14 He rented an office space which was already fully furnished for a monthly rental of P15,000. Gave a rental deposit of P30,000 refundable upon termination of rent contract. Billed SMC for a project feasibility study on its new business venture. SMC issued a check for P100,000. 15 21 The account with ElectroWorld was paid. 22 Received and paid a bill in the amount of P500 for calling cards ordered from Hansen. Completed the installation of a computerized accounting system and billed The Racks P120,000, 27 Withdrew cash of P15,000 for personal use. 25 28 29 Attended a seminar on Quality Management and paid P5,000. Paid annual membership fee of P1,500 to People Management Association of the Philippines. 30 Paid P17,500 for rent and P6,000 for utilities. 31 Paid for the salary of the office clerk, P4,500. Supplies used amounted to P500. Instruction: a) Analyze the transactions by putting the title of the account in each of the money columns to represent the accounting elements. Place the amounts and the effects (+ or -) of the transactions. Use the following accounts: Cash, Accounts Receivable. Equipment, Deposit for Rent, Supplies, Accounts Payable and King, Capital. Use the following temporary accounts to analyze the changes in the owner's equity: King. Drawings, Professional Income, Advertising Expense, Membership Fee Expenses. Rent Expense, Salaries Expense, Seminar Fee Expense, Supplies Expense and Utilities Expense. b) Prepare an income statement for May. c) Prepare a statement of changes in owner's equity for May. d) Prepare a properly classified report form of statement of financial position as of May 31. Rent Deposit is classified as Other Non-Current Asset after Property and Equipment

14 He rented an office space which was already fully furnished for a monthly rental of P15,000. Gave a rental deposit of P30,000 refundable upon termination of rent contract. Billed SMC for a project feasibility study on its new business venture. SMC issued a check for P100,000. 15 21 The account with ElectroWorld was paid. 22 Received and paid a bill in the amount of P500 for calling cards ordered from Hansen. Completed the installation of a computerized accounting system and billed The Racks P120,000, 27 Withdrew cash of P15,000 for personal use. 25 28 29 Attended a seminar on Quality Management and paid P5,000. Paid annual membership fee of P1,500 to People Management Association of the Philippines. 30 Paid P17,500 for rent and P6,000 for utilities. 31 Paid for the salary of the office clerk, P4,500. Supplies used amounted to P500. Instruction: a) Analyze the transactions by putting the title of the account in each of the money columns to represent the accounting elements. Place the amounts and the effects (+ or -) of the transactions. Use the following accounts: Cash, Accounts Receivable. Equipment, Deposit for Rent, Supplies, Accounts Payable and King, Capital. Use the following temporary accounts to analyze the changes in the owner's equity: King. Drawings, Professional Income, Advertising Expense, Membership Fee Expenses. Rent Expense, Salaries Expense, Seminar Fee Expense, Supplies Expense and Utilities Expense. b) Prepare an income statement for May. c) Prepare a statement of changes in owner's equity for May. d) Prepare a properly classified report form of statement of financial position as of May 31. Rent Deposit is classified as Other Non-Current Asset after Property and Equipment

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 3EA: In which section of the statement of cash flows would each of the following transactions be...

Related questions

Question

Transcribed Image Text:ch of

two

ber

The

por

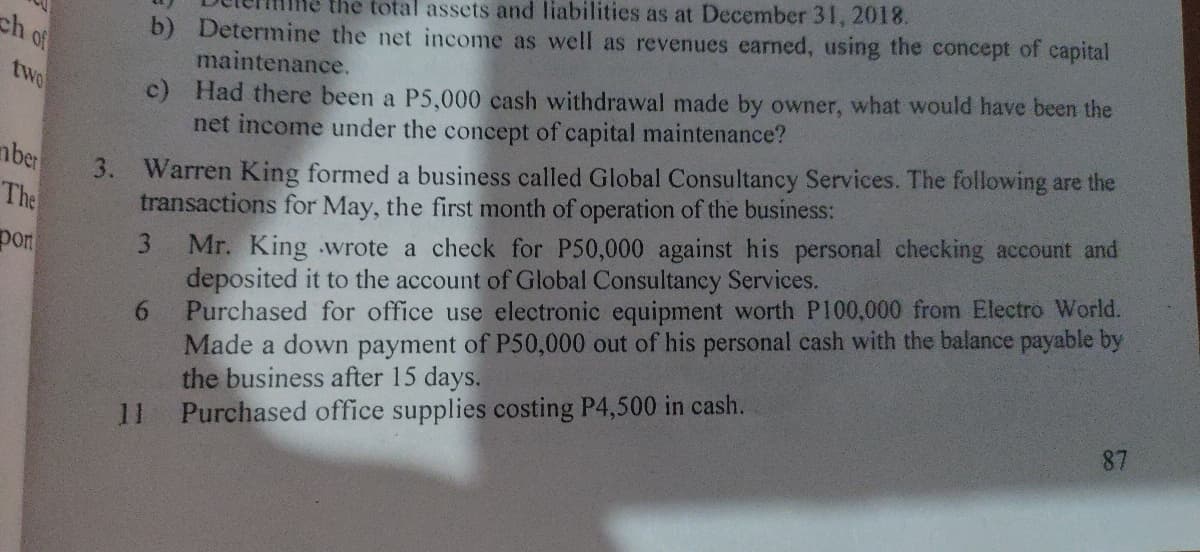

the total assets and liabilities as at December 31, 2018.

b) Determine the net income as well as revenues earned, using the concept of capital

maintenance.

c) Had there been a P5,000 cash withdrawal made by owner, what would have been the

net income under the concept of capital maintenance?

3. Warren King formed a business called Global Consultancy Services. The following are the

transactions for May, the first month of operation of the business:

3 Mr. King wrote a check for P50,000 against his personal checking account and

deposited it to the account of Global Consultancy Services.

Purchased for office use electronic equipment worth P100,000 from Electro World.

Made a down payment of P50,000 out of his personal cash with the balance payable by

the business after 15 days.

Purchased office supplies costing P4,500 in cash.

6

87

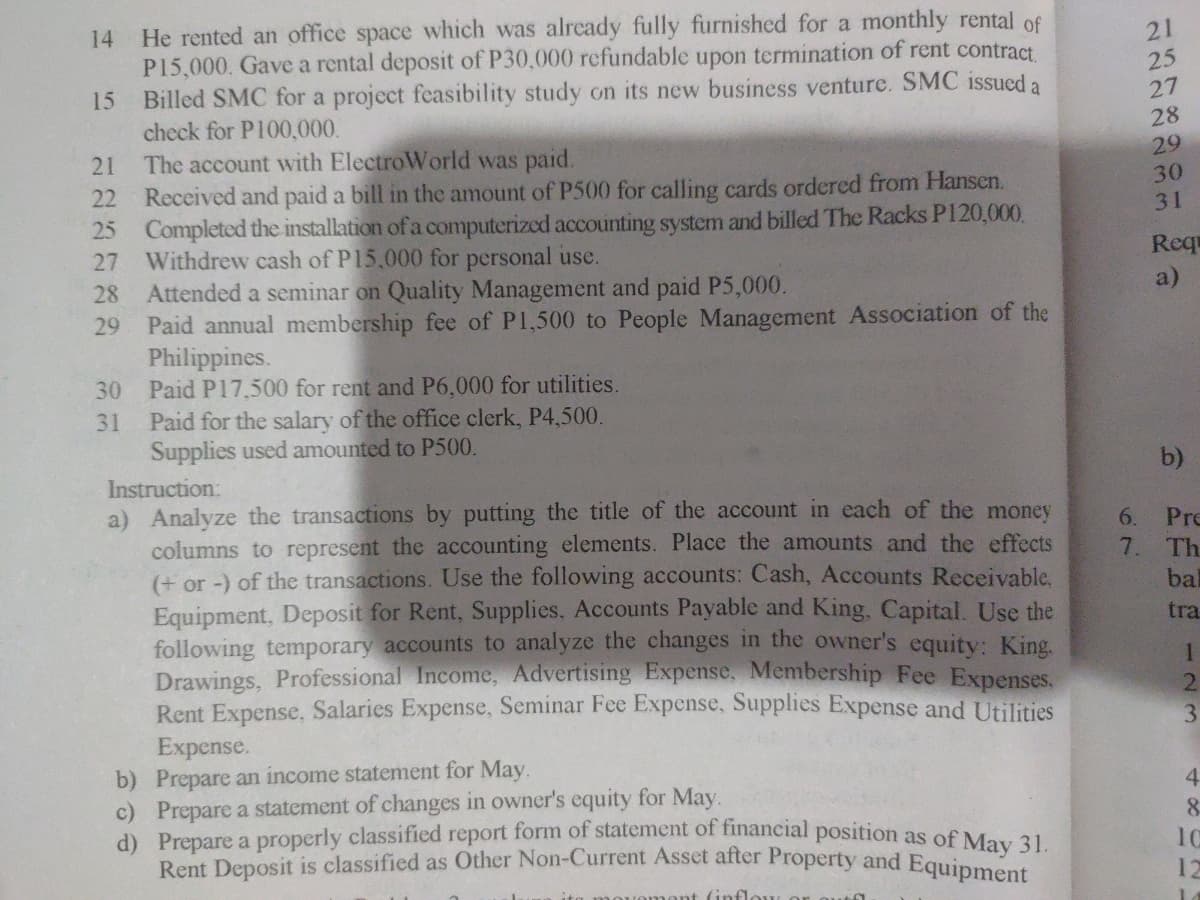

Transcribed Image Text:14 He rented an office space which was already fully furnished for a monthly rental of

P15,000. Gave a rental deposit of P30,000 refundable upon termination of rent contract.

Billed SMC for a project feasibility study on its new business venture. SMC issued a

check for P100,000.

15

21

The account with ElectroWorld was paid.

22 Received and paid a bill in the amount of P500 for calling cards ordered from Hansen.

25 Completed the installation of a computerized accounting system and billed The Racks P120,000.

27 Withdrew cash of P15,000 for personal use.

28 Attended a seminar on Quality Management and paid P5,000.

29 Paid annual membership fee of P1,500 to People Management Association of the

Philippines.

30 Paid P17,500 for rent and P6,000 for utilities.

31

Paid for the salary of the office clerk, P4,500.

Supplies used amounted to P500.

Instruction:

a) Analyze the transactions by putting the title of the account in each of the money

columns to represent the accounting elements. Place the amounts and the effects

(+ or -) of the transactions. Use the following accounts: Cash, Accounts Receivable.

Equipment, Deposit for Rent, Supplies, Accounts Payable and King, Capital. Use the

following temporary accounts to analyze the changes in the owner's equity: King.

Drawings, Professional Income, Advertising Expense, Membership Fee Expenses.

Rent Expense, Salaries Expense, Seminar Fee Expense, Supplies Expense and Utilities

Expense.

b) Prepare an income statement for May.

c) Prepare a statement of changes in owner's equity for May.

d) Prepare a properly classified report form of statement of financial position as of May 31.

Rent Deposit is classified as Other Non-Current Asset after Property and Equipment

movement (inflow

21

25

27

28

29

30

31

Requ

a)

b)

6.

Pre

7. Th

bal

tra

1

2

3

4

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning