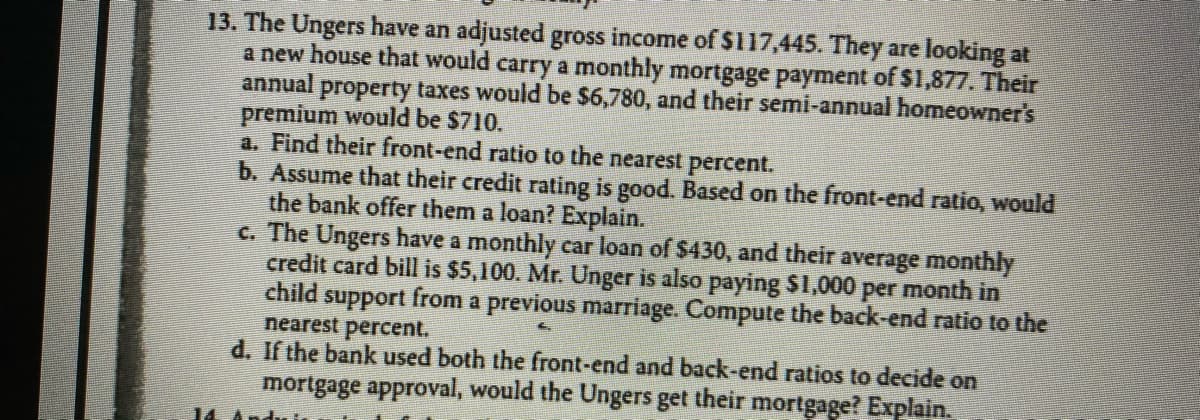

13. The Ungers have an adjusted gross income of $117,445. They are looking at a new house that would carry a monthly mortgage payment of $1,877. Their annual property taxes would be $6,780, and their semi-annual homeowner's premium would be $710. a. Find their front-end ratio to the nearest percent. b. Assume that their credit rating is good. Based on the front-end ratio, would the bank offer them a loan? Explain. c. The Ungers have a monthly car loan of $430, and their average monthly credit card bill is $5,100. Mr. Unger is also paying $1,000 per month in child support from a previous marriage. Compute the back-end ratio to the nearest percent. d. If the bank used both the front-end and back-end ratios to decide on mortgage approval, would the Ungers get their mortgage? Explain. 14

Unitary Method

The word “unitary” comes from the word “unit”, which means a single and complete entity. In this method, we find the value of a unit product from the given number of products, and then we solve for the other number of products.

Speed, Time, and Distance

Imagine you and 3 of your friends are planning to go to the playground at 6 in the evening. Your house is one mile away from the playground and one of your friends named Jim must start at 5 pm to reach the playground by walk. The other two friends are 3 miles away.

Profit and Loss

The amount earned or lost on the sale of one or more items is referred to as the profit or loss on that item.

Units and Measurements

Measurements and comparisons are the foundation of science and engineering. We, therefore, need rules that tell us how things are measured and compared. For these measurements and comparisons, we perform certain experiments, and we will need the experiments to set up the devices.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images