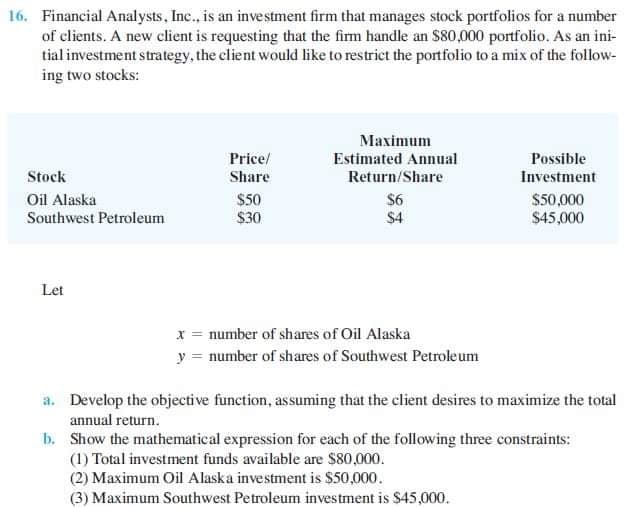

16. Financial Analysts, Inc., is an investment firm that manages stock portfolios for a number of clients. A new client is requesting that the fim handle an $80,000 portfolio. As an ini- tial investment strategy, the client would like to restrict the portfolio to a mix of the follow- ing two stocks: Price/ Share Maximum Estimated Annual Return/Share Possible Investment Stock Oil Alaska Southwest Petroleum $50 $30 $6 $4 $50,000 $45,000 Let x = number of shares of Oil Alaska y = number of shares of Southwest Petroleum a. Develop the objective function, assuming that the client desires to maximize the total annual return. b. Show the mathematical expression for each of the following three constraints: (1) Total investment funds available are $80,000. (2) Maximum Oil Alaska investment is $50,000. (3) Maximum Southwest Petroleum investment is S45,000.

16. Financial Analysts, Inc., is an investment firm that manages stock portfolios for a number of clients. A new client is requesting that the fim handle an $80,000 portfolio. As an ini- tial investment strategy, the client would like to restrict the portfolio to a mix of the follow- ing two stocks: Price/ Share Maximum Estimated Annual Return/Share Possible Investment Stock Oil Alaska Southwest Petroleum $50 $30 $6 $4 $50,000 $45,000 Let x = number of shares of Oil Alaska y = number of shares of Southwest Petroleum a. Develop the objective function, assuming that the client desires to maximize the total annual return. b. Show the mathematical expression for each of the following three constraints: (1) Total investment funds available are $80,000. (2) Maximum Oil Alaska investment is $50,000. (3) Maximum Southwest Petroleum investment is S45,000.

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Topic Video

Question

pls answer and provide solution

Transcribed Image Text:16. Financial Analysts, Inc., is an investment firm that manages stock portfolios for a number

of clients. A new client is requesting that the firm handle an $80,000 portfolio. As an ini-

tial investment strategy, the client would like to restrict the portfolio to a mix of the follow-

ing two stocks:

Maximum

Price/

Estimated Annual

Possible

Stock

Share

Return/Share

Investment

$50

$30

Oil Alaska

$50,000

$45,000

$6

Southwest Petroleum

$4

Let

x = number of shares of Oil Alaska

y = number of shares of Southwest Petroleum

a. Develop the objective function, assuming that the client desires to maximize the total

annual return.

b. Show the mathematical expression for each of the following three constraints:

(1) Total investment funds available are $80,000.

(2) Maximum Oil Alaska investment is $50,000.

(3) Maximum Southwest Petroleum investment is $45,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,