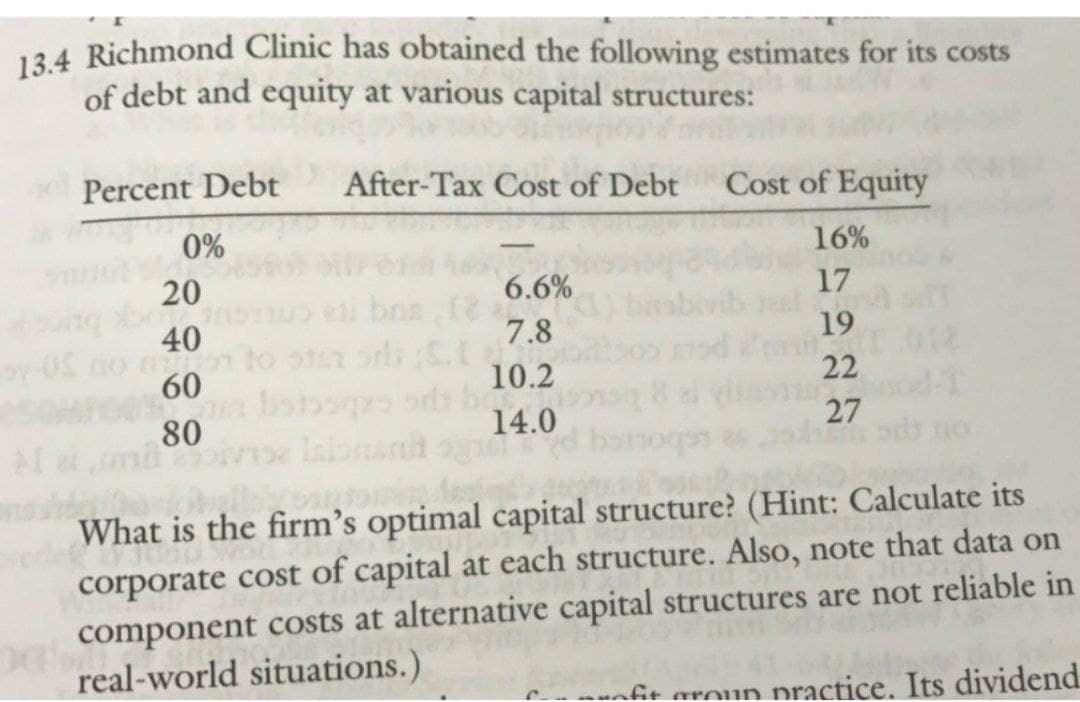

134 Richmond Clinic has obtained the following estimates for its costs of debt and equity at various capital structures: Percent Debt After-Tax Cost of Debt Cost of Equity 0% 16% - 20 6.6% 17 40 7.8 19 60 10.2 22 80 14.0 27 What is the firm's optimal capital structure? (Hint: Calculate its corporate cost of capital at each structure. Also, note that data or component costs at alternative capital structures are not reliable real-world situations.) tice Its divider

134 Richmond Clinic has obtained the following estimates for its costs of debt and equity at various capital structures: Percent Debt After-Tax Cost of Debt Cost of Equity 0% 16% - 20 6.6% 17 40 7.8 19 60 10.2 22 80 14.0 27 What is the firm's optimal capital structure? (Hint: Calculate its corporate cost of capital at each structure. Also, note that data or component costs at alternative capital structures are not reliable real-world situations.) tice Its divider

Chapter13: Capital Structure Concepts

Section: Chapter Questions

Problem 5P

Related questions

Question

134 Richmond Clinic has obtained the f;llo i i : wing esti i of debt and equity at various capital structu?-cc:f e Percent Debt After-Tax Cost of Debt ~ Cost of Equity 0% = 16% 20 6.6% 17 40 7.8 19 60 10.2 22 80 14.0 27 What is the firm’s optimal capital structure? (Hint: Calculate its pital at each structure. Also, note that data on corporate cost of ca component costs at alternative capital structures are not reliable in real-world situations.) > e e 1Is daividend

Transcribed Image Text:134 Richmond Clinic has obtained the following estimates for its costs

of debt and equity at various capital structures:

Percent Debt

After-Tax Cost of Debt

Cost of Equity

0%

16%

-

20

6.6%

17

40

7.8

19

10.2

22

60

14.0

27

80

md

labnanh

What is the firm's optimal capital structure? (Hint: Calculate its

corporate cost of capital at each structure. Also, note that data on

component costs at alternative capital structures are not reliable in

real-world situations.)

nfit aroun practice. Its dividend

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning