15–3. (Calculating capital structure weights) (Related to Checkpoint 15.1 on page 502) Winchell Investment Advisors is evaluating the capital structure of Ojai Foods. Ojai's balance sheet indicates that the firm has $50 million in total liabilities. Ojai has only $40 million in short- and long-term debt on its balance sheet. However, because inter- est rates have fallen dramatically since the debt was issued, Ojai's short- and long-term debt has a current market price that is 10 percent over its book value, or $44 million. The book value of Ojai's common equity is $50 million, but its market value is cur- rently $100 million. a. What are Ojai's debt ratio and interest-bearing debt ratio calculated using book values b. What is Ojai's debt-to-enterprise-value ratio calculated using the market values of the firm's debt and equity and assuming excess cash is zero? c. If you were trying to describe Ojai's capital structure to a potential lender (i.e., a bank), would you use the book-value-based debt ratio or the market-value-based doht to voluo rotio? Whu?

15–3. (Calculating capital structure weights) (Related to Checkpoint 15.1 on page 502) Winchell Investment Advisors is evaluating the capital structure of Ojai Foods. Ojai's balance sheet indicates that the firm has $50 million in total liabilities. Ojai has only $40 million in short- and long-term debt on its balance sheet. However, because inter- est rates have fallen dramatically since the debt was issued, Ojai's short- and long-term debt has a current market price that is 10 percent over its book value, or $44 million. The book value of Ojai's common equity is $50 million, but its market value is cur- rently $100 million. a. What are Ojai's debt ratio and interest-bearing debt ratio calculated using book values b. What is Ojai's debt-to-enterprise-value ratio calculated using the market values of the firm's debt and equity and assuming excess cash is zero? c. If you were trying to describe Ojai's capital structure to a potential lender (i.e., a bank), would you use the book-value-based debt ratio or the market-value-based doht to voluo rotio? Whu?

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter13: Capital Structure And Leverage

Section: Chapter Questions

Problem 14SP: WACC AND OPTIMAL CAPITAL STRUCTURE Elliott Athletics is trying to determine its optimal capital...

Related questions

Question

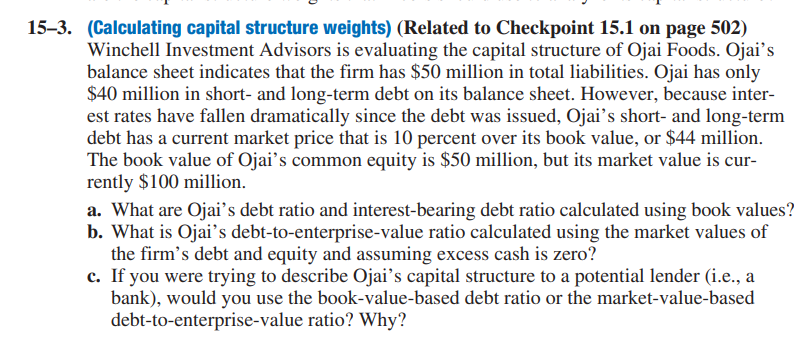

Transcribed Image Text:15–3. (Calculating capital structure weights) (Related to Checkpoint 15.1 on page 502)

Winchell Investment Advisors is evaluating the capital structure of Ojai Foods. Ojai's

balance sheet indicates that the firm has $50 million in total liabilities. Ojai has only

$40 million in short- and long-term debt on its balance sheet. However, because inter-

est rates have fallen dramatically since the debt was issued, Ojai's short- and long-term

debt has a current market price that is 10 percent over its book value, or $44 million.

The book value of Ojai's common equity is $50 million, but its market value is cur-

rently $100 million.

a. What are Ojai's debt ratio and interest-bearing debt ratio calculated using book values?

b. What is Ojai's debt-to-enterprise-value ratio calculated using the market values of

the firm's debt and equity and assuming excess cash is zero?

c. If you were trying to describe Ojai's capital structure to a potential lender (i.e., a

bank), would you use the book-value-based debt ratio or the market-value-based

debt-to-enterprise-value ratio? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT