Transactions during 2020 follow: Borrowed $20,000 cash on July 1, 2020, signing a one-year, 10 percent note payable. Purchased equipment for $18,000 cash on July 1, 2020. Sold 10,000 additional shares of capital stock for cash at $0.50 market value per share at the beginning of the year. Earned $70,000 in revenues for 2020, including $14,000 on credit and the rest in cash. Incurred $27,000 in wages expense and $8,000 in miscellaneous expenses for 2020, with $7,000 on credit and the rest paid with cash. Note: Wages are paid in cash. Purchased additional small tools, $3,000 cash. Collected accounts receivable, $8,000. Paid accounts payable, $11,000. Purchased $10,000 of supplies on account. Received a $3,000 deposit on work to start January 15, 2021. Declared a cash dividend on December 1, $10,000; paid on December 31. Data for adjusting entries: Supplies of $4,000 and small tools of $8,000 were counted on December 31, 2020 (debit Miscellaneous Expenses). Depreciation for 2020, $2,000. Interest accrued on notes payable (to be computed). Wages earned since the December 24 payroll but not yet paid, $3,000. Income tax expense was $4,000, payable in 2021.

Transactions during 2020 follow: Borrowed $20,000 cash on July 1, 2020, signing a one-year, 10 percent note payable. Purchased equipment for $18,000 cash on July 1, 2020. Sold 10,000 additional shares of capital stock for cash at $0.50 market value per share at the beginning of the year. Earned $70,000 in revenues for 2020, including $14,000 on credit and the rest in cash. Incurred $27,000 in wages expense and $8,000 in miscellaneous expenses for 2020, with $7,000 on credit and the rest paid with cash. Note: Wages are paid in cash. Purchased additional small tools, $3,000 cash. Collected accounts receivable, $8,000. Paid accounts payable, $11,000. Purchased $10,000 of supplies on account. Received a $3,000 deposit on work to start January 15, 2021. Declared a cash dividend on December 1, $10,000; paid on December 31. Data for adjusting entries: Supplies of $4,000 and small tools of $8,000 were counted on December 31, 2020 (debit Miscellaneous Expenses). Depreciation for 2020, $2,000. Interest accrued on notes payable (to be computed). Wages earned since the December 24 payroll but not yet paid, $3,000. Income tax expense was $4,000, payable in 2021.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 5PB: Reece Financial Services Co., which specializes in appliance repair services, is owned and operated...

Related questions

Question

Transactions during 2020 follow:

- Borrowed $20,000 cash on July 1, 2020, signing a one-year, 10 percent note payable.

- Purchased equipment for $18,000 cash on July 1, 2020.

- Sold 10,000 additional shares of capital stock for cash at $0.50 market value per share at the beginning of the year.

- Earned $70,000 in revenues for 2020, including $14,000 on credit and the rest in cash.

- Incurred $27,000 in wages expense and $8,000 in miscellaneous expenses for 2020, with $7,000 on credit and the rest paid with cash. Note: Wages are paid in cash.

- Purchased additional small tools, $3,000 cash.

- Collected accounts receivable, $8,000.

- Paid accounts payable, $11,000.

- Purchased $10,000 of supplies on account.

- Received a $3,000 deposit on work to start January 15, 2021.

- Declared a cash dividend on December 1, $10,000; paid on December 31.

Data for

- Supplies of $4,000 and small tools of $8,000 were counted on December 31, 2020 (debit Miscellaneous Expenses).

Depreciation for 2020, $2,000.- Interest accrued on notes payable (to be computed).

- Wages earned since the December 24 payroll but not yet paid, $3,000.

- Income tax expense was $4,000, payable in 2021.

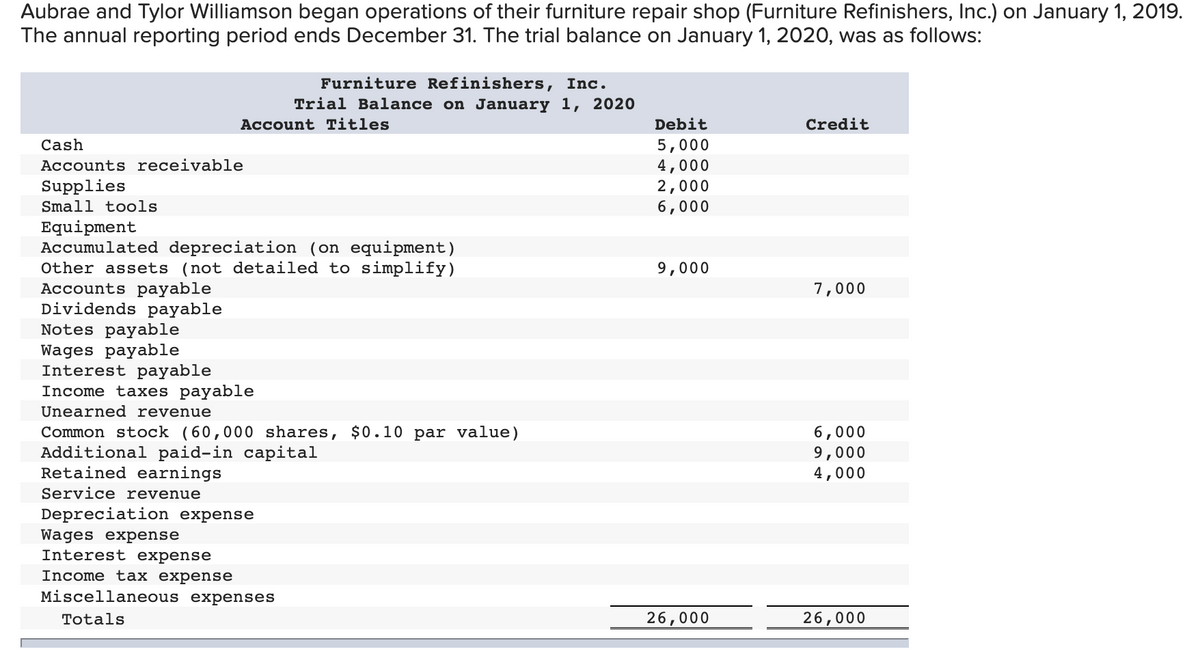

Transcribed Image Text:Aubrae and Tylor Williamson began operations of their furniture repair shop (Furniture Refinishers, Inc.) on January 1, 2019.

The annual reporting period ends December 31. The trial balance on January 1, 2020, was as follows:

Furniture Refinishers, Inc.

Trial Balance on January 1, 2020

Account Titles

Debit

Credit

Cash

5,000

4,000

2,000

6,000

Accounts receivable

Supplies

Small tools

Equipment

Accumulated depreciation (on equipment)

Other assets (not detailed to simplify)

Accounts payable

Dividends payable

Notes payable

9,000

7,000

Wages payable

Interest payable

Income taxes payable

Unearned revenue

Common stock (60,000 shares, $0.10 par value)

Additional paid-in capital

Retained earnings

6,000

9,000

4,000

Service revenue

Depreciation expense

Wages expense

Interest expense

Income tax expense

Miscellaneous expenses

Totals

26,000

26,000

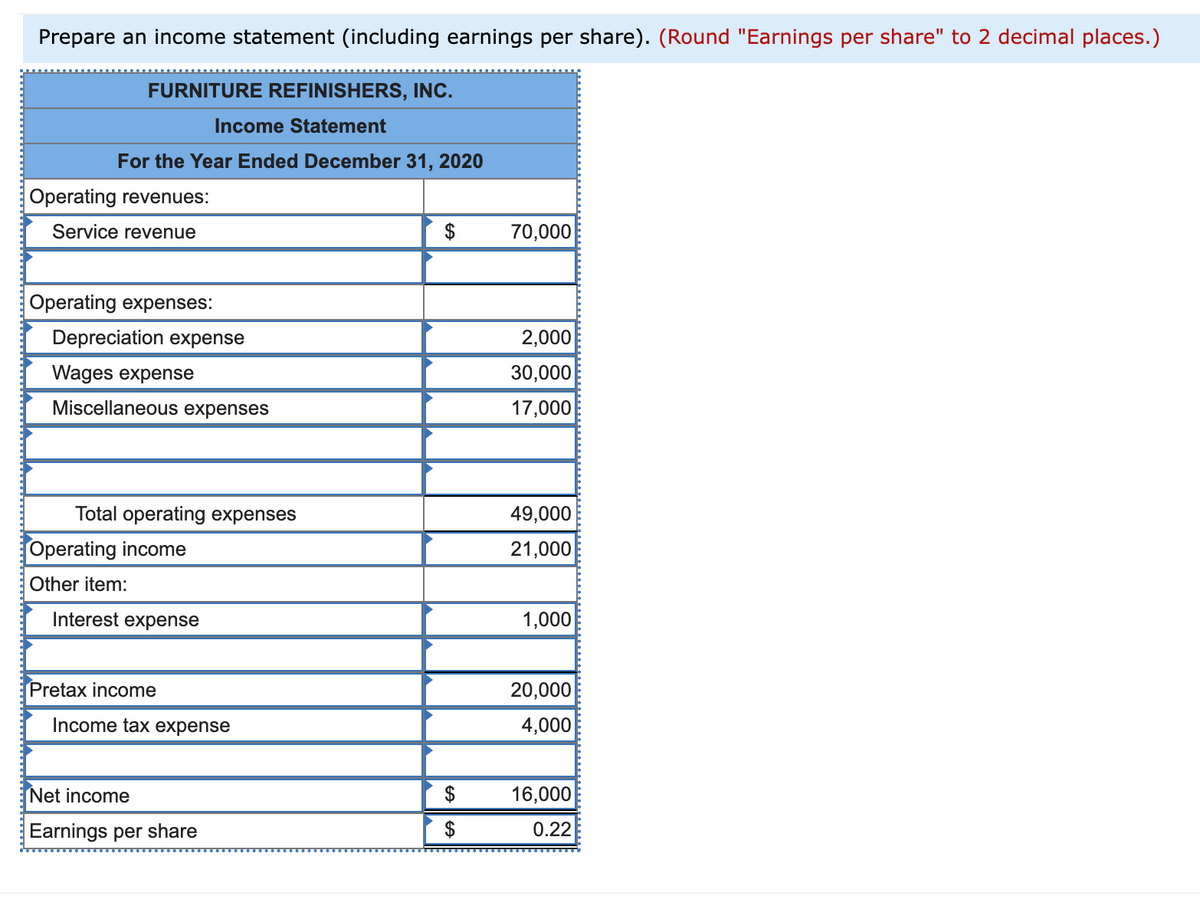

Transcribed Image Text:Prepare an income statement (including earnings per share). (Round "Earnings per share" to 2 decimal places.)

FURNITURE REFINISHERS, INC.

Income Statement

For the Year Ended December 31, 2020

Operating revenues:

Service revenue

$

70,000

Operating expenses:

Depreciation expense

2,000

Wages expense

30,000

Miscellaneous expenses

17,000

Total operating expenses

49,000

Operating income

21,000

Other item:

Interest expense

1,000

Pretax income

20,000

Income tax expense

4,000

Net income

$

16,000

Earnings per share

$

0.22

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub