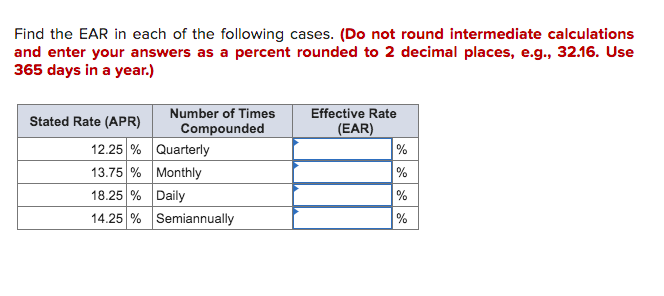

Find the EAR in each of the following cases. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year.) Number of Times Compounded Effective Rate Stated Rate (APR) (EAR) % 12.25 % Quarterly 13.75 % Monthly 18.25 % Daily 14.25 % Semiannually %

Find the EAR in each of the following cases. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year.) Number of Times Compounded Effective Rate Stated Rate (APR) (EAR) % 12.25 % Quarterly 13.75 % Monthly 18.25 % Daily 14.25 % Semiannually %

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Find the EAR in each of the following cases. (Do not round intermediate calculations

and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use

365 days in a year.)

Number of Times

Compounded

Effective Rate

(EAR)

%

%

Stated Rate (APR)

12.25 % Quarterly

13.75 % Monthly

18.25 % Daily

14.25 % Semiannually

%

%

Expert Solution

Step 1

An effective annual rate of interest or E.A.R. is the interest which is earned in real times over a period of time on the savings account or any investment. This is calculated when compounding takes place over a certain time period. It is also known as the real percentage that is owed or earned depending whether it is a loan or an investment. It is also known as the effective rate, annual equivalent rate and so on.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT