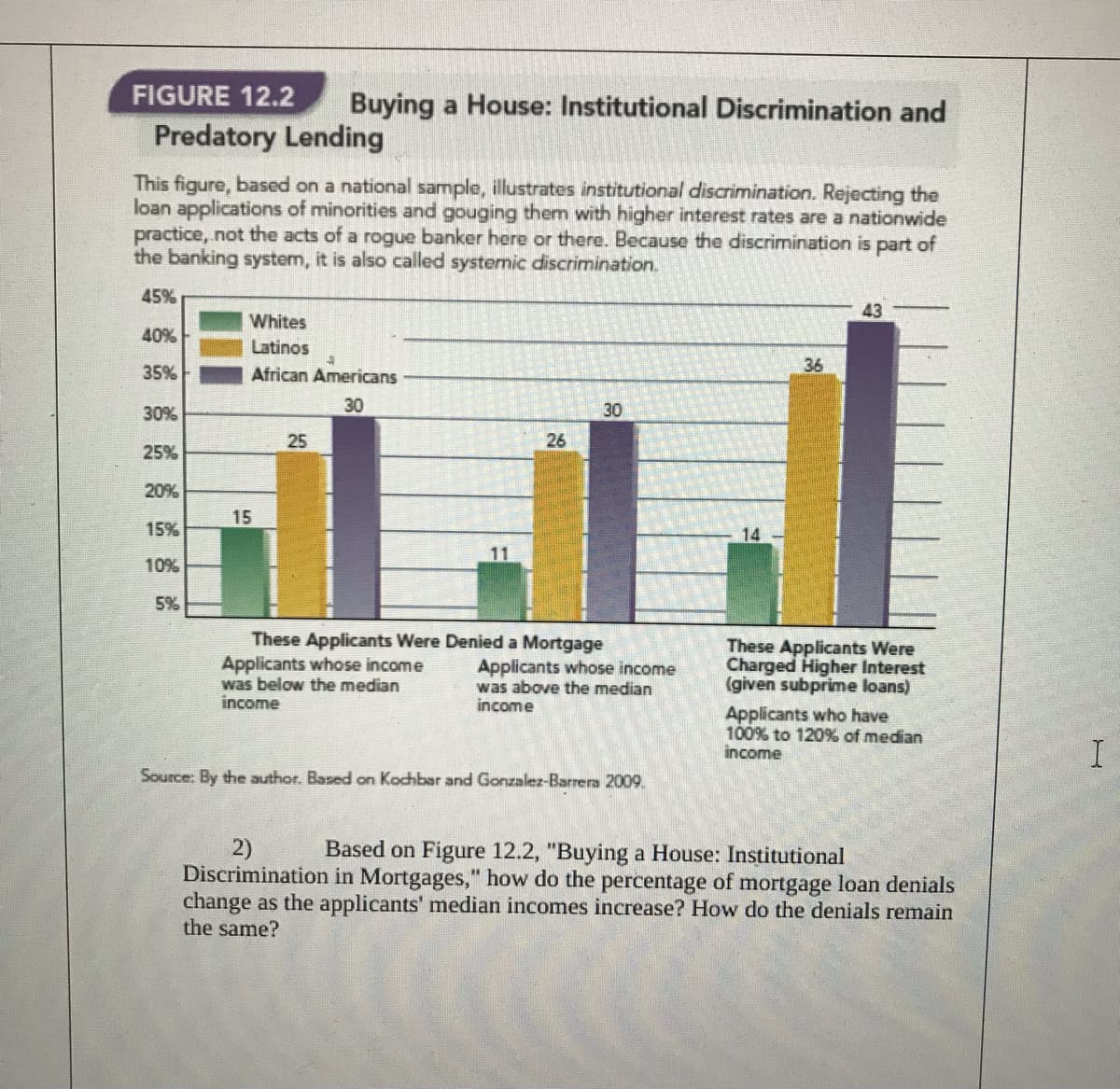

This figure, based on a national sample, illustrates institutional discrimination. Rejecting the loan applications of minorities and gouging them with higher interest rates are a nationwide practice, not the acts of a rogue banker here or there. Because the discrimination is part of the banking system, it is also called systemic discrimination. 45% 43 Whites 40% Latinos 35% African Americans 36 30% 30 30 26 25% 20% 15 15% 25

This figure, based on a national sample, illustrates institutional discrimination. Rejecting the loan applications of minorities and gouging them with higher interest rates are a nationwide practice, not the acts of a rogue banker here or there. Because the discrimination is part of the banking system, it is also called systemic discrimination. 45% 43 Whites 40% Latinos 35% African Americans 36 30% 30 30 26 25% 20% 15 15% 25

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

100%

Transcribed Image Text:FIGURE 12.2

Buying a House: Institutional Discrimination and

Predatory Lending

This figure, based on a national sample, illustrates institutional discrimination. Rejecting the

loan applications of minorities and gouging them with higher interest rates are a nationwide

practice, not the acts of a rogue banker here or there. Because the discrimination is part of

the banking system, it is also called systenic discrimination.

45%

43

Whites

40%

Latinos

36

35%

African Americans

30%

30

30

25

26

25%

20%

15

15%

14

11

10%

5%

These Applicants Were Denied a Mortgage

Applicants whose income

was below the median

income

Applicants whose income

was above the median

income

These Applicants Were

Charged Higher Interest

(given subprime loans)

Applicants who have

100% to 120% of median

income

I

Source: By the author. Based on Kochbar and Gonzalez-Barrera 2009.

2)

Discrimination in Mortgages," how do the percentage of mortgage loan denials

change as the applicants' median incomes increase? How do the denials remain

the same?

Based on Figure 12.2, "Buying a House: Institutional

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman