells for 55.00. last years dividend (D0) was 2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skyes preferred stock pays a dividend of 3.30 per share, and its preferred stock sells for 30.00 per share. The firms before-lax cost of debt is 10%, and its marginal tax rate is 25%. The firms currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skyes beta is 1.516. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals 1.2 million. a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.) d. If Skye continues to use the same market-value capital structure, what is the firms WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?The HP Corporation has reported the BV of common equity of $9 billion at the end of 2020, with 450 million shares outstanding. The required rate of return is 12%. The company trades in the stock market for $15. The firm is a. overvalued b. undervalued c. not enough informationd. trading at par valueThe following are earnings and dividend forecasts made at the end of 2020 for the IBM Corporation with a $40 BV per common share at that time. In 2021, EPS will be $7 and DPS $1. In 2022, EPS will be $8 and DPS $1.50. In 2023, EPS will be $9 and DPS $2. The firm has a required equity return of 15% per year. Calculate the book value per share for the company for each year from 2021 to 2023, accordingly.

- Morrissey Technologies Inc.'s 2019 financial statements are shown here. Suppose that in 2020, sales increase by 10% over 2019 sales. The firm currently has 100,000 shares outstanding. It expects to maintain its 2019 dividend payout ratio and believes that its assets should grow at the same rate as sales. The firm has no excess capacity. However, the firm would like to reduce its operating costs/sales ratio to 87.5% and increase its total liabilities-to-assets ratio to 30%. (It believes its liabilities- to-assets ratio currently is too low relative to the industry average.) The firm will raise 30% of the 2020 forecasted interest-bearing debt as notes payable, and it will issue long-term bonds for the remainder. The firm forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 12.5%. Assume that any common stock issuances or repurchases can be made at the firm's current stock price of $45.a. Construct the forecasted financial…On January 1, 2019, the total assets of the Dexter Company were $270 million. The firm'spresent capital structure, which follows, is considered to be optimal. Assume that there is noshort-term debt.Long-term Debt=$135,000,000 Common Stock=$135,000,000New bonds will have a 10 percent coupon rate and will be sold at par. Common stock, currently,selling at $60 a share, can be sold to net the company $54 a share. Stockholders' required rate ofreturn is estimated to be 12 percent., consisting of a dividend yield of 4 percent and an expectedgrowth rate of 8 percent. (The next expected dividend is $2.40, so $2.40/$60 = 4%.) Retained earnings are estimated to be $13.50 million. The marginal tax rate is 40 percent.Assuming that all asset expansion (gross expenditures for fixed assets plus related workingcapital) is included in the capital budget, the dollar amount of the capital budget, ignoringdepreciation is $135 million. The marginal tax rate is 40 percent. Assuming that all assetexpansion…On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $25 million in new projects. The firm's present market value capital structure, shown below, is considered to be optimal. Assume that there is no short-term debt. Debt $30,000,000 Common equity 30,000,000 Total capital $60,000,000 New bonds will have an 9% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders' required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so $1.20/$30 = 4%.) The marginal corporate tax rate is 35%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet In order to maintain the present capital structure, how much of the…

- The Dell Corporation has reported the BV of common equity of $10 billion at the end of 2020, with 400 million shares outstanding. The required rate of return is 5%. The company trades in the stock market for $30. calculate the price-to-book ratio.For 2020 the free cash flow to the firm (FCFF) of ABC Co. was ₱30,000. The firm has total debt of ₱20,000, and there were 12,000 shares outstanding. The required rate of return is 9% and the estimated growth rate in FCFF is 6.5%. How much is the intrinsic value per share of ABC Co.? ₱80.45 ₱94.92 ₱104.83 ₱112.50 answer not givenIs my answer correct? I feel as if I am missing a few steps. AFW Industries has 201 million shares outstanding and expects earnings at the end of this year of $673 million. AFW plans to pay out 61% of its earnings in total, paying 34% as a dividend and using 27% to repurchase shares. If AFW's earnings are expected to grow by 8.9% per year and these payout rates remain constant, determine AFW's share price assuming an equity cost of capital of 12.1%. Formula is g = ROE x b Do the opposite of the formula G = 8.9%; payout is 61% (1 - .61 = .39) 9% - .39 = .89 -.39 = .5

- Milton Inc. is an all-equity firm and investors expect it to remain an all-equity firm in the future. It has 100 million shares outstanding and is subject to a 40% corporate tax rate. It has no excess cash. The cost of equity is 20%. The firm is expected to generate free cash flows of $100 million per year forever, with the first free cash flow coming exactly one year from now (in December 2020). (a) What is the current stock price of Milton Inc.? Suppose that today, Milton Inc. makes a surprise announcement that it will issue $200 million worth of perpetual debt (i.e., it will maintain a constant debt level of $200 million forever) with coupon rate 8%, which coincides with its cost of debt. Milton will use the proceeds from the issuance of debt to repurchase stocks. Assume that the recapitalization will take place very soon, within a few days. (b) What will be the total value of the firm after the recapitalization described above? (c) What will be the total value of equity (i.e., the…A company needs $35,943,750 to finance a major project in the company. The company expects that next year’s earnings from current operations and the additional earnings from the new project will be a total of $45,650,000. The company currently has 5,075,000 shares outstanding, with a price of $17.75 per share. The company’s management is assuming that any the additional shares issued to finance the project will not affect the market price of the company’s common stock. Calculate the following: If the $35,943,750 needed for the project is raised by selling new shares, what will the forecast for next year’s earnings per share (EPS) be? If the $35,943,750 needed for the project is raised by selling new shares, what will the firm’s price earnings ratio (PE ratio) be? If the $35,943,750 needed for the project is raised by issuing new debt, what will the forecast for next year’s earnings per share be? (Assume that there is no “tax shield effect” with issuing corporate debt.) If the…On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $30 million in new projects. The firm’s present market value capital structure, shown below, is considered to be optimal. There is no short-term debt. Debt $30,000,000 Common equity 30,000,000 Total capital $60,000,000 New bonds will have an 8% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders’ required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so the dividend yield is $1.20/$30 = 4 %.) The marginal tax rate is 40%. a. In order to maintain the present capital structure, how much of the new investment must be financed by common equity? b. Assuming there is sufficient cash flow for Tysseland to maintain its target capital structure without issuing additional shares of…